Open Your New York Llc Bank Account

Put on your lucky shoes. Its time to open a business account for your LLC. Youll need to bring the bank the following:

- your New York LLCs EIN

- a copy of your Articles of Organization

- a copy of your Operating Agreement

- your business license

You need an LLC bank account to keep your business finances separate from your personal finances.

One of the biggest upsides of an LLC is that it creates a legal separation between you and your business. This separation is valuable, especially when it comes to liability.

Letting your personal and business finances intermingle erodes that separation. To keep it intact, you need to open and use an LLC bank account.

Yes. If your LLC intends to accept credit card payments, youll need a bank account for depositing funds after the payments are cleared and settled. This is a basic requirement of any payment processor, and youll need the bank account in advance of applying for your merchant account.

Tax Treatment Of Llcs And Llps

- The New York personal income tax and the corporate franchise tax conform to the federal income tax classification of LLCs and LLPs.

- An LLC or LLP that is treated as a partnership for federal income tax purposes will be treated as a partnership for New York tax purposes.

- An LLC or LLP that is treated as a corporation, including an S corporation, for federal income tax purposes will be treated as a corporation for New York tax purposes or as a New York S corporation if the New York S election is made .

- A single-member LLC that is treated as a disregarded entity for federal income tax purposes will be treated as a disregarded entity for New York tax purposes.

- If the SMLLC is disregarded and the single member is an individual, the SMLLC will be treated as a sole proprietorship for New York tax purposes.

- If the SMLLC is disregarded and the single member is a corporation, including an S corporation, the SMLLC will be considered a division of the corporation for New York tax purposes.

- If the SMLLC is disregarded and the single member is a partnership, the SMLLC will be considered a division of the partnership.

- For information regarding the tax treatment of an LLC or LLP for purposes of the New York City Business Corporation Tax, New York City General Corporation Tax , and the New York City Unincorporated Business Tax , please visit the New York City Department of Finance Business webpage.

Apply For Business Licenses And Permits

Depending on what your business does and where it is located, there will likely be various business licenses and permits needed before starting your business. Some common registrations include:

- Business License Some cities require businesses to obtain licensing before they can start.

- Professional License Certain services such as barbershops, accountants, salons, and others must be licensed.

- Sales Tax Certificate of Authority To sell products and certain services in New York State, registration with the New York Department of Taxation and Finance will be necessary.

Related: What Business Licenses are Needed in New York?

Read Also: Watch Kim And Kourtney Take New York

Cost Of Filing Formation Certificates

The New York Certificate of Formation is responsible for the majority of the cost, which could also vary depending on whether youre forming a domestic LLC or a foreign LLC. Still, you can file both at the New York Secretary of State.

New YorkDomestic LLC

- Biennial Report filing costs $9

- Name Reservation fee costs $20

- Certificate of Publication Fee: $50 . Download the PDF form and send it to Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

- Fill out the application form, and send it to New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231. Costs $200.

New YorkForeign LLC

- Fill out the application form, and send it to New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231. Costs $250.

- Certificate of Good Standing Fee: $25. Fill up the form and send it to Department of State Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Ave. Albany, NY 12231.

- Biennial Report filing costs $9

- Name Reservation fee costs $20

Note that filing online is ideal, not only because you need to go to the Secretary of State office, but also it would be faster. You wont have to wait in a queue in doing so.

Pros And Cons Of Running An Llc In New York

Before setting up a New York limited liability company, or LLC, you should compare the pros and cons of a New York LLC and other forms of business structure.

Structuring your business as a limited liability company in New York has both pros and cons. Whether a certain feature is an advantage or a disadvantage may depend upon the type of business structure being compared with creating a New York LLC.

An LLC is often seen as having the same limitation of liability for owners as a corporation, but with more potential tax benefits and less complexity. However, as will be seen, it’s not quite that simple. These factors, as well as others, will be discussed in comparison with other ways of structuring a business.

Read Also: Can I Register A Car Without A License In Ny

How Much Does It Cost To Form An Llc In 2022

| State | |

|---|---|

| $45 online, $50 by mail | $150 Franchise Tax Report |

| $100 online, $110 by mail | $50 |

| $100 online, $120 by mail | $0 |

| $95 online, $100 by mail | Biennial report $32 online, $50 by mail |

| $160 online, $165 by mail | $55 |

| $155 online, $135 by mail | $0 |

| $50 online, $105 by mail | $0 |

| $100 online, $110 by mail | $10 |

| $75, plus $150 for the initial list of officers | $150 Annual List of Members & Managers |

| $150 online, $165 by mail | $50 |

| $130 online, $170 by mail | $25 |

| $102 online, $100 by mail | $50 minimum |

Some people will look at the cost of starting an LLC as too expensive and want to form a Sole Proprietorship instead. Learn the differences between an LLC and Sole Proprietorship to see which one is right for you.

Cost To Form A Foreign Llc In New York

If you already have an LLC that is registered in another state and youd like to expand your business into New York, youll need to register your LLC as a foreign LLC in New York.

The cost for registering a New York foreign LLC is $250. You can register a foreign LLC in New York by filing an Application for Authority .

Recommended Reading: New Yorker Magazine Poetry Submissions

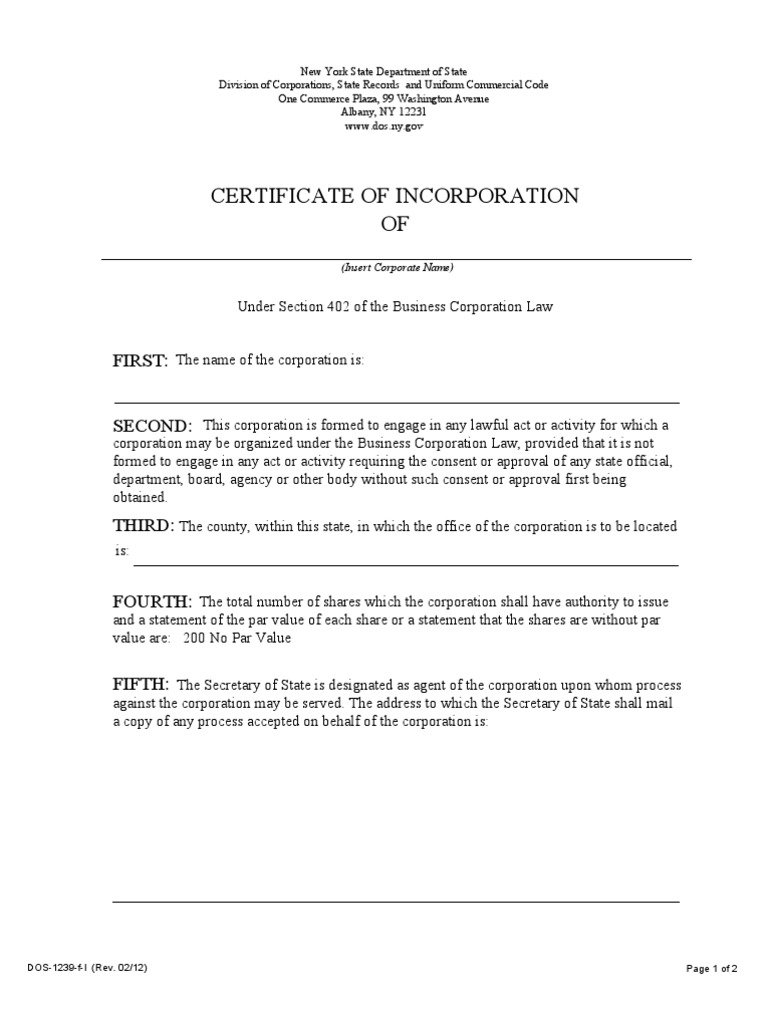

Prepare And File Articles Of Organization

The Articles of Organization is a document that officially establishes your LLC by laying out basic information about it. New York has a form that individuals can access to file Articles of Organization.

Prepare Articles of Organization and file them with the New York State Division of Corporations to register your New York LLC properly. Though it sounds like a big job, that simply means filling out a relatively simple online form and submitting it. You can also send it by mail.

To prepare your articles, you’ll usually need the following information:

- Your LLC name.

- The county in New York where the LLC will be located.

- A New York address where the Secretary of State should mail legal documents to the LLC.

- The signature of LLC’s organizer.

- The person and address forming the LLC is required to sign the Articles.

Once you file your Articles, the secretary of state will review the filing. If the articles are approved, the LLC becomes a legal business entity.

File Your Llc Articles Of Organization

You’ll need to file New York LLC Articles of Organization in order to officially form your NY LLC. To get started in the process of filing your formation documents, you need to either create an account for online filing or . You’ll also need to submit the filing fee of $200 to the New York Department of State.

Don’t Miss: New York City Mugshots

Amending Facts About Your Llc

Your business formation paperwork states certain facts about your business at the time it’s formed. Over time, some or all of this information may change. If it does, you’ll need to file a Certificate of Amendment with the Secretary of State along with a filing fee of $60. You can do this yourself or Incfile can do it for you.

You may want to file Articles of Amendment when you:

- Change your LLC’s name

- Add, remove or change an LLC member or manager

- Alter the stated purpose and activities of your LLC

- Change your LLC’s business address

Get An Ein Number For Your Business

An EIN is a nine-digit number that is issued by the IRS and used to uniquely identify your business for tax purposes. Think of it as a Social Security Number for your business, except an EIN is far less sensitive. It is important to wait until the LLC has been approved by the state before applying, and for that reason, filing for an EIN is one of the last things to do when you are setting up a business Like a social security number, the EIN allows you to:

Like a social security number, the EIN allows you to:

- Open business checking, savings, or investment accounts

- File taxes for the business

- Complete payroll for employees if applicable

- Obtain lines of credit and credit cards, as well as “build credit” for your business

- Apply for applicable business licenses when required.

You only need a few pieces of information to file including your mailing address and legal business name. You can apply online with the IRS by downloading IRS Form SS-4

+How do I form an LLC in New York as a licensed professional?

In New York, business owners cannot form an LLC if the services they provide require a professional state license. This often includes doctors, lawyers, therapists, and other professions where state licensure is required. If you are unsure if your service requires a license in the state of New York, you can check with the Department of consumer affairs or the Secretary of State.

Generally, this can include the following professions:

- Accounting

You May Like: Nyc Pay Ticket Online

Whats The Difference Between My Llcs Name And An Assumed Business Name

Your LLCs name is its official namethe one listed on your Articles of Organization. An assumed business name , is any name other than your LLCs name or your own legal name under which you do business. New York requires anyone using an assumed business name to register with the Department of State by filing a Certificate of Assumed Name. For an LLC, registering an assumed business name costs $25.

Obtain Relevant Business Licenses And Permits

Depending on where your LLC operates and what industry its in, you might need to obtain licenses and/or permits. These can include anything from general local licenses that municipalities and counties issue, to specialized permissions such as building permits or a locksmith license.

An attorney and/or your local municipality can help identify any licenses or permits that your LLC might need.

Don’t Miss: Plateman Staten Island Hours

Requirements After Forming Your Llc

There are also a number of requirements you need to meet after your LLC is formed, including:

- Biennial report All LLCs in New York are required to submit a biennial report to the New York Secretary of State. Along with the report, you must pay a filing fee of $9. If you miss your filing deadline, you may be charged a late fee of up to $250.

- Income reporting requirements The IRS regards every multi-member LLC as a partnership, unless they elect corporation tax status. If your company is a multi-member LLC, you are required to use the partnership return, or Form 1065, to report your income to the IRS.

If you need help with NY state LLC filing fee, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved

Naming Your New York Llc

Your New York LLC must have a name that can be distinguished from all other business names used in the state. The easiest way to check whether a name is distinct enough is by conducting a name search using the Department of State Division of Corporationss Business Entity Database. There is no cost for using the database to conduct searches.

Although there isnt a cost to search for a business name, keep in mind that you might want to reserve a name and/or obtain a doing business as . Both of these do have costs associated with them:

- Business names can be reserved for 60 days by filing an Application for Reservation of Name . The fee to reserve a business name is $20

- DBAs that allow businesses to operate under an assumed name can be obtained by filing a Certificate for Assumed Name . The fee for an LLC is $25

Estimated Cost of Naming Your LLC: $0 $45

Recommended Reading: How To File For Disability Nyc

How Do Online Llc Services Work

Using an online LLC service removes much of the hassle from the business formation process. With these services, all you need to do is provide them with the name, location, and industry your business operates in, along with some info about yourself and your registered agent.

The service then creates your articles of organization and files them with your state to create your new LLC.

File A Certificate Of Publication For Your Llc

Within 120 days of filing the Articles of Organization with the New York Department of State, an LLC must publish a copy, classified ad, or public notice related to the LLC formation in two newspapers within the LCC’s home county for six consecutive weeks. Upon publication, the newspaper publishers will send you an affidavit, which should then be submitted to the New York Department of State along with the Certificate of Publication

- The name of the LLC and the New York Department of State file number

- The registered agents name and address

- The address of the principal office of the business

- The mailing address of the business

- The names and addresses of the managers or members and the CEO of the business

- The principal business activity

Basically, only the contact details and the most general information about the business is required.

Recommended Reading: Renew Italian Passport Nyc

Do You Need A Registered Agent For An Llc

Each state requres LLCs to have a registered agent . The registered agent can be the owner of the business, accountant or anyone who lives in the state and is generally available during normal business hours. Some businesses will pay a registered agent service for additional privacy and peace of mind knowing someone is always available to receive service of process should the LLC be sued.

S After Forming An Llc

After forming your LLC, it’s important to:

- Open a business bank account. A business bank account helps separate personal expenses and company expenses, which is required to maintain your LLC’s corporate veil. A corporate veil protects your personal assets from creditors in potential lawsuits against your LLC or Business.Learn more by reading this guide to Banking for Entrepreneurs. For a multi-member LLC, you’ll also want to set up capital accounts for members. We also recommend checking out our review of the best business bank accounts.

- Get a business credit card. A business credit card will help separate personal and business expenses while building your companys credit history. A strong credit history will be useful for raising capital in the form of small business loans.

- Hire a business accountant. A business accountant will help you save on taxes and avoid penalties and fines. An accountant makes bookkeeping and payroll easier. Find out how much you could be saving with a consultation with a business accountant.

- Get business insurance. Business insurance helps manage risk. The most common forms of business insurance are general liability, professional liability, and workers compensation.

Find out the real cost of getting insurance for your business. Get a free quote or call .

Don’t Miss: Nyc To Italy Flight Time

File Your Articles Of Organization In New York

The state of New York requires you to file Articles of Organization to order to form an LLC. The Articles of Organization is a simple one page form that contains all of the basic information required to register your business. Once your Articles of Organization have been accepted by the New York Department of State’s office, your business is officially formed. A standard filing fee of $200 must be included along with your application.

What information should be included in the Articles of Organization?

The information required in the Articles of Organization is only the most basic details of the business, including the LLC’s name, the principal business address, registered agent details, business purpose, and management type .