Differences Between A Dba And An Llc

At first glance, a DBA may seem similar to a limited liability company . After all, the acronyms are often discussed together and both let you conduct business using an identity other than your legal name.

However, this is essentially where the similarities end. DBAs are fictitious namesnot business structures . Meanwhile, an LLC is a formal business entity that is legally separate from its owners. It allows owners to avoid liability in the event of a lawsuit or other attempts to go after their private assets. LLCs also have tax advantages for some business owners.

If you require more than just an legitimate alias, you might want to consider an LLC or another formal business structure. Otherwise, a DBA is usually good enough to legitimize your chosen trade name.

Disadvantages Of A Dba

Using a DBA does have one major disadvantage. It does not provide personal asset protection against creditors and lawsuits. Limited liability companies and corporations provide liability protection. Unlike a DBA, these entities may protect the owners personal assets from lawsuits and creditors.

If a person is in a business that is more likely to see lawsuits, it is better to form a limited liability company or a corporationboth offer personal asset protection in most cases.

Want To File A Dba In The Usa Here Are The Official Links To All States

Overview of each state links to official websites and online filing information

Written by

Disclosure: Your support helps keep the site running! We earn a referral fee for some of the services we recommend on this page. Learn more

Choosing a business name to trade is part of the startup process of growing businesses. While it isnt necessary to register a domain and choose a name immediately, some may choose to file a Doing-Business-As to:

- Legally trade under a business name different from the owners or registered businesss

- Protect a desired future trading name

You May Like: Cost Of Registering A Car In Ny

What Is An Assumed Name

An Assumed Name, commonly known as a DBA or Doing Business As, Trade Name, or Fictitious Name is a name used by a business, that is different from the legal name of the business.

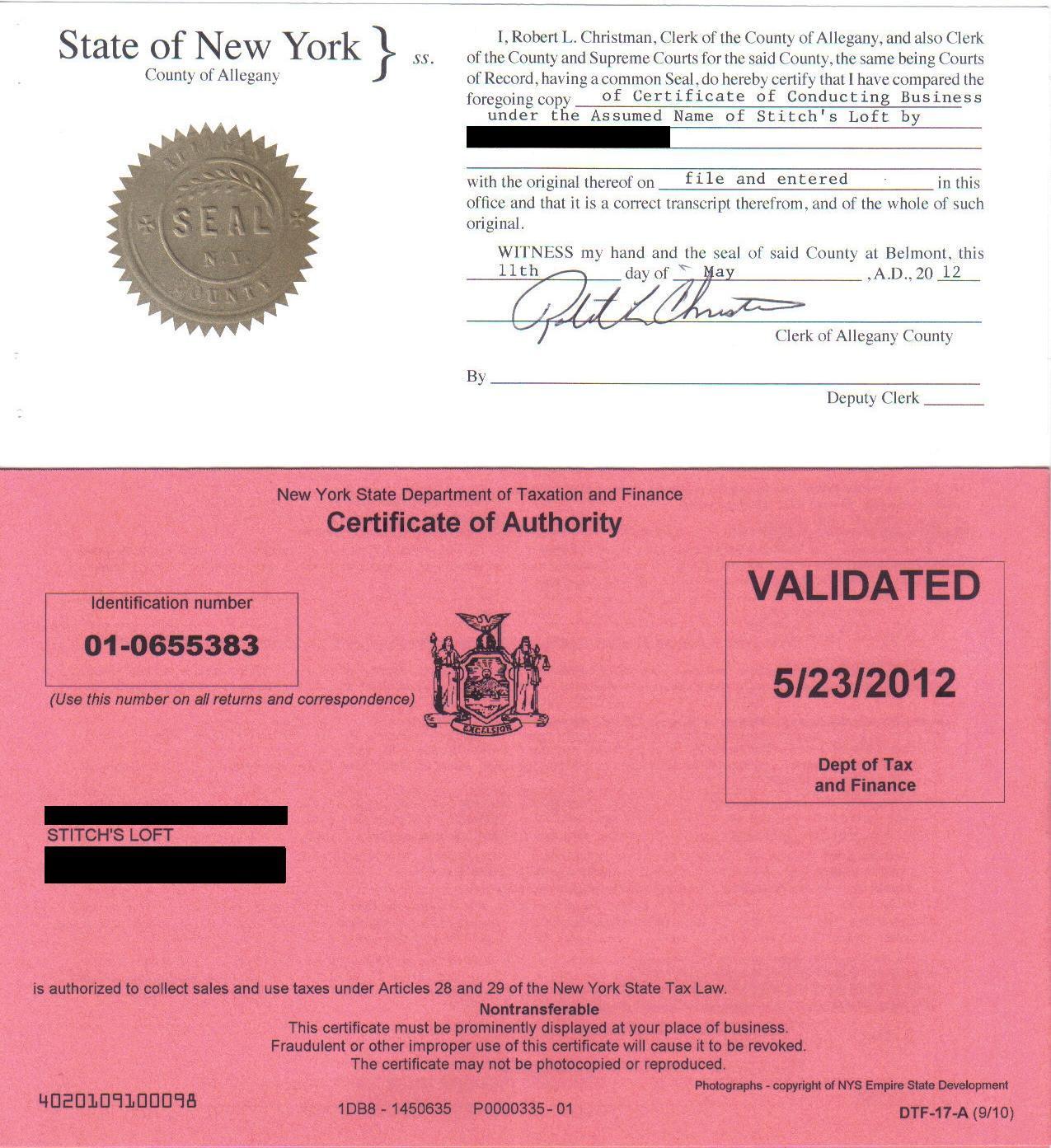

When a business wants to operate under a name other than their legal name, the state of New York, like most states, require the business to register their business name. The registration requirement was designed to protect consumers from business owners hiding anonymously behind the name of a business.

All You Need To Know To Successfully File A New York Dba

According to the law in New York, enterprises managed as corporations, limited partnerships, limited liability companies, and are required to carry out their day-to-day business activities under a legal name. If any of these enterprises or business entities wants to undertake daily business activities under a name thats different from the legal name, the proprietor must take steps to file a DBA or Certificate of Assumed Name. The certificate must be filed with the New York Department of State.

Recommended Reading: Nyc Parking Tickets Payment Online

Decide On A Business Structure

There are 3 basic options: a DBA, a Corporation or an LLC. .

- A DBA or Doing Business As is not really a separate structure, but just a different name that an individual or partners use as their business name.

- A Corporation is a separate entity that has a structure that includes shareholders, directors and officers. More complex than a DBA but the entity of choice for large companies and startups that intend to raise funding. Some professions are required to choose what is known as a Professional Corporation or PC .

- An LLC or Limited Liability Company is a newer type of business that is both a separate entity but provides very easy management and taxation. Has largely replaced the DBA and Corporation in popularity recently as it provides liability protection but with much less complexity than a Corporation.

How Much Does A Dba Cost In Ny

DBA filing fees vary depending on the location of the business and the business type.

Sole proprietor and partnership DBA fees are assessed by the county where the business is located. You must access your county directly for specific fee information. You can do this online or by calling the county clerk. You can find your counties’ contact information on the NYSAC.org website.

Fees for incorporated businesses like LLCs and corporations are as follows:

$25 for the Certificate of Assumed Name$10 Certified Copy of Certificate of Assumed Name$150 2-hour processing, $75 Same day, $25 within 24 hours

Additional Fees For Corporations Only

$100 for each NYC county where the business is or will be conducted within New York City $25 for each county where the business is or will be conducted outside New York City$1,950 to include every New York State county and the Certificate of Assumed Name combined

Recommended Reading: Wax Museum In Times Square

How To File For A Dba In Queens New York

ny view image by Andrew Kazmierski from Fotolia.com

When a business is conducted under a name that is not that of the owner, Queens County requires business owners to register a fictitious name. The fictitious name, trade name or assumed name is known as a DBA, for “doing business as.” This name is different than the personal name of the business owner. In Queens, New York, DBAs must be registered in the county clerks office.

Purchase a DBA legal form from a stationery store or online store that sells legal forms. Examples of retailers that sell legal forms are Staples, Office Max and Blumberglegalforms.com.

Fill out the DBA form and have it notarized.

Visit the Queens County Clerks Office and submit the form with the $100 filing fee.

Queens County Clerks Office 88-11 Sutphin Blvd. Room 106 Jamaica, NY 11435 718-298-0605

You can also mail the form with a $100 check or money order for the filing fee. The county clerks office keeps the original.

Queens County Clerks Office 88-11 Sutphin Blvd. Room 106 Jamaica, NY 11435 718-298-0605

Publishing Notice Of Articles Of Organization

New LLCs must publish a notice of formation in two county newspapers for six weeks within six months of formation. One must be a daily paper and one must be a weekly, and both must be located in the county of your principal address .

For a list of approved newspapers in every county, check out our NY LLC Publication Requirements guide.

You’ll need to file the Certificate of Publication along with an Affidavit of Publication provided by the newspaper with the New York State Department of State once you’ve finished meeting the publication requirement.

Filing Fee: $50

Looking for more details on the publication requirement? Check out our New York LLC Publication Requirements guide.

Read Also: The Wax Museum Nyc

Consequences For Operating A Dba Without A Registration

A business that operates without registering a DBA is subject to fines of up to $500. If the Secretary of State notifies you, and you do not comply with the states registration rules within 60 days of the notice, you could face a fine of at least $200, but not more than $500.

Any government officer or injured person in addition to the Secretary of State can also make the notification, and you would incur the same fines.

Additionally, if you file a certificate of alternative name that contains a false statement or omission of the date you first used the fictitious name, the state could also fine you at least $200 but not more than $500.

The state recovers the penalty upon prosecution by the Attorney General.

Is Having A Dba In New Jersey A Must

No. A New Jersey business does not need to have a DBA name. In fact, only domestic sole proprietors and general partnerships and foreign corporations, including limited liability companies, can use a DBA name.

A bona fide entity would not need a DBA name since it can pick any available name it wants whereas, a sole proprietor uses his full name, and a general partnership uses all the partners names in the company name.

Recommended Reading: New York Times Paywall Smasher For Google Chrome

Starting A New York Llc Is Easy

You can form a New York LLC online by filing the NY Articles of Organization with the Secretary of State. The cost to start an LLC in New York is $200.

Follow our How to Start an LLC in New York guide below to get started.

To learn how to form an LLC in any state, visit our How to Form an LLC guide.

General Partnerships And Sole Proprietorships

If you want to form a general partnership in the state of New York, youll file your DBA name using an Assumed Name Certificate. Youll do this with the county clerk where your business will operate.

If you want to form a sole proprietorship in the state of New York, youll file your DBA name using an Assumed Name Certificate. However, youll file this with the county clerk only if youll operate your sole proprietorship under a different name than the sole proprietor.

Recommended Reading: Can I Register A Car Without A License In Ny

The Process Of Filing A Dba In New York

Filing a DBA in New York starts with determining that the name you have chosen for the assumed name is not presently in use. In addition, your assumed or fictitious name cannot use specific words and phrases like Limited Partnership, Limited Liability Company, Incorporated, Corporation or their abbreviations.

Registering A Dba In New York

New York has separate procedures for filing DBA, depending on the type of company filing it:

DBA filed by an individual or general partnership is called “Business Certificate”, and it is registered by filing a DBA with the county clerk in the county in which the business is based . The fee to file a business certificate varies depending on the county, but it is typically more expensive in the 5 boroughs of New York City. Application must be notarized prior to filing.

DBA filed by an organized entity is called “Certificate of Assumed Name”, and it is registered by filing an application with New York Department of State. This application does not need to be notarized prior to filing, however the fee for corporations depends on the counties for which the certificate is filed . LLCs and Limited Partnerships don’t have the additional county fee.

We can help you research the assumed or fictitious business name of your choice, and prepare and file all the necessary registration paperwork with the county clerk of your choice – all you need to do is complete our simple application below.

You May Like: How Much Are Tolls From Ny To Dc

How Do I Change My Dba In New York

To make changes to your certificate of assumed name, you must complete and submit the Certificate of Amendment of Certificate of Assumed Name form.

For most changes, visit the County Clerks office to complete an amendment form and pay a filing fee. Contact your county clerk for county-specific instructions for changing your DBA at the county level.

Create A New York Llc Operating Agreement

Creating a New York LLC operating agreement is the only way to legally lock down your LLCs management and ownership structure. Having this document in place will give you something to return to if a dispute or lawsuit arises.

Even single-member LLCs benefit from having an operating agreement.

Your operating agreement should outline the following:

- Each members responsibilities

- How new members will be admitted

- How existing members may transfer or terminate their membership

- How profits and dividends will be distributed

You can add as many provisions as you want, as long as they don’t conflict with New York business law. Take a look at our What is an Operating Agreement guide to learn more.

Download a template or create a custom Free Operating Agreement using our tool.

You May Like: Sabbath Candle Lighting Nyc

Select A Business Entity

The next step to starting a business in New York is selecting a business entity.

The business entity is sometimes referred to as a business structure or legal entity, which refers to how a business is legally organized. There are four primary business entities: sole proprietorship, partnership, corporation, and Limited Liability Company . A brief description of each is below.

A Sole Proprietorship is an individual that decides to go into business. This is the easiest and least expensive of the four entities to set up as there is no state filing. The ease of startup is a big selling point however, a major downside to the sole proprietorship is that the owner is personally responsible for all debts and actions of the company. If the business is sued, the owners personal assets are potentially at risk. Another potential downside is that the owner will pay self-employment tax on all business profits and may be more costly than some other entities.

Related: What is a sole proprietorship?

Related: What is a partnership?

There are multiple ways a corporation can elect to be taxed, which includes the C-corporation and S-corporation. Electing how the entity should be taxed is complicated, so be sure to talk with your CPA as there is the potential of double taxation where profits and dividends are both taxed. Also, there is no self-employment tax with a corporation, as income to the owner will come from either a salary or dividends, which may be beneficial.

How To File A Dba In New York

Filing a DBA allows you to operate and receive payments under a name that is different from your legal business name. This helps you create an identity for your business that presents it in a professional light to customers and vendors, while allowing customers to write you checks and make payments directly to the business name you have chosen. Follow our step by step guide or let us handle the paperwork on your behalf, ensuring your business is filed quickly and accurately.

File a New York DBA for just $129 + state fees

You May Like: How Much Is Registration In Ny

We Can Help You With Your Small Business

When it comes time to set up your small business, ensuring that your business name is available and unique is very important. A DBA is a great way to make sure that your business can develop and operate in the state of New York.

Starting a small business in New York doesnt have to be a hassle. If you want to save time to devote towards other aspects of your new business, turn to the pros. Work with the professionals at 1-800Accountant to help start your small business.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. 1-800Accountant assumes no liability for actions taken in reliance upon the information contained herein.

How Do I File A New York Dba

In New York, the process for getting a DBA, often referred to as an assumed name, is relatively simple. First, you will need to conduct a business entity search here.

This ensures that your desired business name is available, and hasnt already been claimed by another business in the state.

Youll then need to fill out the Certificate of Assumed Name, which requires some important information about your company, including:

- Business name

- Type of business

- Assumed name

- New York counties in which business is transacted

- Address of all secondary locations

- Mailing address

Division of Corporations One Commerce Plaza99 Washington AvenueAlbany, NY 12231

Get Your Business Domain

To fully embrace the business name, register your URL. With GoDaddy youll be able to quickly build a company website so that nobody else can use or take it.

Powered by GoDaddy.com

Also Check: Ship Alcohol To New York

Protect Your Business Name With A Trademark

Once you confirm the availability of your business name and secure it, you can choose to apply for a trademark for your business. This typically costs around $225 to $400 plus any attorney fees as well as a renewal fee every 10 years.

While this cost can be high for a start-up or fledgling business, it will give your company brand nationwide protection backed by federal law. That means if others try to do business with the same or a similar name as yours, youll have legal precedent on your side. For most small businesses, this really isn’t necessary unless they are thinking of going national.

Both must be submitted by mail to the New York State Department of State along with the $60 filing fee.

Write A Business Plan

Once a solid business idea is in place, its time to start working on the business plan.

Many people only consider writing a business plan because the bank asks for one in order to get funding. While thats a valid reason, more importantly, writing a business plan gets the ideas out of the entrepreneurs head and helps create a roadmap for where they want the business to go. Just as most builders wouldnt build a house without blueprints, an entrepreneur shouldnt build a business without a business plan.

The thought of writing a business plan is overwhelming, so here are some resources to help in getting started.

Recommended Reading: New York To Italy Flight

How Do I Manage Ongoing Dba Name Compliance In New York

The date on the receipt issued by the New York State Department of State is proof that the certificate has been registered. Once your DBA name has been registered, the date on the receipt is the same date you can begin trading. Check your receipt to ensure all details are correct.

You do not need to renew your DBA name to remain compliant with state laws, but you may want to make other changes at some point. Specifically, a Certificate of Amendment of Certificate of Assumed Name may need to be completed and filed for $25. County fees will also apply to corporations.

Or you may want to file a Certificate of Discontinuance of Assumed Name for $25 with the Secretary of State should your business circumstances alter. Altered circumstances can include the sale or transfer of the company. Many reasons exist for amendments or the discontinued use of a DBA name. When changes take place, the DBA name must be officially maintained.

New York Small Business Services