Office Of The Internal Revenue Service

The local office of the Internal Revenue Service is located at: 999 Stewart Ave.

Bethpage, NY 11714Ph: 800-829-4933 / 516-576-7428

New York State Sales Tax

For information concerning the collection and filing of sales tax, contact: New York State Department of Taxation and Finance

Sales Tax Registration

Finding An Individual Tax Id

Though there are pros and cons to doing it, if you have a Social Security number, you can use that as your tax ID, even in business. If you work for someone else as an employee, you get a W-2 no later than Jan. 31 of each year, and the SSN is there at the top. If you need a copy of a form from a previous year, you can get it from the employer who issued it. Employers must keep these for at least four years after you leave the company. Your tax return, like the 1040, the 1040A, or the 1040EZ lists your SSN at the top of the first page.

If you don’t have a Social Security number, but you have filed taxes in the past, you may have used an Individual Tax Identification Number on the forms in the space where the SSN usually goes. That number is valid if used in 2013 or later unless the IRS has notified you that you need to renew. If you do need to renew, use form W-7 to ask for a new ITIN. That process takes about seven weeks. If you have a valid ITIN, but you cannot find it, call 1-800-908-9982 from within the United States for help.

If you lose your Social Security card, you can apply for a new one online if you have a driver’s license or another form of state identification. You can also fill out a paper form and turn it in to the local Social Security Administration office you’ll need to take your birth certificate and a photo ID.

New York Tax Id Number Application Manual

Home » Apply Online » New York Tax ID Number Application Manual

The states continue to make it as simple as can be to obtain a Tax ID Number in New York and abroad. All you really need is access to the Tax ID guide within the state. With the guide in hand, you will be able to follow the process to have a grasp of how to obtain an employer identification number. The great thing about the new process is that you can do it by applying right online. All of the forms are available over the Internet and all you need is basic information on yourself and other partners within the organization. Following the submission process, you can expect to have the number in less than one hour.

Don’t Miss: Ny State Arrest Records

S To Get A Tax Id Number

1. Decide if you really need an Employer Identification Number.

- Any business that withholds taxes on employees’ payroll needs an EIN to ensure that payments to the IRS are properly credited.

- New businesses need an EIN to pay taxes or open business accounts or lines of credit with vendors.

- Corporations and business partnerships must get an EIN per IRS regulations.

- Estates, trusts, and nonprofit organizations also need an EIN.

- Sole proprietorships don’t have to get an EIN, but they can if they prefer to do business that way instead of using the owner’s Social Security number. That helps keep personal and business matters separate.

2. Once you know you need an EIN, you can apply for one with the Internal Revenue Service in one of four ways: online, by fax, in the mail, or by phone . The application form is Form SS-4 if you’re looking for it on the IRS website.

3. The next step is choosing the right kind of EIN for the type of business you operate. Some possibilities are sole proprietorship, corporation, LLC, partnership, nonprofit, or estate.

4. You also need to state why you are applying at this time. This could be a new business, or maybe you’ve been operating under your personal Social Security Number and want to set up an EIN to move away from that. Your request might also be related to hiring new employees or setting up a pension plan. Finally, you need to fill in what field you’re in and what products or services you offer and give your name and SSN to complete the form.

The Benefits Of An Ein Number

An employer identification number offers many benefits for business owners. It allows you to:

- Preserve your limited liability since your business is a separate entity

- Open a bank account and obtain financing for your business

- Hire employees and have them follow instructions for Form 1040

New York Small businesses are often prone to identity theft, especially if you have to use your SSN. Separating your business from your own personal identity is essential to protecting your privacy and finances. Having an EIN also helps reduce the risk of identity theft because you can use your EIN instead of your social security number when dealing with suppliers or lenders.

Don’t Miss: What Do I Need To Register A Car In Ny

Wait For Your New York Llc To Be Approved

Wait for your New York LLC to be approved by the Department of State before applying for your EIN. Otherwise, if your LLC filing is rejected, youll have an EIN attached to a non-existent LLC.

However, if this does happen, you can always cancel your EIN and then apply for a new one. And you dont have to wait for your cancellation to go through before applying for a new EIN.

What Is The Tax Id Nyc Business Use

Typically, businesses in New York and the rest of the United States either use the owners Social Security Number or, more frequently, an Employer Identification Number issued by the IRS as a tax ID. The former is typically only used as a sole proprietor tax ID. However, even for that type of business, it is often preferable to have an EIN.

Your business EIN is its uniquely identifying number for filing taxes. So, to file taxes for your business separately from your own, it is necessary to get an EIN. It is similar to a Social Security Number for your business. It is often helpful to have an identifier for your company to help keep its tax filings and other matters separate from your personal ones.

You May Like: New York State Annulment

Is An Ein Number The Same As A Tax Id Number

While people use the terms employer identification number and taxpayer identification number interchangeably, there is a slight difference between them. You can use any TIN to comply with a request for taxpayer identification, depending on the situation.

Taxpayer identification number is the generic term that the IRS uses for any numbers used for tax and identification purposes. This means that while all EINs are TINs, not all tax IDs are EINs. The three main types of tax identification number are:

- Social security number

- Individual taxpayer ID number

- Employer identification number

The individual taxpayer ID number is assigned to people who cant receive an SSN or EIN. These include:

- Non-resident alien filing for a U.S. tax return

- A U.S. resident alien filing for a U.S. tax return

- Dependents and spouses of non-resident and U.S.-resident aliens

The ITIN works similarly and can be used as documentation for a request for taxpayer identification.

Its important to note that the ITIN is only for tax reporting and doesnt work for identification purposes, unlike an SSN or EIN. To apply for an ITIN, the non-resident alien taxpayers will have to follow a similar process as applying for an EIN. Employers can then use the ITIN for tax purposes by filling in Form W-4.

U.S. residents dont have to apply for an ITIN since they already have an SSN. The only people who need to apply for an ITIN are people who are restricted from obtaining another taxpayer identification number.

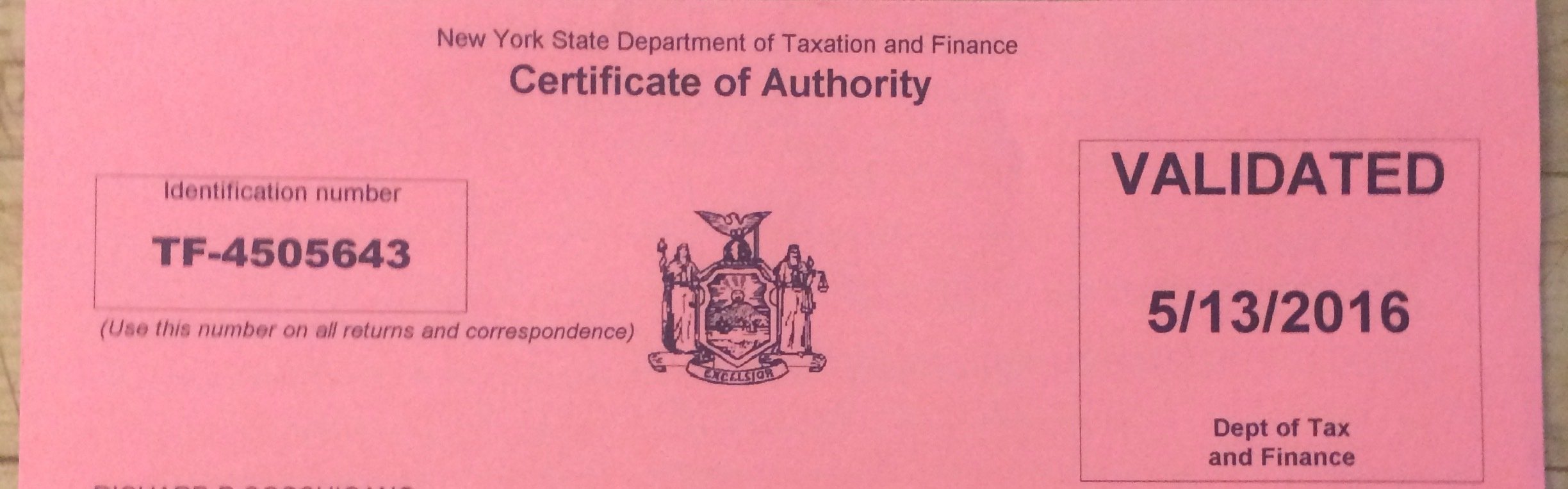

New Certificate Of Authority Needed For Transfer Of Ownership And Organizational Changes

A Certificate of Authority cannot be transferred or assigned. If you are buying an existing business, or taking over the ownership of a family business, you must apply for your own Certificate of Authority. You cannot use the Certificate of Authority that we issued to the previous owner.

You must also apply for a new Certificate of Authority if you are changing the organizational structure of your business, such as switching from a sole proprietorship to a corporation. The new business must have its own Certificate of Authority before it begins business.

You May Like: Arrest Records Ny

How Do You Apply For A State Tax Id Number

Remember, most New York businesses will need both a federal tax ID number and a New York state tax ID number. If youre ready to apply for a New York state tax ID number, your first step will be getting your federal tax ID number, which you can get quickly and conveniently through an online application.

From there, youll follow an application method similar to the one you faced when applying for a federal tax ID number. You can apply for a New York state tax ID number with a traditional method, like phone, mail, or fax, but its faster and easier to apply online. When applying online, youll just need to answer a few questions about your business and your partners. When done, youll receive your state tax ID number in a matter of 4 to 6 weeks.

What Is An Employer Identification Number Or Ein

The IRS issues all businesses an EIN. The number is nine digits long, so it’s similar to a social security number. Anyone who’s self-employed can use an EIN instead of a social security number when they fill out W9 forms.

EINs are used for the following:

- Opening business bank accounts

- Getting lines of credit for a business

- Getting business credit cards

- Applying for business licenses

You can easily tell the difference between an EIN and SSN. In an EIN, there are two digits, a hyphen, and then the remaining seven digits.

You can apply for an EIN free of charge. Applying for an EIN isn’t state specific, as it’s done on the federal level. An EIN and TIN are the same thing.

Read Also: Registering A Car In New York State

How Do I Get A Certificate Of Authority Id Number In New York

In New York State, the Certificate of Authority, also known as the Certificate of Authority to Collect Sales Tax, is the Sales Tax ID number the state requires a business to use when collecting sales tax. Requests for a Sales Tax ID number must go through the New York State Department of Taxation and Finance. The NYS Department of Taxation and Finance accepts requests for the Certificate of Authority online via the DTF-17 Register for a Sales Tax Certificate of Authority application on the Online Permit Assistance and Licensing system.

Select the “Certificate of Authority to Collect Sales Tax” link from under the heading. Click the “OK” button on the pop-up dialog box that opens.

Fill in the fields on the application form window that pops open. The form requests various information about your business including the type of business, reason for applying for a Sales Tax ID, business legal and DBA names and address, as well as your Federal I.D. Number . If you don’t have an FEIN, apply for it through the site by clicking the “Apply for FEIN” button in Section C and following the on-screen instructions.

Apply by mail as an alternative. Call 485-2889 to request a paper application. Once you fill it, send the application to:

New York State Tax Department Sales Registration Unit W. A. Harriman Campus Albany, New York 12227

After applying by mail, it typically takes four to six weeks before the Certificate of Authority arrives.

Tips

Warnings

References

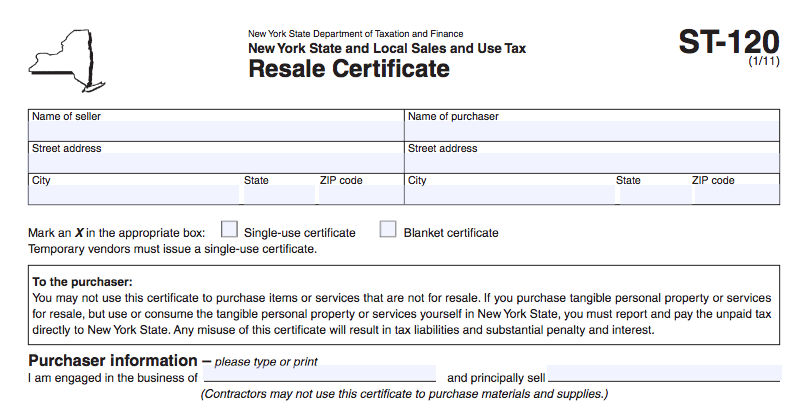

What Steps Should A Business Take To Accept A Resale Certificate

When a business is presented with a resale certificate, the burden of proof is on the seller to verify that the buyers information is correct and to keep these records. Failing to verify this information may put the liability of paying New York sales taxes on the seller.

Before accepting a resale certificate, a seller should:

- Review the resale certificate to make sure it is completely filled out.

- Verify the purchasers New York Certificate of Authority Number is valid by visiting the Department of Taxation and Finances Registered Sales Tax Vendor Lookup database.

- Sellers are also responsible for examining the certificate and evaluating whether the goods sold are reasonably consistent with the purchasers line of business. For example, if the buyers business is a car dealership, but they want to purchase office supplies tax-free, the seller should investigate further.

- Keep a file of resale certificates.

You May Like: Dmv Tvb Office To Request To Reschedule The Hearing

How And Where To Check An Ein

There are several ways to find an EIN:

What Is A Responsible Party

As you can see from the information required, an EIN application requires that someone becomes the responsible party of the entity. This is the person who controls and manages the business, its assets, and funds. The responsible person must be an individual person, not an entity or business unless the applicant is a government entity. If your business has several people who fulfill this role, simply nominate someone to act as the responsible party for the EIN.

The applicant and responsible person dont have to be the same individual, as long as the applicant can show theyve been authorized to request an EIN.

You May Like: How Much Are The Tolls To Nyc

Getting A New Employer Identification Number

Businesses dont stay the same and will often undergo radical changes in structure as they grow. In some instances, you may need to get a new EIN if the changes are significant.Youll need to get a new EIN if:

- You change your type of business

- You become a subsidiary of a corporation, or youve used the parent companys EIN previously

- Youve formed a new corporation after a merger

- Youre a sole-proprietor subject to bankruptcy proceedings

Changes that dont require a new EIN include:

- Changes to the name or address of the business

- Ending a partnership business and starting a new one

How To Obtain A Tax Id Number In New York State

If you’re planning on starting a business in New York state you’ll need to set your business up with the state’s tax department and the Internal Revenue Service. You will likely need a Tax ID number, also known as an Employer ID number, which is issued at the federal level through the IRS. Depending on the business type you may be able to use your social security number, although this is not recommended because of identity theft prevalence.

Applying for a federal tax ID number is simple and quick via the IRS website. The state of New York, however, has additional requirements for your business, especially if you intend on selling retail goods to customers. In this case, you must also apply for a Certificate of Authority to collect sales tax through the New York State Department of Taxation and Finance.

Choose the appropriate certificate for your business. The NYS tax department has two types: regular and temporary. Most businesses need a regular certificate. If you plan on collecting sales tax for no more than two consecutive months in a 12-month period, you only need a temporary certificate. Exceptions include show and entertainment businesses, such as sporting events, flea markets and antique show vendors these businesses need a regular certificate.

Tips

-

You must register for your Certificate of Authority at least 20 days before opening your business.

- Providing your name and email address

- Creating a username and password

- Agreeing to the terms and conditions

Don’t Miss: Wax Musuem Nyc

Notifying The Irs Of Changes

While your EIN may not change, you still have a responsibility to keep the IRS up to date with minor changes to your business that dont affect your EIN. This includes notifying the IRS of changes to your address, which you can do online, via fax, or by mail. If the business closes, you have to notify the IRS so they can close the tax account associated with that particular EIN.

As with social security numbers, each EIN is unique and never reused. When your business closes, your EIN will disappear forever.