What Is The New York State Minimum Wage For 2022

What Is The New York State Minimum Wage For 2022 by state are currently the lowest numbers that every state in the united states offers its staff. In 17 states, What Is The New York State Minimum Wage For 2022 have now been frozen or lowered out of the past twelve months. Several with the suggests, as well as Alaska, Fl, Montana, New Jersey, Ohio, To the south Dakota and Oregon, increased their What Is The New York State Minimum Wage For 2022 according to the present cost of living four of them states in the usa, for example Arizona, Arkansas, Colorado, Maine and Illinois, lowered their minimum wages according to the rising prices amount and, the remainder of the state, Missouri, did not improve minimum wages at all. Minimum wages are currently that is set in each one state at a stage which happens to be generally beneath the existing wage rate for perfect time workforce.

At present, the states with all the highest possible What Is The New York State Minimum Wage For 2022 are Connecticut, Delaware, Section of Columbia, Hawaii, Illinois, Rhode Tropical isle, Vermont, and New Hampshire. These suggests carries a unique minimum wage requirement, but every single also units a different tiered schedule for how large that minimum level might be. These daily schedules fundamentally ascertain who has the highest possible amount of pay out.

New York State Paid Family Leave

Workers will be eligible for 12 weeks of paid family leave in 2018. The time may be used for caring for family members during a serious health condition or to support the workers family when a member is called to active military service. Workers must be employed for six months before being eligible to participate.

As with the minimum wage increase, New York is staging benefit increases, beginning with 50 percent of an employees average weekly wage, capped to 50 percent of the statewide average weekly wage. The average weekly wage will increase to 67 percent by 2021, with a 67 percent cap.

The good news for employers is that workers will pay for the program from a nominal payroll deduction from their checks to cover the entire payroll cost of the program. Except for the cost of scheduling replacement staff, of course.

Keep Informedwith GovDocs Labor Law News

Yonkers

Yorktown

This Labor Law News Blog is intended for market awareness only, it is not to be used for legal advice or counsel.

Who is GovDocs?

GovDocs simplifies the complexity of employment law management for large, multilocation employers across all industries. We offer a suite of innovative compliance products, including labor law postings, data software applications and other program management tools, to ease the day-to-day responsibilities of human resources, compensation, legal and finance teams.

Have less than 30 locations?

New York State Minimum Wage Phase

NEW YORK The New York State Department of Labor announced the state’s $15 minimum wage phase-in will continue, with the next stage taking effect December 31, 2021.

This announcement follows a report done by the Divisions of the Budget that showed pressure for wages to rise in the midst of a pandemic-driven labor shortage.

Hourly employees in Western New York and the rest of the state outside of New York City, Long Island, and Westchester will make at least $13.20 an hour once the change takes effect.

Companies, particularly those that employ low-wage workers, are already raising wages and in some cases offering incentives to hire amid a labor shortage that is showing no sign of abating, and it makes sense to raise the wage floor now and continue supporting New Yorks families while providing a predictable path forward for businesses, Labor Commissioner Roberta Reardon said. With todays action, we are continuing the work of building back with equity and justice.

Future increases that will eventually reach $15 an hour will be determined by the division of budget at the department of labor, which will come after an analysis of the previous increases.

In Other News

You May Like: How To Register A Vehicle In Ny

Ny Minimum Wage For Fast Food Workers

For those working at McDonald’s, Burger King or any other fast food chain, New York has a separate minimum wage.

As of Dec. 31, 2020, the minimum hourly wage for fast food workers is:

- $15 in New York City

- $14.50 in the rest of the state

The minimum wage for fast food workers outside New York City is scheduled to increase to $15 on July 1, 2021.

State law defines fast-food establishments as any chain with at least 30 locations nationwide where customers have to order and pay for their food before they consume it.

Support local journalism

We cover the stories from the New York State Capitol and across New York that matter most to you and your family. Please consider supporting our efforts with a subscription to the New York publication nearest you.

More Or Less Than The Federal Minimum Wage

New York is one of many states whose minimum wage tends to be higher than the federal minimum wage, for both tipped and untipped workers. A few states match the federal minimum wage, and even fewer mandate a minimum wage that is less than the federal minimum wage.

When a states minimum wage law attempts to set a pay rate that is less than the federal minimum wage law, the federal minimum wage law supersedes the state minimum wage law.

When a statelike New Yorkhas a higher minimum wage than the federal minimum wage, the state minimum wage supersedes the federal requirement.

In short, minimum wage laws are always set to favor the employee by establishing the federal or state minimum wage at whichever is the higher wage.

The information contained in this article is not legal advice and is not a substitute for such advice. State and federal laws change frequently, and the information in this article may not reflect your own states laws or the most recent changes to the law.

Recommended Reading: New York City Mugshots

Minimum Wage Increases For Tipped Employees

New York States minimum hourly wage rates for tipped employees in the hospitality industry in Nassau, Suffolk and Westchester counties will increase on December 31, 2021, as follows:

- Food service workers: $9.35 cash with $4.65 tip credit to $10.00 cash with $5.00 tip credit per hour

- Service employees: $11.65 cash with $2.35 tip credit to $12.50 cash with $2.50 tipper hour .

New York State Minimum Wage For Tipped Employees

New York state law allows employers in all industries to satisfy the minimum wage by combining a cash wage paid by the employer with a credit or allowance for tips that the employee receives from customers.

The 2022 minimum wage does not change the amount of tip credit. Employers must continue to ensure that their employees cash wages and tips enable them to receive wages at or above the applicable minimum wage rate.

Cash wages and tip credits in New York state depend on location and industry. Employers should review the information published by the NYDOL for more information.

Don’t Miss: Register A Car Online Ny

Fast Food Minimum Wage

Non-exempt employees at some fast food restaurants are subject to an alternative minimum wage schedule.

This schedule applies to employees who work in covered fast food restaurants whose job duties include at least one of the following: customer service, cooking, food or drink preparation, delivery, security, stocking supplies or equipment, cleaning, or routine maintenance.

These special New York minimum wage rates only apply to fast food restaurants that are part of a chain with at least 30 restaurants nationally.

As of July 1, 2021, the minimum wage for fast food workers throughout the state is $15.00 per hour. No further increases are currently scheduled.

Note: No tip credit is available for fast food employees.

New York States Minimum Wage Rates By Type And Size Of Employer

The minimum wage in New York State varies by employer size as follows:

-

Small employers . The minimum wage has historically risen $1.50 annually before reaching a $15.00 cap on December 31, 2019. This remains the minimum wage as of January 10, 2021.

There is currently a controversial debate surrounding how increasing the minimum wage will affect New York States unemployment rate.

On October 1st, New Yorks Commissioner of Labor will announce whether the state will commit to further increasing the $15.00 minimum wage cap.

-

Large employers . The minimum wage follows the same pattern as for small employers. It rose $1.50 each year before capping at $15.00 on December 31, 2018.

Well find out on October 1st, 2021 whether the cap will be lifted.

Recommended Reading: How To Pay Nyc Parking Tickets Online

New York Minimum Wage And Exempt

Seyfarth Synopsis: As they have each year since 2016, the minimum wage and exempt salary threshold will increase for certain New York employers effective December 31, 2021.

Minimum Wage

In keeping with the gradual increase in the States minimum wage levels, the new tiered rates across the State, effective December 31, 2021, are listed below. The increases depend on employer size and location. The minimum wage rate for New York City employers remains $15 per hour for all employers.

|

Size/Location of Employer |

Minimum Wage as of December 31, 2021 |

|

New York City, 11 or more employees |

$15.00 |

|

New York City, 10 or fewer employees |

$15.00 |

|

Long Island and Westchester employers, regardless of size of employer |

$15.00 |

|

Remainder of state, regardless of size of employer |

$13.20 |

Salary Threshold for Exempt Employees

Along with the increase to the minimum wage, the amounts that employers can deduct from employees wages for items such as uniform allowances and meals are also set to change on December 31. The Department of Labor on its website has summarized the revisions applicable to hospitality employers, employers in miscellaneous industries, and employers in the building service industry. Employers should consult these summaries to determine how much they can deduct for a uniform allowance and claim for meal, lodging and tip credits.

|

Size/Location of Employer |

Ny Minimum Wage For General Workers

The general minimum wage is the one that applies to workers in most industries. If you do not work in fast food or as a hospitality worker who relies on customer tips, this is the one for you in most cases.

As of Dec. 31, 2020, the general hourly minimum wage in New York is:

- $15 in New York City

- $14 in Westchester County and on Long Island

- $12.50 in the rest of the state

You May Like: Submitting Poems To The New Yorker

New York Minimum Wage Increase News

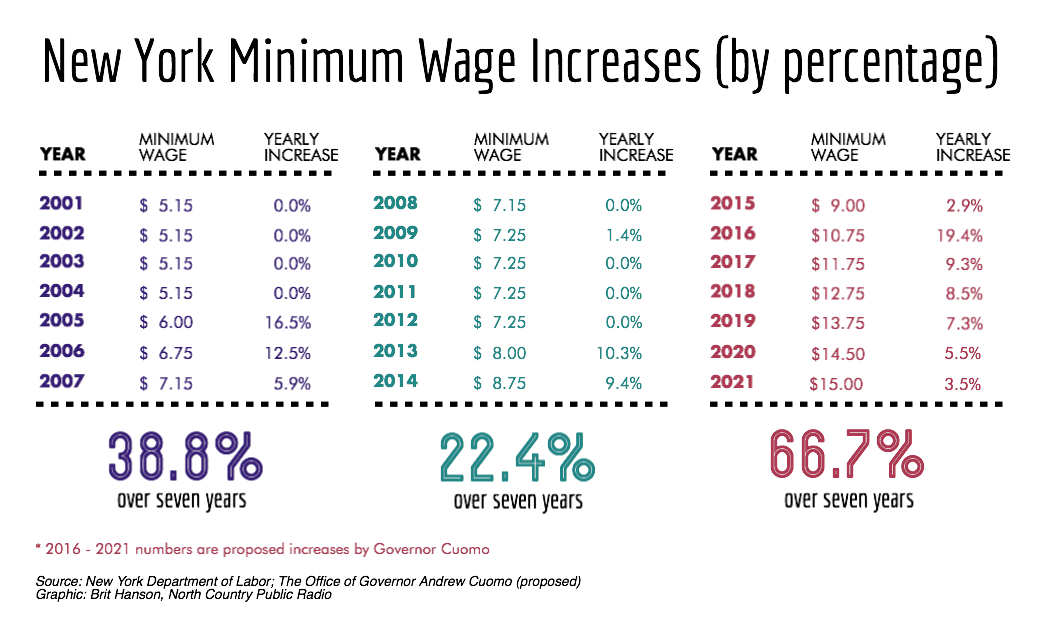

Across the state, the minimum wage is rising each year on December 31 as part of a plan to bring the base minimum wage up to $15 per hour, or $10 per hour for tipped workers. According to the state Department of Labor, in New York City, as of the end of 2018, large employers met this obligation. Small employers also met this obligation at the end of 2019, and Long Island and Westchester companies will meet this obligation by 2021.

The rest of the state has a published increase per year until 2021, when the state Commissioner of Labor will publish the increase each October. They will be percentage increases determined by the Director of the Division of Budget, based on economic indices, including the Consumer Price Index. If you are in need of more money on a faster schedule, however, consider asking for a raise or creating a budget to make your current income last longer.

Image Source

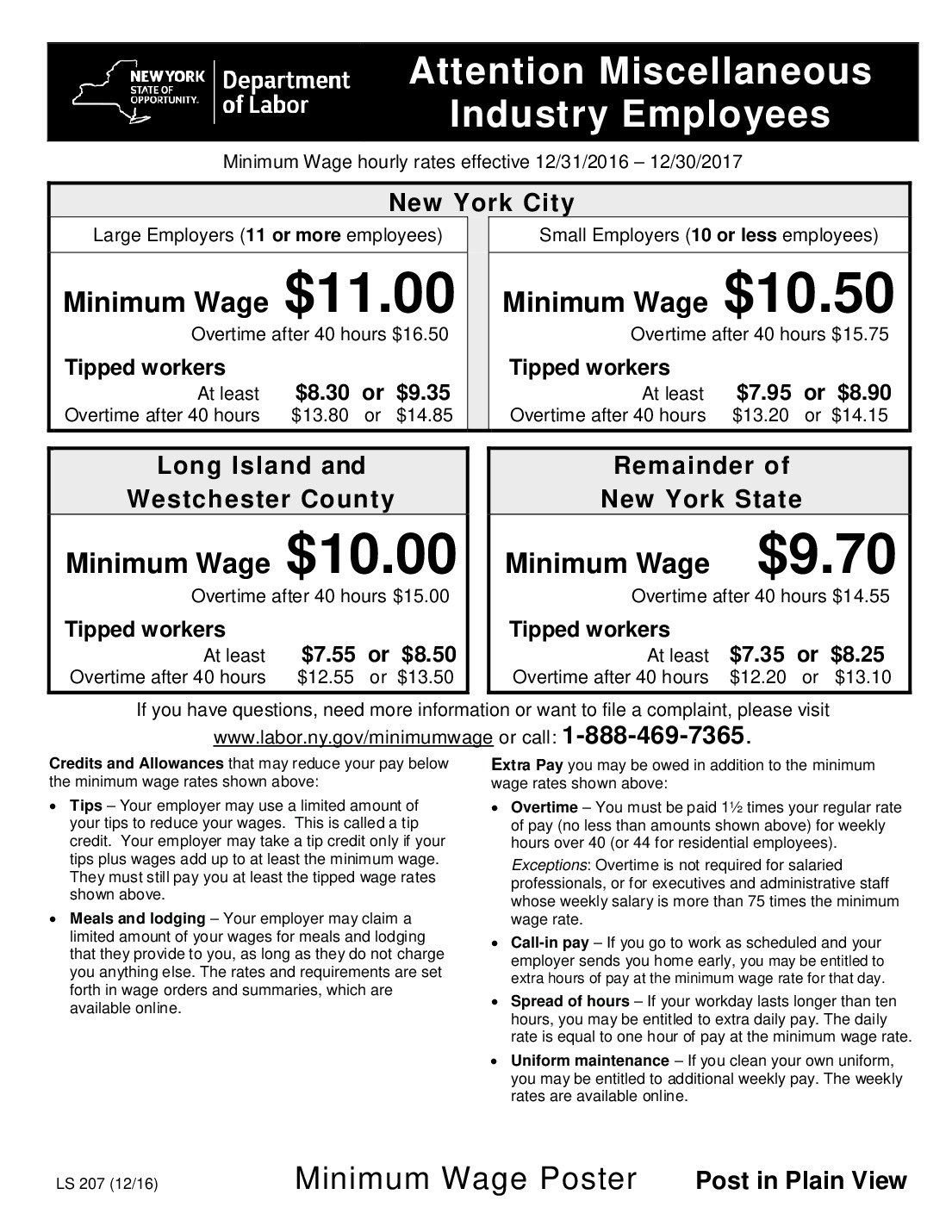

New York Minimum Wage & Labor Law Posters

The Fair Labor Standards Act and New York labor law requires all employers in New York to visibly display an approved New York minimum wage poster, and other New York and federal labor law posters, to ensure that all employees are aware of federal and New York labor law and overtime regulations. Failure to display a New York labor law poster in the workplace can result in severe fines.

Don’t Miss: How To Pay A Ticket Online New York

Household And Family Income

The great majority of New York workers who would benefit from increasing the minimum wage come from families of modest means. As shown in Figure G, about 43 percent of affected workers have total household incomes of less than $50,000, and nearly 63 percent have household incomes of less than $75,000. While these levels of household income may seem high relative to a minimum-wage income, overall household incomes of New York workers, including those who commute from other states, tend to be higher than elsewhere in the country. Less than a quarter of all New York workers have total household incomes below $50,000, and only 42 percent have household incomes less than $75,000. This means that workers from the least-well-off households would disproportionately benefit from the wage hike.

Household income of workers who would benefit from increasing the New York state minimum wage to $15 per hour by July 2021

| Family income level |

|---|

Figure H shows the share of workers grouped by ratio of their family income to the poverty line who would benefit from the higher minimum wage. Three quarters of workers in poverty would get a raise, as would 78.2 percent of workers with family incomes between 101 percent and 200 percent of the poverty line. In contrast, just over 20 percent of workers with family incomes at or above 300 percent of the poverty line would be affected by the policy change.

| Family income-to-poverty status |

|---|

New York State Minimum Wage Laws Across The State

New York State has 14 minimum wages across the state. It is the most complicated state for employers to stay compliant with the labor laws.

Wages break into a geographical location and the size of the employer. It also changes across industries and by employee type.

This article covers the types of minimum wages for an industry, geographical location, and employer size.

Employers in New York must track the wages if they have employees who work in various regions. New York minimum wage changed on December 31, 2017. It changes again on December 31, 2018.

Recommended Reading: Change Llc Name Ny

The Fair Labor Standards Act Flsa Determines The Minimum Wage For Employees In Private And Public Sectors In Both Federal And State Governments

AP The minimum wage is going up at years end throughout New York state. You are entitled to be paid the higher state minimum wage. For workers in New York City employed by large businesses those with at least 11 employees the minimum wage would rise to 11 at the end of 2016 then another 2 each year after reaching 15.

You can read more about the 15 minimum wage phase-in by clicking here. The New York minimum wage was last changed in. 31 2020 the general hourly minimum wage in New York is.

But rising costs to Medicaid and the states shrinking population are raising concerns. Tipped employees include food servers and delivery workers. As part of the 2016-17 State Budget Governor Cuomo signed legislation enacting a statewide 15 minimum wage plan that will lift the earnings of more than 21 million New Yorkers in all industries across the state.

New York began phasing in a 15 minimum wage boost statewide in 2016 and New York City reached 15 in 2018 and 2019. Under the FLSA non-exempt employees must be paid the minimum wage or higher. 15 in New York City As it has been since Dec.

The Director of the Division of Budget will determine a schedule of additional rate increases that lead to the 1500 per hour target rate. The minimum wage rate is the lowest hourly pay that can be awarded to workers also known as a pay floor. 31 2020 everywhere outside of New York City Long Island and Westchester County.

Pin On Useful Classroom Images

Pin On Social Media Tools

What To Do If You Dont Receive Your Minimum Wage

Every employee has the right to be paid for every hour of their work. If an employer pays his employees less than the minimum wage or refuses to pay them at all, they are breaking the wage and hour laws. Employers in the state of New York may also be violating wage and hour laws by not including particular time as work time, such as:

- Time an employee worked off the clock, before clocking in or after clocking out for the day

- Required training programs and classes

- Meals or rest breaks that an employee had to work through

- Certain travel time and

- Waiting time that an employee has spent on the employers premises.

If this happens to you, you have the right to file an unpaid wage complaint against your employer. This way, you will get back whats rightfully yours as well as some additional compensation in the form of liquidated damages, which are typically equal to the amount of unpaid wages. Additionally, you may also be able to collect interest in unpaid wages, lawyer fees, and legal costs.

Employers who willfully and repeatedly violate the minimum wage or overtime laws may become subject to civil money penalty of up to $1000 for every violation. However, such willful violations may result in criminal prosecution, where an employer can be fined up to $10,000, and if they repeat the violation, they may face imprisonment. If an employer makes false statements about supposedly exempt overtime employees, they may be fined up to $16,000 or imprisoned for as many as 16 months.

Don’t Miss: Renew My Italian Passport