Do Stores On Indian Reservations Pay Federal Tobacco Taxes

It would appear that some tribes are now having to pay federaltax on tobacco products. At least one tobacco store on an Indianreservation in Washington state is charging the tax when they selltobacco products in accordance with the same rate announced by thefederal government.That doesn’t mean they are paying the tax it could only meanthat they are charging more for the tobacco.

Cost Of Cigarettes By State

Scroll down to find where you can get the cheapest cigarettes in the USA. Below, we will list each state from least to most expensive. We will also analyze the cigarette tax for every state and provide approximations on the annual price of smoking two packs a week.

The average US retail price of cigarettes is $6.65 per pack. Americans who smoke two packs a week, therefore, spend about $688 a year.

About Cigarette And Tobacco Products

What is the tax on cigarettes?

New York State and New York City impose an excise tax on all cigarettes possessed in the state for sale.

- The state excise tax rate is $4.35 per package of 20 cigarettes.

-

The New York City local excise tax is $1.50 per package of 20 cigarettes, bringing the combined tax rate for a package of 20 cigarettes purchased in New York City to $5.85.

How is the tax paid?

The excise tax is paid when a licensed cigarette stamping agent purchases New York State tax stamps from the Tax Department. As evidence of payment of the state tax, stamps must be affixed to the bottom of each pack of cigarettes sold in New York State. A joint New York State and New York City tax stamp is evidence that both the state and city excise taxes were paid.

In addition to the excise tax, the agent pays a prepaid sales tax at the time the cigarette tax stamps are purchased and passes that tax on to wholesalers and retailers. For more information on the prepaid sales tax, see Form ST-133, Certificate of Prepayment of Sales Tax on Cigarettes.

When are minimum wholesale and retail cigarette prices changed?

New York State establishes minimum resale prices for sales of cigarettes at the wholesale and retail levels. Minimum wholesale and retail selling prices are subject to change when a manufacturer price change or cigarette excise tax rate change occurs.

What is the tax on tobacco products?

How is the tax paid?

Additional information

Read Also: What Airlines Fly To Cabo San Lucas From New York

Cigarette Prices By State 2021

Cigarette prices per state vary between $5.25 and $12.85 per pack. With 20 cigarettes per pack, this ranges between $.26 and $.64 per cigarette.

Only two states are outliers, with cigarette prices above $10 per pack. Illinois charges $11.50 per pack, and New York charges $12.85 per pack. While both of these states have large populations, there is no correlation between state population and how much they charge for a pack of cigarettes.

New Study Finds New York’s High Cigarette Tax Has Dramatically Reduced Smoking But State Must Do More To Help Low

Statement of Danny McGoldrick, Vice President for Research, Campaign for Tobacco-Free Kids

WASHINGTON, DC A new study published in the journal PLoS One confirms that New Yorks high cigarette tax has helped the state dramatically reduce smoking far faster and to far lower levels than the nation as a whole. The study also finds that smoking rates remain higher among low-income New Yorkers, indicating the need to do more to help low-income smokers quit.

New Yorks cigarette tax of $4.35 per pack, the highest in the nation, has helped reduce both adult and youth smoking by more than twice as much as the nation as a whole. While the studys numbers do not show a decline in smoking among low-income New Yorkers during the period covered by the study, other studies do show that raising cigarette taxes reduces smoking among low-income populations. In addition, this study shows that low-income New Yorkers smoke at much lower rates than their national counterparts, and disparities in smoking between income groups are smaller in New York than nationally.

There is no question that New Yorks efforts to reduce smoking have been highly successful:

- From 2003 to 2010 , New York reduced adult smoking by 28 percent, from 21.6 percent to 15.5 percent who currently smoke. In contrast, the national smoking rate fell by only 11 percent, from 21.6 percent to 19.3 percent.

New York should take additional actions to further reduce tobacco use:

Media Contacts

Read Also: Shipping Alcohol To New York

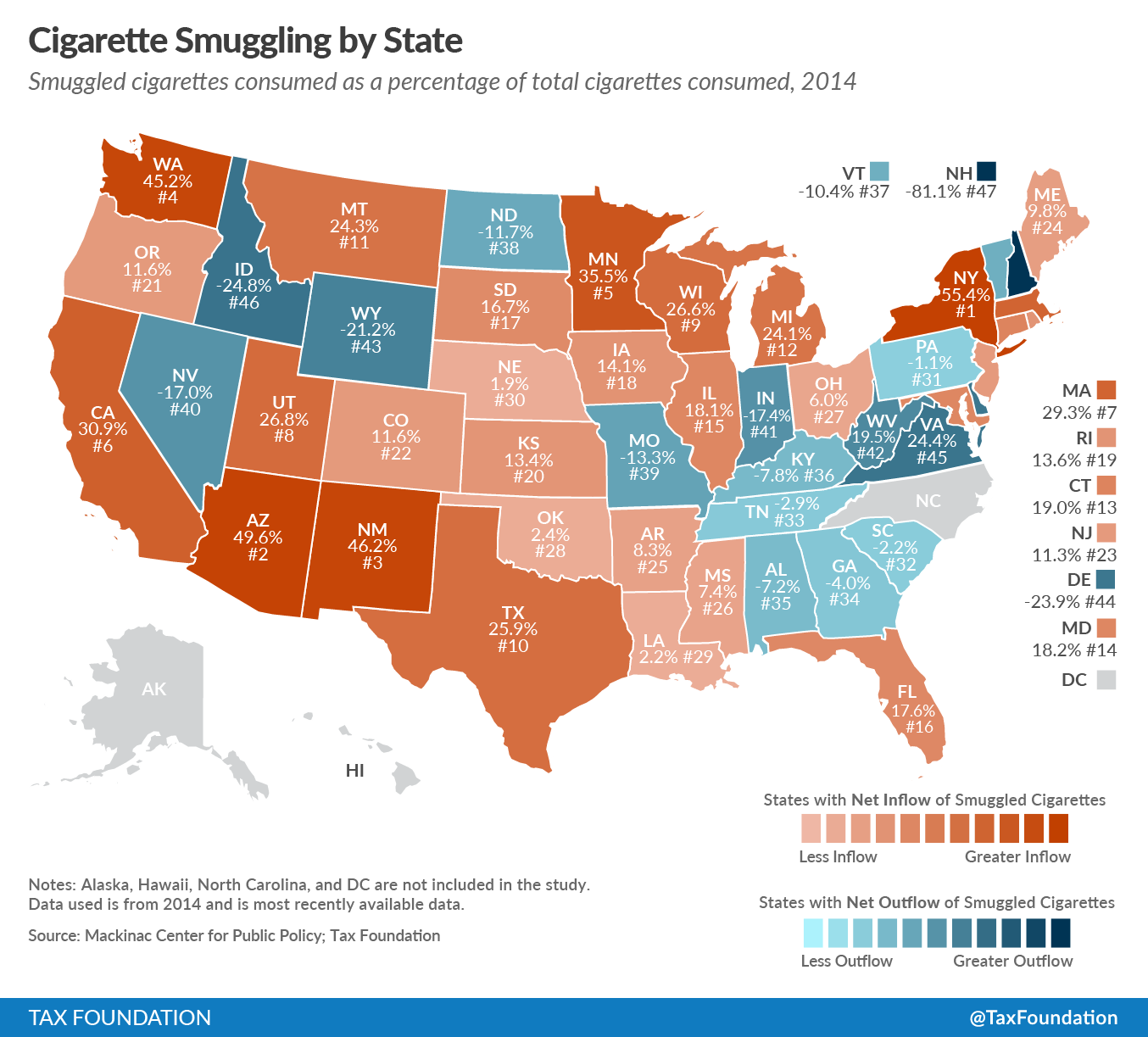

Cigarette And Tobacco Product Tax Crimes

Tax crimes, one of many White Collar crimes aggressively investigated and prosecuted by law enforcement agencies across the state, come in a variety of schemes. One such fraudulent set of offenses is centered on and around cigarette and tobacco products. Codified not in the Penal Law, but New York State Tax Law Section 1814, these unstamped cigarette offenses range from misdemeanors to felonies and carry the same weight and force as those in any statute criminalizing illegal conduct. Whether your lawyer successfully secures a dismissal, reduction or an alternate plea, know that a conviction is equally permanent to those codified in the Penal Law. Simply, with potentially dire direct and collateral consequences, retaining legal counsel to advocate and understanding the basics of the law are essential to implementing your best defense.

Understanding and Defining the Law and its Penalties

Although New York State Tax Law 1814 is the primary statute addressing these offenses, each subsection is vetted with its own definition and elements. Some of these subdivisions are as follows:

NYS Tax Law 1814: If you attempt to evade a tax imposed on ten thousand cigarettes or more, twenty-two thousand cigars or more, or four hundred pounds of tobacco or more, then you would run afoul of this statute. A class E felony, a conviction is punishable by up to one and a third to four years in prison.

Applicable Legal PresumptionsAssociated Crimes and Collateral Issues

New York Cigarette Tax

1st highest cigarette tax

The New York excise tax on cigarettes is $4.35 per 20 cigarettes, one of the highest cigarettes taxes in the country. New York’s excise tax on cigarettes is ranked #1 out of the 50 states. The New York cigarette tax of $4.35 is applied to every 20 cigarettes sold . If a pack contains more then 20 cigarettes, a higher excise tax will be collected.

Recommended Reading: Madame Tussauds New York Parking

How Much Do Cigarettes Cost In Each State

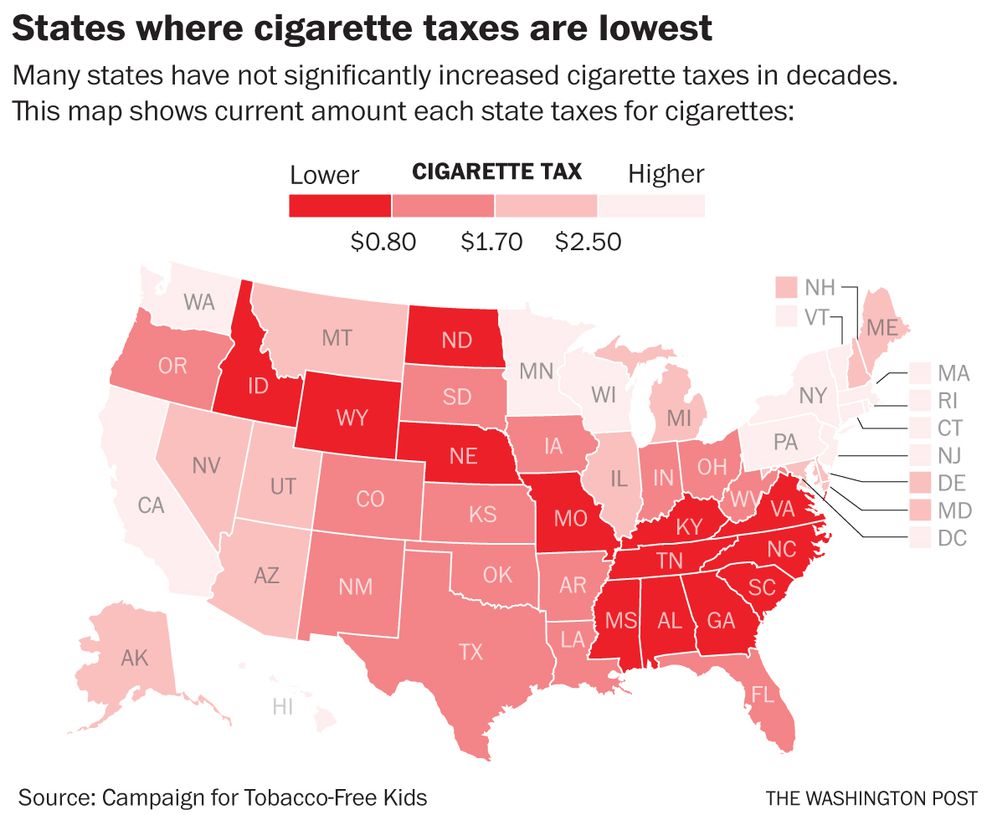

Various factors, including state excise tax per pack, affect the actual cigarette cost in each state. In 17 states, therefore, the average price per pack is under $6.

Cigarettes are the most expensive in New York, Rhode Island, and Connecticut. In these states, they cost over $10 per pack. Missourians have the cheapest cigarettes that cost $4.91 on average, according to data on cigarette prices by state.

Can I Deduct My New York Excise Taxes

Unlike the New York Sales Tax, excise taxes are not generally deductible on New York income tax returns or on your federal tax return. However, the IRS occasionally allows certain excise taxes to be deducted for certain tax years.

- Vehicle Tax Deduction

- New York sales and excise taxes on cars or vehicles bought during 2009 may be deducted once from your federal tax return. You cannot deduct excise taxes for vehicles bought during other years.

- Phone Tax Deduction

- You may deduct excise taxes paid on long-distance phone calls between the years of 2003 and 2006 from your federal tax return.

Read Also: What Do I Need To Register A Car In Ny

How Effective Are Taxes In Reducing Tobacco Consumption

Tobacco taxes are a highly effective instrument to reduce the consumption of tobacco, discourage new young smokers, raise government revenue, and help reduce the social and economic costs of tobacco products consumption, estimated at 8 million premature deaths per year and costing 1.8 percent of global output in health …

Computation Of The Prepaid Sales Tax

The prepaid tax equals the:

- base retail price of cigarettes, multiplied by

- the 8% prepaid sales tax rate.

The Tax Department adjusts the base retail price of cigarettes each year by a factor based on the manufacturers list price for a carton of standard brand cigarettes. The Tax Department issues guidance each year regarding any change in the base retail price of cigarettes and the resulting prepaid sales tax rate. For information, see Important notices on our Web site.

Recommended Reading: How Much Money Should I Save To Move To New York

Which State Has The Highest Cigarette Tax

D.C. has the highest cigarette excise tax per pack of $4.50. Combined with the $0.48 state sales tax per pack, the total tax amount totals $.98.

Connecticut and New York are the second-worst states in this regard, with their cigarette taxes of $4.35 per pack. Still, New Yorkers pay the highest retail price per pack of cigarettes of $10.47.

Other Tobacco Products Tax Rates

- Cigar: $0.80 per individually packed cigar for a package, $0.80 for the first cigar, plus $0.175 for each additional cigar

- Little cigar: $1.09 per pack

- Smokeless tobacco: $0.80 per 1.2 oz. plus an additional $0.20 for each 0.3 oz. or any fraction thereof in excess of 1.2 oz.

- Snus: $0.80 per 0.32 oz. plus an additional $0.20 for each 0.08 oz. or any fraction thereof in excess of 0.32 oz.

- Shisha: $1.70 per 3.5 oz. plus an additional $0.34 for each 0.7 oz., or any fraction thereof in excess of 3.5 oz.

- Loose tobacco: $0.25 per 1.5 oz. package plus an additional $0.05 for each 0.3 oz. or any fraction thereof in excess of 1.5 oz.

Don’t Miss: Do I Need Insurance To Register A Car In Ny

Why Are Taxes Collected On Tobacco And Alcohol

- Just as the tax on tobacco products has helped to raise awareness of the dangers of tobacco by funding anti-tobacco programs, the alcohol tax is used in providing money to programs designed to reduce drunk driving and other alcohol-related problems. Alcohol taxes can also be used by individual cities which have imposed a sales tax on the alcohol.

New York Property Tax

Property taxes are assessed exclusively by counties and cities in New York State, which means that rates vary significantly from one place to the next. Effective rates – taxes as a percentage of actual value as opposed to assessed value – run from less than 0.7% to about 3.5%.

Surprisingly, the city with the lowest effective property tax rate is New York City, where property taxes paid total an average of just 0.88% of property value. The reason for that relatively low rate is that the taxable value of most residential property in New York City is equal to just 6% of the market value. That is, if your home is worth $500,000, you will only be charged taxes on $30,000 of that amount. Outside of New York City, however, rates are generally between 2% and 3%.

Regardless of city, if you are looking to refinance or purchase a property in New York with a mortgage, check out our guide to mortgages in New York. Weve got details on average mortgage rates and other information about getting a mortgage in the Empire State. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York.

Also Check: How To Change Your Name In New York State

Cigarette Prices By State Latest Data And Trends

Americans spend an average of $6.96 for a cigarette pack. Not all US residents, however, pay the same price to satisfy their smoking habits. New Yorkers, for example, pay double the price paid by those in Missouri. Meaning, smoking two packs per week will cost you circa $1,308 a year in the Empire State. Missourians, by contrast, pay only $546. How much money does an average cigarette pack cost? What is the state with the cheapest cigarettes? Why do some states have more expensive tobacco products? Find all the answers in this guide on cigarette prices by state.

New York Income Taxes

New York States top marginal income tax rate of 8.82% is one of the highest in the country, but very few taxpayers pay that amount. The state applies taxes progressively , with higher earners paying higher rates. For your 2020 taxes , only individuals making more than $1,077,550 pay the top rate, and earners in the next bracket pay nearly 2% less. Joint filers face the same rates, with brackets approximately double those of single filers. For example, the upper limit of the first bracket goes up from $8,500 to to $17,150 if youre married and filing jointly.

You May Like: Register Car New York

Do You Have To Pay Taxes On Tobacco

- Selling or even trading any quantity of homegrown tobacco is much more complex. As soon as a grower sells dried tobacco leaves, cigarettes or any other product, that grower becomes a marketer. According to federal law, all marketers must pay tax on their sales. Penalties for non-payment of taxes can be extremely stiff.

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Recommended Reading: Where Is The Wax Museum In New York

Can I Get A New York Excise Tax Refund

While sales tax refunds are available for goods that are purchased in New York and exported, New York excise taxes paid on goods are generally non-refundable. Incentives may exist allowing certain state of federal excise taxes to be refunded on goods bought for specific uses, but such incentives change frequently.

Has this free tax information helped you?

New York Cellphone Tax

3rd highest cellphone tax

The average tax collected on cell phone plans in New York is $17.78 per phone service plan, one of the highest cellphone taxes in the country. New York’s average cellphone tax is ranked #3 out of the 50 states. The New York cellphone tax is already included in the service plan price you pay to your service provider, and may be listed as “Misc. taxes and Fees” or “Other” on your monthly bill.

You May Like: How To Register A Used Car In Ny

What Restrictions Are In Place For Retail Or Youth Access

Sale/distribution of e-cigarettes, vapor products or liquid nicotine to persons under age 21 prohibited.

Vending machine sales of e-cigarettes permitted in bars, private clubs, and tobacco businesses in other businesses that have proportionally few employees under 21, the products must not be accessible to the general public and must be visible to and under the direct control of person in charge.

New York Alcohol Excise Taxes

New York collects special excise taxes on the sale of all types of alcohol, subdivided into specific taxes on wine, beer, and liquor . Alcohol taxes are sometimes collectively referred to as “sin taxes”, which also include excise taxes on cigarettes, gambling, drugs, and certain other items.

Please note that the IRS also collects a federal excise taxes on alcoholic beverages, which are included separately from New York’s alcohol taxes in the final purchase price.

Also Check: How Much Are Tolls From Virginia To New York

What Are The Tobacco Control Policies In New York

- Tobacco Control Policies in NYS. New York is a leader in tobacco control policy development and implementation, with many strong and effective tobacco control policies in place at the state and local levels. State laws related to tobacco include: New York has one of the highest state cigarette taxes in the United States.

Other Tobacco Products Tax

Who Must Pay This Tax?This tax must be paid by the wholesale dealers on sales of OTP to New York City retail dealers or other persons in New York City for purposes of resale.

Who is Exempt from the Tax?No tax is owed on other tobacco products sold to:

- OTP wholesale dealers located within New York City

- dealers located outside of New York City, or for sale and shipment to a person in another state for use there

- the United States government

- a voluntary unincorporated organization of the Armed Forces operating a place for the sale of goods pursuant to federal regulations

- the State of New York, or any public corporation, or political subdivision of the state, not for resale or

- the United Nations, its personnel, and certain qualified diplomatic personnel.

Read Also: Where Is The Wax Museum In New York