Is It Illegal To Withdraw Money From A Dead Person Account

Withdrawing money from a bank account after death is illegal, if you are not a joint owner of the bank account. The penalty for using a dead persons credit card can be significant. The court can discharge the executor and replace them with someone else, force them to return the money and take away their commissions.

Create Your Estate Plan

The New York estate planning attorneys at Lissner & Lissner LLP can advise you about your estate planning options. Located in midtown Manhattan, we have been helping our clients with elder law and estate law for more than 65 years. We can help you create an estate plan that works for your specific situation. Call or contact us online today for help setting up your estate plan.

Will The State Get Your Property

If you die without a will and don’t have any family, your property will “escheat” into the state’s coffers. However, this very rarely happens because the laws are designed to get your property to anyone who was even remotely related to you. For example, your property won’t go to the state if you leave a spouse, children, grandchildren, great grandchildren, parents, grandparents, siblings, nieces, nephews, great nieces or nephews, aunts, uncles, or cousins.

Also Check: Cost Of Cremation Nyc

Petition The Court For Final Distribution And Acceptance Of Account

Once all the debts and expenses of the estate are paid you can now ask the court to approve your actions and your distribution plan. The probate court will hold a hearing on the petition for final distribution and account and then issues an order to discharge the remaining assets to the family members. As in the prior hearings, if family members all sign waivers and consent an official hearing and accounting can be waived. If anyone objects, then a formal hearing will be held and an official account will be required.

Estate Planning With Children As Beneficiaries

Children can inherit property in New York. They are often are named in wills as beneficiaries by parents and grandparents. That’s what generational wealth is all about, right? But there are no laws in the country or New York state that require parents to name their kids in their will and leave them property. In New York, parents can disinherit a child if the will contains clear and unequivocal language to that effect.

What does this mean for the child who is born after the will is drawn up and is therefore not named as a beneficiary? New York estate law terms this child an “afterborn” child, even if the birth occurred before the death. As long as the will did not specifically exclude the child as a beneficiary , the afterborn child is entitled to split the inheritance with the other children in an equitable division.

Don’t Miss: How Much To Save Before Moving To Nyc

Loopholes Claiming That There Is No Money In The Estate

There are ways that people try to plan their estate in order to exclude their spouse and take money outside of the estate in an attempt to avoid the elective share. New York lawmakers are aware of those attempts and have done their best to close those loopholes.

Property Transferred Within a Year of Death Property transferred within a year of death is considered subject to the spousal rights of elective share in New York. The defenders of the will are going to claim that the decedent does not own the property and its not a part of the estate and not subject to the estate rules, but the claim is not likely to work, as New York law has a claw-back provision whereby the surviving spouse can recapture the property gifted by the decedent and taken out of the estate within a year of his death. Such property is considered to be a part of the augmented estate for the purposes of calculating the amount of elective share due to the surviving spouse.

Specific Devises Vs Residuary Bequests In A Will

The way real property is gifted in a last will and testament matters a lot. A gift of real property is generally either specifically devised or passes to the residuary estate.

A specific devise is language in a will that designates a unique piece of real estate to specific beneficiaries . The language would read something like, I give my condo on 323 58th Street, New York, New York 10018 to my niece, Jenny Rogers.

If a gift of real property at death is made as a specific devise in a will, the will does not need to be probated at least not for the purpose of passing the specifically devised real property . Rather, the beneficiary/devisee automatically inherits on the death of the person who made the will .

Specifically devised realty is not a part of the probate or administrable estate, which means court supervision, or proving the validity of the will to a judge, is not required to inherit the real estate. Title vests in the beneficiary immediately upon the death of the person who made the will.

On the other hand, if the real property passes through the residuary estate, the will needs to be probated, or proven as valid to the Surrogates Court. The residuary estate consists of all property that is not specifically devised or bequeathed .

You May Like: Marriage Annulment Nyc

Other New York State Succession Laws

Here are a few more things you should know about New York State’s intestacy laws.

Parent-Child Relationship

Children, as defined by New York State Inheritance Law, requires a legal parent-child relationship, which seems obvious for the family members involved. However, it becomes less clear to a court-appointed judge. In any case, here’s what state law has determined:

- Adopted Children are legally considered the same as biological children

- Foster Children and stepchildren do not have inheritance rights unless they were legally adopted by the deceased

- Posthumous Children, or children conceived prior to but born after the person passes, will inherit the assets as if they had been born while the deceased was alive

- Non-Marital Children or children born outside of marriage, will inherit from a deceased parent if paternity/maternity or legal agreement is established

- Grandchildren inherit the deceased’s estate only if their parent died prior to the deceaseds death

Other Family Members

- Half-Siblings. In New York State, half-siblings inherit as if they were full-blood relatives.

- Posthumous Family. Similarly to posthumous children, relatives conceived prior to but born after the person passes will inherit the deceaseds assets as if they had been born while the deceased was alive.

- U.S. Citizenship. Family members will inherit your estate whether or not they are American citizens or have legal immigration status in the United States.

Everything You Need To Know About New York Intestacy Law In 2022

Starting to think about your will and who will inherit your things can bring up a lot of mixed feelings. You may still feel that you have a long time to live and that it is not yet time to think about it. However, it is best to be prepared for when that time comes.

That is why, below, we will discuss every detail of what happens when a person dies without a valid will in New York.

Recommended Reading: Madame Tussauds New York Parking

Other Necessary Tax Filings

The New York estate tax is in addition to the federal estate tax that calls for individual estates worth more than $11.4 million between gross assets and prior taxable gifts to pay within nine months of the individuals death. Only the value of the estate greater than the above exemption is eligible for the federal estate tax. An automatic six-month extension will be automatically granted for this should you ask for it prior to the due date.

The federal and New York state governments also require a final individual state and a final individual federal income tax return to be filed by tax day of the year following the individuals death. There is a federal estate/trust income tax return that needs to be taken care of as well. For this, make sure you file by April 15 of the year following the individuals death.

The IRS demands that an estate has its own employer identification number to represent itself in any tax-related matters. To apply for an EIN, visit the IRS website or apply by fax or mail.

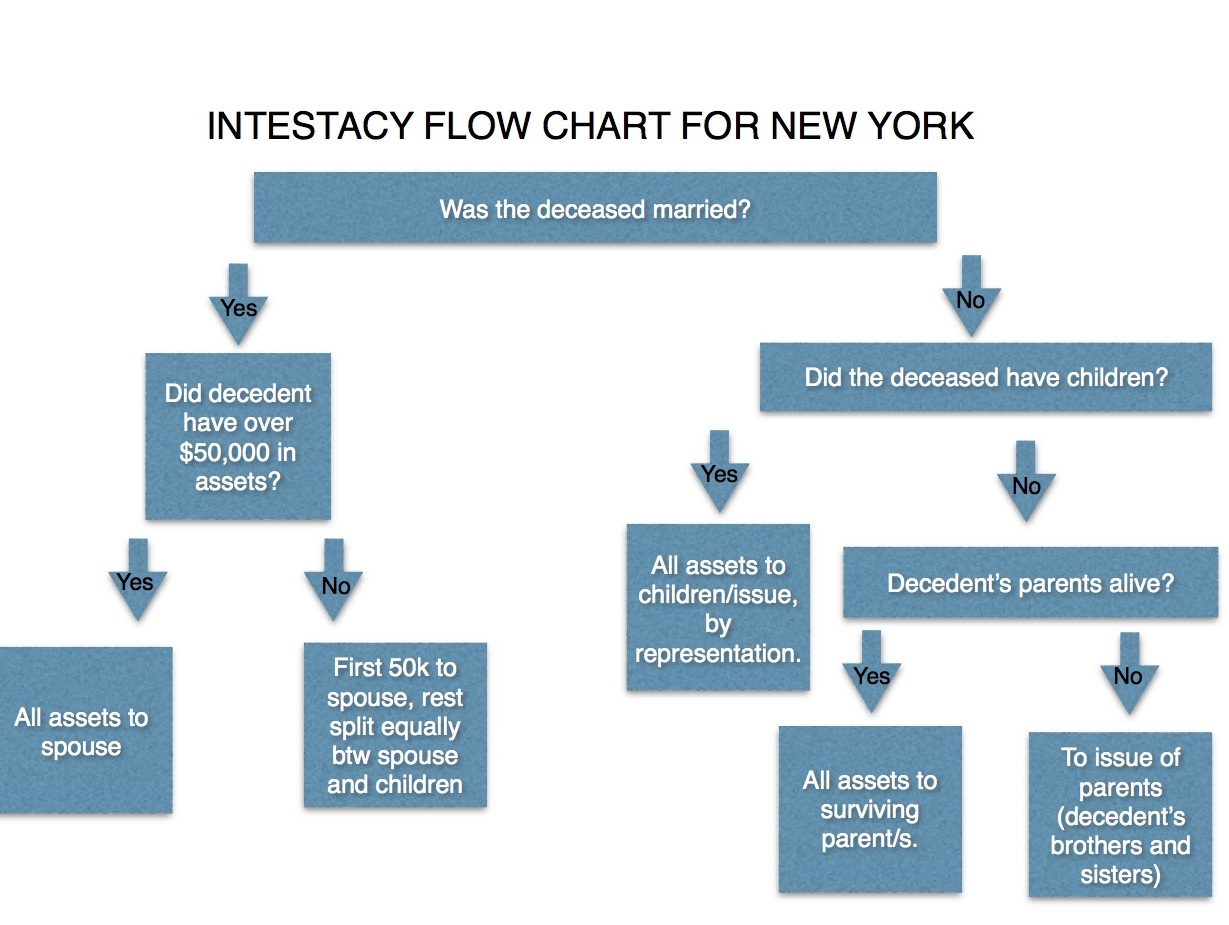

New York Intestacy Laws

The term intestate is used to describe someone who dies without a will in place. When this occurs, all of their assets and property will be distributed through the New York Court System according to the rules of intestate succession. These rules provide a guideline based upon the relationships the deceased had during their lives, as well as any surviving family members that exist. While failing to have a will can have strong impacts and generate great controversy among the surviving family members, the actual guidelines for intestate succession are fairly simple:

- If the deceased had a spouse and no children, the spouse inherits everything

- If the deceased had a spouse and children, the spouse inherits the first $50,000 plus half the total balance of the estate, and the remainder is divided among the children

- If the deceased had children but no spouse, the estate is equally divided among the children

- If the deceased had no spouse or children, the parents would inherit everything. If the parents are deceased, the deceaseds siblings would then inherit everything.

Read Also: Renting A Yacht In Nyc

Specific Gifts Residue And Trusts

The rules about automatic vesting do not apply to co-ops because interests in cooperative corporations are personal property and not real property.

Co-op interests owned as JTWROS or TIE pass automatically at death to the survivor. But if they are owned individually or as TIC, they can only pass through probate and administration, even if they are a specific gift in a will or if there is no will.

Coops can also be titled in trust if it is permitted by the particular cooperative corporation. Each co-op corporation has its own set of rules regarding the titling of shares into a trust, and some prohibit it all together.

Other Factors To Consider

People should understand that they do not want their assets to go by what the State determines is appropriate. They should make a will so they do not have intestacy.

The estate goes to the State in the event that there is no one closer than a first cousin. If there are no first cousins and no descendants of pre-deceased first cousins, then the State takes the money.

There may be an elderly parent getting support from a child that dies. Under the laws of intestacy, the entire estate goes to the surviving spouse and the deceaseds descendants. The parent was depending upon their child to keep supporting them because it is assumed that parents will survive their children, however, after their death the parent receives nothing. One way to overcome that is the deceased could have made a will and provided for his or her parents, in addition to his or her spouse.

On the other hand, if a man does not want to leave his entire estate to his wife. He wants to leave a portion of his estate to his children. If he writes a will leaving a portion of his estate to his children, his wife may be very angry and disappointed, so he does not make a will. The law says that the wife gets the first $50,000 plus 50 percent of the estate, and each of his two children will get 25% each of the balance. The man used the laws of intestacy to accomplish what he wanted without making an affirmative step that would antagonize his wife.

You May Like: Csi New York Where To Watch

How Estate Property Is Categorized In New York Inheritance Law

Property in New York is divided into two simple groups: personal property and real property. Included in real property are things like houses and land or, more broadly, real estate. On the other hand, personal property is just about everything else, such as cars, jewelry, furniture, cash, investments and family heirlooms.

New York is not a community property state. This means that a spouse wont automatically receive most or all of the decedents property following his or her death, according to New York inheritance laws.

Who Raises My Children When I Die

You can name a guardian in a will to raise your children. Usually if one parent dies and the other parent is still alive, the living parent will raise the children. If both parents die simultaneously, the court first looks to see if there is a will that appoints a guardian in it. In the event you do not have a will naming an individual or individuals as guardians for your children, the Surrogates Court will appoint the guardians for your children. This is accomplished by family members, friends or other individuals bringing a proceeding in the Surrogates Court to be appointed the guardian of your children. It is the responsibility of the guardians to see to the childrens health, education, general well being, manage the childrens property and deal with all other needs for the children.

Don’t Miss: How To Register A Car In Ny From Out Of State

Appointment Of A Guardian

If a minor child inherits money, an adult must look after it for the child. New York law does not allow a child under the age of 18 to directly inherit and take control over assets, money or property. If a child is a minor when they become a beneficiary under a will or an heir through intestacy laws, the child cannot legally assume ownership of their share of the estate. Instead, an adult must be appointed as the guardian of the child’s property to manage the money until the child turns 18.

If either parent is alive, they are usually given the job of guardian. If both parents are deceased, the court will usually appoint the guardian named in the will, if any. If the will doesn’t provide for a guardian for the children, and both parents are deceased, the New York court appoints someone else, another family member, trusted family friend or, in the case of large estates, an attorney or bank to look after their interests. If no plans have been made to make certain that the money and property is appropriately managed on behalf of the child, the court will appoint a guardian for the funds.

The guardian owes the child a fiduciary duty to take care of the property and manage it in the childâs best interests. This is the highest legal duty that one person can owe to another. The guardian of the funds may be supervised by the court and required to account for their actions with the assets.

What If No Executor Is Named In A Will

If there is no named executor, a person, usually a friend, family member or another interested party, may come forward and petition the court to become the administrator of the estate by obtaining letters of administration. If no one comes forward on their own, the court may ask a person to serve as an administrator.

Read Also: Registering Vehicle In Ny

What Do You Do When Someone Dies Without A Will In Ny

A person would hire an estate lawyer to deal with the matter whether it is intestacy or probate. If the person had assets, there are two choices, probate or administration. The administration proceeding takes place when a person dies without a will and someone must be appointed to manage their affairs.

What Is A Will An Overview Of Last Will And Testament In New York

A will, or last will and testament, is a legal document that is intended to convey how to distribute ones property after their death. The term property in the context of the legal document refers to real estate property, personal property, and money.

New York laws regarding wills are codified under the New York Consolidated Laws, Estates, Powers and Trusts Law, also known as NY EPT Law.

A will is a major part of estate planning, as it is a legal document detailing ones final wishes for how they want to distribute their property.

Usually, people want their belongings to go to their descendants however, a last will and testament can make directions for gifts to certain loved ones. A will can also give specific instructions for funeral arrangements and care of ones minor children and pets after his or her death.

As your last will and testament is a serious and complex legal document that involves major reflection, it is highly advised to consult a New York estate planning attorney prior to drafting a will.

Also Check: Register Vehicle In Ny

What Happens If Your Loved One Dies Without A Will

First of all, youre not alone. In fact, the majority of probate cases do not have a will. We can help you through this process!

When your loved one dies without a will, or if the will is deemed invalid by the court, you, or the intended legal representative, must open an estate and complete probate, the process of court-supervised distribution of the assets of the deceased. The process the court uses when there is no will is called intestate succession, which simply translates to “no will estate.”

Nuances Of Childrens Status

If the child was adopted by other parents with the consent of the natural parents, they may be foreclosed from inheriting from their natural parents. There are situations where that happens. For example, when a couple divorces and the mother stays with the child, remarries, and the stepfather adopts the child with the consent of the natural parent, it is possible that the child will not inherit in the absence of a will from their natural parent. However, if a child was adopted by the person who died, they are treated the same as natural children.

An illegitimate child inherits from both natural parents the same as a legitimate child. A person is deemed to be illegitimate if both parents were not married while he/she was born.

A stepchild will probably not inherit from the stepparent but will always inherit from the natural parents, unless adopted by the stepparent.

Also Check: How To Change Your Name In Nys