Short Term Disability Insurance

Available through the workplace, this coverage helps protect your income if you cant work after an accident or illness.

Weekly payments: receive a portion of your salary for 3 months to 1 year, depending on your policy

Rehab incentives: coverage may include financial incentives designed to help you transition back to work

Easy claims filing: report claims online or by phone

Competitive rates: this group coverage is offered only through employers

For complete plan details, talk to your companys benefits administrator.

Duration: 2:56

How Much Does Social Security Disability Pay

You receive SSDI payments based on your lifetime average earnings covered by Social Security. The majority of SSDI recipients get between $800 in $2,000 per month. The average for 2019 was $1,258 per month. The base amount is $783 per month for an individual, and $1,175 per month for a couple. The maximum you can receive in SSD benefits is $3,011 per month.

Is Short Term Disability Insurance Worth It

Whether a short term disability policy is right for you is a decision only you can make. But considering that over 1 in 4 of todays 20-year-olds will become disabled before they retire,3 having a short term disability policy in place can help you feel confident that youre protected, whatever challenges life may bring. If youre not sure how a short term disability policy will fit into your overall financial plan, talk with a financial professional who can help you figure out how to best protect yourself.

Don’t Miss: Register A Vehicle In Ny

Clinical And Claim Support Highlights

Clinical Case Management: Clinical touch points where people need them, including for multiple diagnoses and behavioral health claims

Behavioral Health Resources: Behavioral health case managers review claims weekly to identify those who may need assistance

Coordinated Decision-Making: Clinical input on complex claims and all behavioral health claims

Integration: Helps employees follow through with medical providers treatment recommendations and referrals to available services, such as the employer’s Employee Assistance Program

Strong Support Ratios: Staffing model that gives nurse and vocational case managers ready access to benefit examiners and analysts

Short Term Disability Faq

The Cornell Short Term Disability Plan provides partial income benefits for all eligible Cornell nonacademic endowed and contract college employees who are unable to work due to an illness or injury not related to their job.

This FAQ provides a simplified summary of your benefits. Please refer to HR Policy 6.9 for a complete statement of the policy governing absences from work.

Recommended Reading: How Much Are Tolls From Virginia To New York

How Californians Can Apply For Short

California workers who become disabled for up to one year may file a State Disability Insurance claim. The states Employment Development Department handles all SDI claims, which only cover disabled Californians with off-the-job illnesses and injuries. Californias SDI policy covers claimants for up to 52 weeks the longest period for any state-managed short-term disability benefits program. Once approved, you may receive up to $1,300 in weekly cash payments, though other factors may change your approved amount. Learn more helpful information about how Californias SDI program works.

Whats It Like To Return To Work After Short

As the above answer illustrates, depending on your disability, different logistical elements obviously need to be sorted out upon your return.

But thats not the only factor at play heretheres also an emotional and relational element involved when you return to the office after an extended amount of time off.

Most of it was just emotional and mental fatigue after having spent four months not really on a computer every day or using my brain in that kind of way, says Tiernan.

There was the expectation that I was going to be able to jump back in right away, she adds. Looking back, I appreciate that now because I dont think I wouldve been able to transition as well as I had if it had been slow.

In addition, companies arent stagnant and there are likely some larger changes that will happen while youre out on your leaveincluding employees leaving and new team members being added. There were shifts that occurred during my time gone, so I needed to readjust to the changes that had happened, Tiernan adds.

Also Check: Can I Register A Car Online In New York

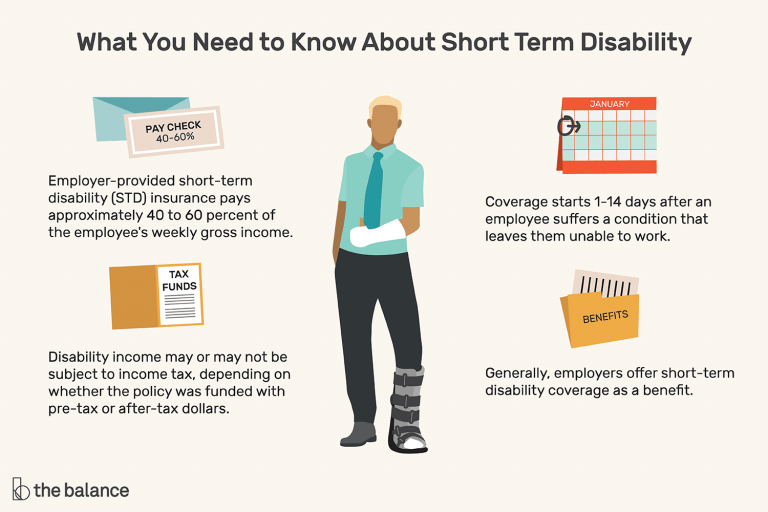

Whats The Difference Between Short Term And Long Term Disability Insurance

As the name indicates, short term disability insurance is intended to cover you for a short period of time following an illness or injury that keeps you out of work. While policies vary, short term disability insurance typically covers you for a term somewhere between 13-26 weeks and can replace anywhere from 40-70% of your income during that benefit period. If you have both short term and long term disability policies in place, short term disability will pay you benefits during the waiting period before your long term disability coverage begins, at which point youll transition from one policy to the next to receive benefits. For that reason, it makes sense to have both policies to help ensure an unexpected illness or injury wont derail your financial confidence for a few months or for several years.

Is Disability Insurance Required In New York State

newyork is one of the few states that has a temporary disability insurance program, which requires employers to provide short-term disability insurance for their employees. Employers are required to provide partial wage replacement, for up to 26 weeks, to employees who are temporarily unable to work due to disability.

People ask , does New York have state disability? The Department of Health does not provide disability benefits. If you get sick or injured when youre not at work, the NY state Insurance Fund Disability Benefits can help: www.nysif.com. Find out if you are eligible for Social Security benefits and apply for Social Security Disability benefits.

Also, who pays for NY statedisabilityinsurance? Who Pays the Premiums for Disability insurance? disability premiums may be paid entirely by the employer. The employee is permitted but not required to contribute to the cost. The employee may not contribute more than one half of one percent of the first $120 of weekly wages, to a maximum of $.

, what states have mandatory disability insurance? Five states California, Hawaii, New Jersey, New york, and Rhode Island and Puerto Rico require employees to receive short-term disability coverage. Four of these states also require paid family leave benefits.

Don’t Miss: How To Delete New York Times Account

Group Short Term Disability Plan Details

Salary Replacement: Up to 70 percent for employer-paid plans

Weekly Benefit: Up to $5,000 per week

Duration: Up to 52 weeks

Benefit Waiting Periods: Starting at zero days for accidents and seven for illnesses and pregnancies

Return-to-Work Incentives: Financial support for employees who are ready to come back to their jobs

Coverage Options: Non-occupational or 24-hour

Performance Guarantee: For groups with at least 1,000 insured employees

Reporting: Administrative claims reports available

How Much Do I Have To Pay For Employer Disability Benefits

Mandatory Disability Insurance rates vary from each New York State authorized insurance carrier, so it is best to shop around. Rates are charged per each covered male and female employee. Premiums can be paid annually in advance or quarterly in arrears.

Employers may collect a salary deduction from employees to help fund their insurance obligation. The employee contribution rate is 0.5% of the first $120.00 of weekly wage and not to exceed $.60 per week or $31.20 per year. The employer funds the remainder of plan cost. Employers do not have to require employee contributions. New York is among one of the few states that requires employer disability benefits. Other states that require disability benefits are: California, Hawaii, New Jersey, Rhode Island and Puerto Rico.

For more information or if you would like a custom quote for your business, please call: 800-514-3513

Read Also: Does Disability Get The Extra $600 A Week

Also Check: How To Pay A Ticket Online New York

Nys Paid Family Leave Act

The PFL comes into effect in January 2018. Parents who have to stop work at this point will see several advantages over the federal act.

Employees will qualify for 50 to 67 percent of the average worker’s weekly wages, depending on which year they’re taking their paid time off. Also, more workers will qualify, as there is no criteria regarding hours worked or employer size.

You May Qualify For Legal Assistance

Figuring out which temporary or short-term disability benefits you may qualify for can be confusing, depending on your specific circumstances. Having an attorney file your claim makes you 2x more likely to win benefits the first time you apply. Plus, an attorney can get you the maximum benefits you may qualify for, regardless of your claim type.

You May Like: What Airlines Fly To Cabo San Lucas From New York

What Alternatives Are There To Short

The best alternative to short-term disability insurance is to self-insure with an emergency savings fund. Most financial experts suggest that you have an emergency fund of anywhere between three and six months salary anyway, which, combined with an LTD policy, can easily cover you during a disability.

However, if you donât have that emergency fund, or are in the process of building up your fund, then an emergency fund may not make sense as an alternative to STDI. If you receive short-term disability benefits from an employer, and they pay 100% of your premiums or the cost is relatively low, it may make sense to have an emergency fund plus and STDI policy. That way, your emergency fund can be saved for other purposes, like home repairs or medical emergencies.

The federal government does not supply any kind of coverage for short-term disabilities. Social Security Disability Insurance, or SSDI, is designed to cover long-term disabilities. Additionally, acceptance rates for SSDI are low, and if you have the means to cover yourself with private insurance, you should.

Disability And Paid Family Leave Benefit Plans

Employers may provide New York State Disability and Paid Family Leave benefits to their eligible employees under a Board approved Plan. All Plans must be accepted by the Board and will need to adhere to the statutory requirements of the New York State Disability and Paid Family Leave Law . Once a Plan has been accepted by the Board, the employer must provide administration of these benefits from a licensed NYS insurance carrier, or by obtaining the Boards approval to administer benefits as a Self-Insured employer.

Also Check: How To Submit Poetry To New York Times Magazine

How Does Short Term Disability Work In New York State

Short Term Disability – NYS. Under New York State Law, the RF provides this off-the-job illness or injury benefit, and pays full coverage, to all employees. You must first exhaust any sick leave benefits. You can receive benefits up to a maximum of 26 weeks.

Also know, how does short term disability work in NY?

Disability benefits will pay 50% of your average wages up to a maximum of $170 per week. Benefits will begin on your eight consecutive day out of work the first seven days is an unpaid waiting period. You can receive benefits for a maximum of 26 weeks in a 52-week period.

Also Know, how long does it take for short term disability to kick in? You can start receiving money from your short–term disability insurance policy after a waiting period, usually no days to 14 days, after becoming sick or disabled, the III says The actual time for coverage to kick in depends on whether you suffer an illness or injury.

Similarly, you may ask, is short term disability mandatory in New York State?

New York State short–term disability insurance is a statutory program that pays benefits to covered workers. The mandated policy pays claims temporarily when an eligible medical condition prevents you from working and earning an income.

How long does an employer have to hold a job for someone on disability in New York?

You May Like Also

What Employers Need To Know About Nys Mandatory Disability Benefits Law

NYS requires all employers to provide Mandatory Disability Insurance Benefits to their employees. Failing to provide coverage is a misdemeanor and carries a $500 fine or up to one year in jail.

Employers may comply with this mandate to make short term disability insurance coverage available to their employees in one of two ways:

1. Purchase disability insurance from a state approved insurance company for the benefit of his/her employees or,

2. Establish a Private, self-insured disability benefits law plan

Don’t Miss: How To Pay A Ticket Online New York

When A Claim Is Denied

If the claim is denied, Sun Life notifies the:

- Employee directly

- Campus, if the claim was scanned and submitted via e-mail, with a response indicating denial.

- Central office by sending a copy of the denial.

- Attending Physician’s Statement and Authorization for Release and Disclosure of Health Related Information

Note: Long-term disability claims can be initially approved, and subsequently denied, during any of the claim’s periodic reviews.

The employee has the right to appeal if denied. Instructions for appealing are included in the denial letter sent from Sun Life.

New York Disability Appeals Process

If you file for Social Security or SSI disability benefits and your application is denied, you’ll need to appeal. A new step was added to the beginning of the appeals process in New York in January 2019, called reconsideration. Now, after getting a denial from the Division of Disability Determinations , you have to request that the the DDD reconsider its decision. If you receive a denial at the reconsideration stage, you can then request a hearing in front of an administrative law judge .

Also Check: How To Delete New York Times Account

Special Rules For People Who Are Blind Or Have Low Vision

We consider you to be legally blind under Social Security rules if your vision cannot be corrected to better than 20/200 in your better eye or if your visual field is 20 degrees or less, even with a corrective lens. Many people who meet the legal definition of blindness still have some sight and may be able to read large print and get around without a cane or a guide dog.

If you do not meet the legal definition of blindness, you may still qualify for disability benefits if your vision problems alone or combined with other health problems prevent you from working.

There are a number of special rules for people who are blind that recognize the severe impact of blindness on a persons ability to work. For example, the monthly earnings limit for people who are blind is generally higher than the limit that applies to non-blind disabled workers.

In 2021, the monthly earnings limit is $2,190.

Dont Miss: How Much Do You Get For Disability

How Much Paperwork Is Involved

The exact paperwork youll be required to complete is again dependent on your specific plan. But the process typically begins with a relatively straightforward claim form that requires some information from you , your employer , and validation from your doctor that your condition prevents you from working.

Fortunately, if you find yourself confused about any of the documents or applications, you can ask for helpwhether its from your companys own HR department or even people at your doctors office.

I actually found the team at my physicians office to be extremely helpful, says Tiernan, who admits her own leave process was slightly more complicated, as she took advantage of both short-term disability and FMLA for the birth of her child .

They have a whole team dedicated entirely to filling out forms and navigating this process, so I was on the phone with them a lot. They helped me figure out the best forms to fill out, what the dates would be, and any follow-ups that I needed. They even spoke to my HR team directly here at the office.

Also Check: Airlines That Fly To Italy From New York

How Do You File For Short

If you believe that youll need to take advantage of your short-term disability benefit, your first step is to make sure that your illness or injury is well-documented, as youll have to provide some medical evidence or backing.

Consult with your doctor and find out what youre up against first. Make sure you speak honestly about your symptoms and the things that you are experiencing. That medical record will be reviewed by an insurance company, so start out with a strong pronouncement of, Hey, Im having this problem, advises McDonald.

Then, approach your HR department to begin the process of filing a claim . Dont have an HR department? Connect with your manager or consult your plan documents to understand exactly what you need to do to submit your claim.

Be aware that short-term disability plans have a requirement for how many days you need to be out of work before you can claim disabilityits called an elimination period. The reason is that they dont want to invoke short-term disability for something that could be covered by sick days, says Bartolic.

What Happens To My Job While Im On Short Term Disability

A benefit-eligible staff members position, or an equivalent, is held for a total of 26 weeks of qualifying leave during any 52 week period. This calculation will include any leave time taken as NY Paid Family Leave, extended bonding leave, family health leave, and military leaves , as well as personal medical leaves, short term disability, and/or workers compensation, including any partial days used under short term disability or workers compensation. Return to work issues are individually considered and the job hold period of time may be extended for valid business reasons, including the provision of a reasonable accommodation. Contact a representative from MLA for further details.

Don’t Miss: Wax Museum Nyc Times Square