New York Property Tax

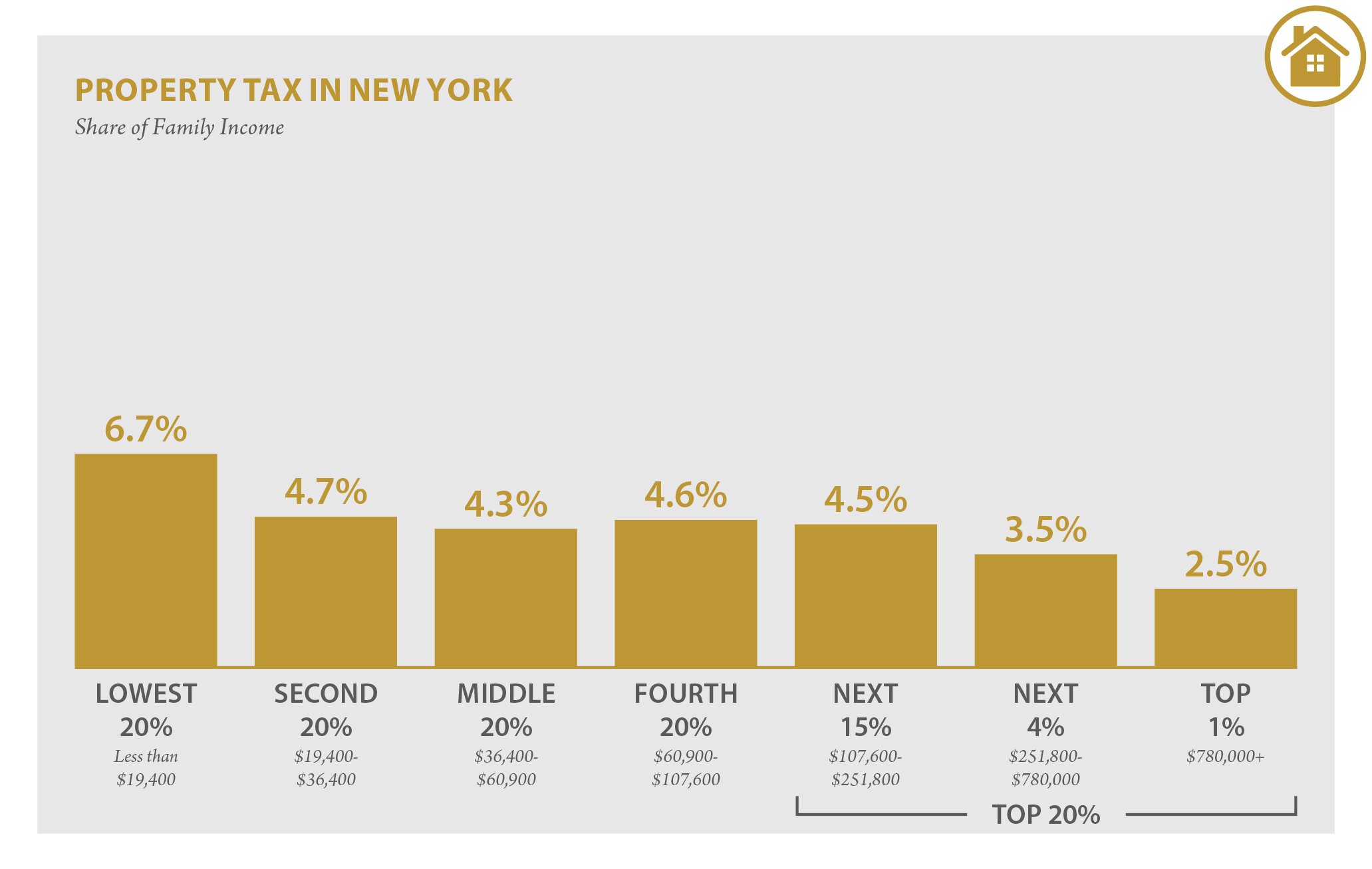

Property taxes are assessed exclusively by counties and cities in New York State, which means that rates vary significantly from one place to the next. Effective rates – taxes as a percentage of actual value as opposed to assessed value – run from less than 0.7% to about 3.5%.

Surprisingly, the city with the lowest effective property tax rate is New York City, where property taxes paid total an average of just 0.88% of property value. The reason for that relatively low rate is that the taxable value of most residential property in New York City is equal to just 6% of the market value. That is, if your home is worth $500,000, you will only be charged taxes on $30,000 of that amount. Outside of New York City, however, rates are generally between 2% and 3%.

Regardless of city, if you are looking to refinance or purchase a property in New York with a mortgage, check out our guide to mortgages in New York. Weve got details on average mortgage rates and other information about getting a mortgage in the Empire State. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York.

Watch Trading Activity In Your Portfolio

When your mutual fund manager sells stock at a gain, these gains pass through to you as realized taxable gains, even though you dont withdraw them. So you may prefer a fund with low turnover, assuming satisfactory investment management. Turnover isnt a tax consideration in tax-sheltered funds such as IRAs or 401s. For growth stocks you invest in directly and hold for the long term, you pay no tax on the appreciation until you sell them. No capital gains tax is imposed on appreciation at your death.

Corporate Income And Franchise Taxes In New York

Corporate income and franchise taxes

Taxable income

How is taxable income determined in your state? To what extent is the state income tax base aligned with the federal income tax base?

Corporate taxpayers in New York State pay tax equal to the highest amount calculated under three alternative tax bases:

- business income

- capital base or

- fixed dollar amount.

The starting point for the New York State business income is the federal income tax base. Certain additions are required, including:

- income from non-New York bonds

- depreciation adjustments and

- royalty payments to related parties.

Subtractions include depreciation adjustments and interest income on U.S. bonds.

Business income is apportioned to New York based on the receipts sourced to New York.

New York City has a similar approach to New York State, apportioning the income based on receipts from New York City.

A separate election must be filed with New York State in order for a corporation to be treated as an S corporation. However, if no New York election is made for a federal S corporation and the corporations investment income is more than 50% of its federal gross income for that year, it will automatically be considered an S corporation for New York State purposes. New York State S corporations pay the fixed dollar minimum amount.

New York City does not recognize federal S corporation election, and S corporations are subject to general corporation tax.

Nexus

Rates

Exemptions, deductions and credits

N/A.

You May Like: Tolls From Nyc To Miami

Gains Or Losses From Real Property

In the past, the rules in this area were clear. Under current legislation, the phrase real property located in this state as defined in Tax Law section 631 is redefined to include interests in a partnership, limited liability company, S corporation, or closely held C corporation owning real property located in New York State if the value of the real property exceeds 50% of the value of all of the assets in the entity. There is a two-year lookback rule to avoid taxpayersstuffing assets into an existing entity before a sale. For sales of entity interests occurring on an after May 7, 2009, any gain recognized on the sale of an interest in that entity will be allocated among the assets in the entity, and the amount allocated to New York real property will be treated as New York-source income.

Ways To Pay Less In Taxes And Save Money

Would you like to reduce your federal income tax bill? I cant imagine anyone who wouldnt prefer to pay less of their income to the federal government. And there are several ways to cut your tax bill or increase your tax refund without running afoul of IRS rules.

While tax credits and tax deductions are easy ways to reduce your tax bill, they tend to come and go as Congress makes changes to the tax code. Here are a few ways to trim your tax bill that remain relevant year after year, barring legislative action.

You May Like: New York City Arrest Record

Moving To Avoid Higher New York Taxes New York May Still Come After You

February 20, 2021 By Asher Rubinstein, Esq.

New York residents who are planning to move out of state to avoid higher New York state taxes should be prepared to prove that they no longer have a tax nexus to New York in case the state decides to audit their returns.

It is no surprise that the COVID-19 pandemic has further destroyed the finances of New York City and New York State. As people and businesses have made less money in 2020, the government has collected fewer tax dollars, while the costs of running the government and dealing with the pandemic have significantly increased. Governor Cuomo announced tax increases to try to lessen the shortfall, and New York State residents will soon pay more tax. Some New York City residents will pay the highest state and local tax rate in the United States , as Governor Cuomo acknowledged in his announcement. COVID-19 has resulted in many taxpayers leaving New York City, and the tax increases will further the trend as more people flee. Florida is one of a few states that offers sunshine and zero state income tax. In addition to the thousands of people moving out of New York, Goldman Sachs, Citadel and Blackstone, among other businesses, are also moving to Florida.

Whether you move for better weather or to pay less in taxes, be prepared for a residency audit. High-tax jurisdictions like New York frequently challenge claims that taxpayers have severed ties and are living and working in low-tax jurisdictions.

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Don’t Miss: Can I Ship Wine To New York

Services Subject To Tax In New York City

New York City collects sales tax on certain services that the state doesnt tax. Examples include beautician services, barbering, tanning and massage services. The city also charges sales tax at health and fitness clubs, gymnasiums, saunas and similar facilities. If youre trying to improve your credit, keep in mind that New York City charges sales tax on most credit reporting services.

Select The Correct Filing Status

Your filing status has a significant impact on your tax situation, as it determines both your tax rate and the amount of your standard deduction.

For example, for the 2020 tax year, the standard deduction is $12,400 for a single filer but $18,850 for a taxpayer claiming the head of household filing status. The tax brackets for heads of household are also more generous than those for single filers.

Depending on your situation, you may have the option of choosing between two different filing statuses.

Here are the five available filing statuses:

- Single. This status is for taxpayers who arent married or who are divorced or legally separated under state law.

- . Married taxpayers can file a joint return with their spouse. If your spouse died during the tax year, you might be able to file a joint return for that year.

- . A married couple can choose to file two separate tax returns. However, selecting this filing status rarely results in a lower tax bill.

- Head of Household. This status generally applies to unmarried taxpayers who pay more than half the cost of keeping up a home for themselves and another qualifying person, such as a dependent child or parent.

- Qualifying Widow With Dependent Child. This status is available to taxpayers whose spouse died during the tax year or in the two preceding tax years who have a dependent child.

You May Like: Dc To New York Tolls

The Basics Of New York State Taxes

The New York State Department of Taxation and Finance administers the various types of tax that you may be subject to in the Empire State. That includes income tax, sales tax, property tax, estate taxes and other taxes.

Whether you live or work in New York, or are a visitor, its important to know what types of taxes you may be on the hook for, and how much you can expect to pay. Heres a summary of what you can expect from each type of tax note that tax rates can change from year to year, so check the Department of Taxation and Finance website for the most up-to-date information.

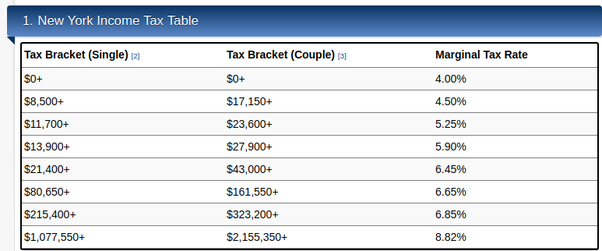

Like the federal tax system, the Empire State has a progressive schedule for income taxes, which means that lower-income taxpayers typically pay a lower marginal rate than those with higher incomes. Your tax rate is determined not only by your adjusted gross income, or AGI, but also by your filing status.

While tax rates may be updated each year, here are the and tax brackets for the 2019 tax year.

| New York state income tax rates |

| Tax rate |

| $60,001 and more | $90,001 and more |

Also, the city of Yonkers has a resident income tax surcharge of 16.75%, which is withheld from your paycheck if youre a W-2 employee.

What Is Sales And Use Tax

When you read about sales tax in New York, youll see talk of Sales and Use Tax. What is use tax and why do you have to pay it?

As you might know, sales tax applies to goods and services you buy within a state. Use tax is an equivalent tax that you pay on items that you purchase outside of the state. It ensures that out-of-state retailers dont benefit just because they dont have to pay the in-state sales tax. The use tax in New York is the same as the sales tax. The two taxes are also mutually exclusive so if you pay one of them, you wont have to pay the other.

Lets look at an example to show how use tax works: Imagine youre a New York resident and you buy a computer somewhere within the state. The seller will collect the regular New York sales tax. But if you buy a computer from New Hampshire, the seller wont collect the New York sales tax. That means you can get the computer without paying the full tax on it. So New York collects a use tax. New York requires residents to report their out-of-state spending in their New York income taxes.

Also Check: Watch Kim And Kourtney Take New York

Invest In Treasury Securities

For high-income taxpayers, who live in high-income-tax states, investing in Treasury bills, bonds, and notes can pay off in tax savings. The interest on Treasuries is exempt from state and local income tax. Also, investing in Treasury bills that mature in the next tax year results in a deferral of the tax until the next year.

Will High Earners Move

Whenever tax increases come up, especially at the state level, those affected may wonder if they should move to a state with a lower tax liability.

Especially as so many have worked remotely due to the pandemic, it’s possible that some could make permanent moves to lower-tax states.

“Are you really going to be in that much of a hurry to embrace what’s effectively a 15% tax that you can avoid by rearranging your affairs?” said Edward Renn, a partner at the Withers law firm, adding that many high-income earners will likely at least consider a move or working remotely to avoid the hike.

Still, there are other considerations to make before moving for tax reasons, even though individuals who are targeted by this increase have more resources than most to relocate.

“I find when people move for tax reasons often it’s not a good idea,” said Slott.

Renn agreed. “I always advise clients to not let the tax tail wag the dog,” he said. “Go where you’re happy.”

Read Also: Ny Times Submission Guidelines

Real Property Tax Credit

Taxpayers who meet certain income limits can claim a credit for real estate taxes paid on property valued at $85,000 or less. You must have a household gross income of $18,000 or less.

It’s available to either homeowners or renters who paid property taxes and meet eligibility requirements. The maximum credit amount is $375. It is refundable.

New York State Sales Taxes

Whether youre a New York resident or a visitor, youll pay a sales-and-use tax on goods purchased in the state. The state charges a flat 4% rate, but your actual rate can vary based on any local sales tax imposed by the city, county or school district in which the sale occurs. For example, the sales tax rate for New York City is 8.875%, while its 7.5% in Ontario County.

Also, theres an additional sales tax of 0.375% on sales made within the Metropolitan Commuter Transportation District.

Check the states website for a list of sales-and-use tax rates by jurisdiction. Or you can use the states online tool to look up the rate by address.

Don’t Miss: Erase New York

Allow The Assessor Access To Your Home

You do not have to allow the tax assessor into your home. However, what typically happens if you do not permit access to the interior is that the assessor assumes you’ve made certain improvements such as added fixtures or made exorbitant refurbishments. This could result in a bigger tax bill.

Many towns have a policy that if the homeowner does not grant full access to the property, the assessor will automatically assign the highest assessed value possible for that type of propertyfair or not. At this point, it’s up to the individual to dispute the evaluation with the town, which will be nearly impossible unless you grant access to the interior.

The lesson: Allow the assessor to access your home. If you took out permits for all improvements you’ve made to the property, you should be fine.

New York Gasoline Tax

The Motor Fuel Excise Taxes on gasoline and diesel in New York are 8.05 cents per gallon and 8.00 cents per gallon, respectively. Furthermore, the Petroleum Business Tax is paid by petroleum businesses for certain types of fuel and paid at different points in the distribution chain. As of Jan. 1, 2020, the PBT is 17.4 cents per gallon.

Don’t Miss: Parking Near Madame Tussauds New York

Schedule A Tax Allocation Consultation With The Attorneys At Hodgson Russ Llp

In today’s world, many taxpayers lead complex lives and may travel to multiple states as part of business, family obligations and other experiences. If you are subject to a New York State nonresident audit or have questions about residency or nonresidency issues, contact the attorneys at Hodgson Russ LLP for a consultation.

New York State Returns

You are considered a New York resident and liable for New York taxes if you’ve resided at least 184 days of the year in the state during the tax year. You’re also required to file a New York resident return IT-201 if your New York adjusted gross income is greater than the New York standard deduction for your filing status. As of tax year 2019 , the standard deductions are:

Also Check: How Many Tolls From Baltimore To New Jersey

Ask For Your Property Tax Card

Few homeowners realize they can go down to the town hall and request a copy of their property tax cards from the local assessor’s office. The tax card provides the homeowner with information the town has gathered about their property over time.

This card includes information about the size of the lot, the precise dimensions of the rooms, and the number and type of fixtures located within the home. Other information may include a section on special features or notations about any improvements made to the existing structure.

As you review this card, note any discrepancies, and raise these issues with the tax assessor. The assessor will either make the correction and/or conduct a re-evaluation. This tip sounds laughably simple, but mistakes are common. If you can find them, the township has an obligation to correct them.

New York State Sales Tax

In the state of New York, the sales tax that you pay can range from 7% to 8.875% with most counties and cities charging a sales tax of 8%.

The sales tax rate in New York actually includes two separate taxes: sales tax and use tax. The state groups these together when talking about sales tax and both taxes are the same rate so it doesnt matter where you purchase things. New York sales tax is currently 4%. Each county then charges an additional sales tax between 3% and 4.5%.

Counties in the metropolitan commuter transportation district also collect a sales tax of 0.375%. This applies to all taxable sales within the counties of Bronx, Kings , New York , Queens, Richmond , Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, Westchester.

| Sales Tax in New York Counties |

| County |

| 8% |

Don’t Miss: Pay Tvb Ticket