Do You Have To Renew Your Sales Tax Permit

Some of these states require you to renew your certificate after a certain amount of time, while others do not. TaxJar has an extensive and very useful list with all the information.

At888 Lots we require a valid resale certificate from the state you are located in. We will keep you certificate on file after your first purchase with us, so you do not need to present it every time.

How Long Will It Take To Process My Business License

The time it takes depends on the complexity of your business. Some types of business licenses can be completed over the counter, while others could take weeks or months. You could need to speak with Development Services, County Health, or Fire depending on the requirements for your business location and business type. Those are the departments that will take time with plans, inspections, corrections, permits etc. The Business License Department would not be able to answer on a timeline for those departments since it is not their area of expertise.

Costs by license type

Each type of license has a fee that is based on the cost of staff time to approve. It is listed on the application form.

Who Must Have A General Vendor License

You must have a General Vendor license to sell, lease, or offer to sell or lease goods or services in a public place that is not a store.

You do NOT need a General Vendor license to sell:

- Newspapers, periodicals, books, pamphlets, or other written matter.

- Artwork, including paintings, photographs, prints, and sculptures.

- Food. Note: Food vending requires a license from the Department of Health and Mental Hygiene. Call 311 or visit nyc.gov/health for information about food cart vendor licenses and permits.

- Items at a garage sale on private property.

- Merchandise from a booth or stand at an authorized Street Fair . Please note that you must obtain a Temporary Street Fair Vendor Permit to sell merchandise at an authorized Street Fair.

This description is only a general explanation of which individuals need to have a General Vendor license.

You May Like: Wax Museums In New York City

Is A New Mexico Sales Tax Permit The Same As A New Mexico Resale Certificate

A New Mexico sales tax permit is not the same as a New Mexico resale certificate. The former allows a company to make sales inside a state and collect/remit sales tax for those sales. Conversely, a resale certificate allows a buyer to purchase goods from a supplier without having to pay sales tax on the goods that would otherwise be taxable. It is the responsibility of the supplier to keep a copy of the resale certificate for compliance purposes and the responsibility of the retailer to collect sales tax when the goods are sold. In order to have a New Mexico resale certificate, you must first apply for a New Mexico sales tax permit. This permit will provide you with a New Mexico Tax ID number which will be a necessary field on the New Mexico resale certificate.

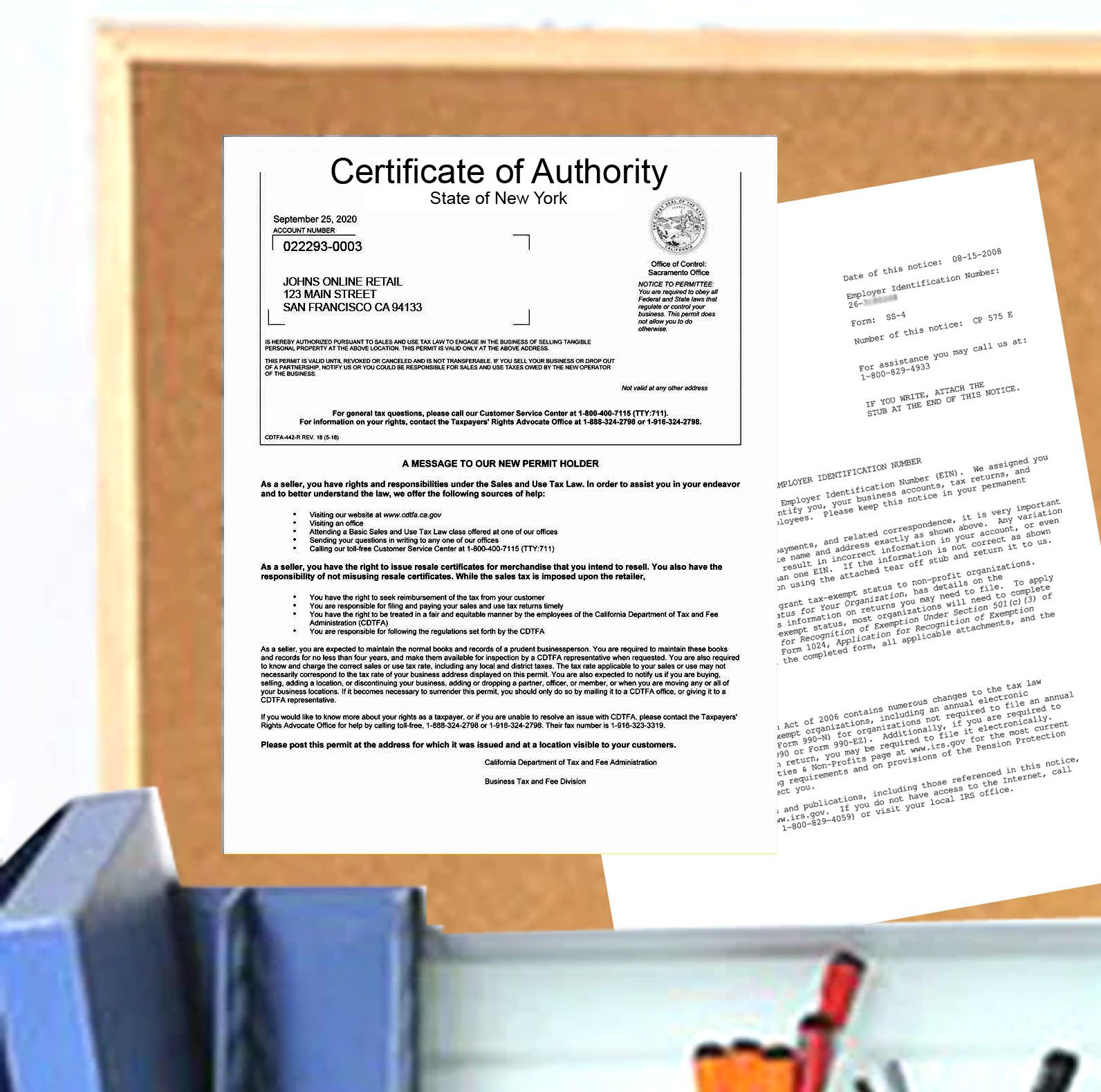

New York Resale Certificates For Businesses

You may use a resale certificate in New York to purchase items intended for resale without paying sales tax, but you may also need a Certificate of Authority to do so. Find out what types of businesses need to obtain these important documents.

Like most states, New York permits resellers to purchase items tax free if the goods are to be resold. Such items must then be documented on a New York resale certificate. In order for your business to participate, you may have to register as a seller and obtain a Sales Tax Certificate of Authority, which gives you permission to collect sales tax. You can then apply for the New York resale certificate, also called a sales tax exemption certificate.

Recommended Reading: Cost To Register A Car In Ny

Penalties For Failing To Register For Sales Tax

If you are required to register for sales tax purposes but fail to do so and you operate a business without a valid Certificate of Authority, you will be subject to a penalty. The maximum penalty for operating a business without a valid Certificate of Authority is $10,000, imposed at the rate of up to $500 for the first day business is conducted without a valid Certificate of Authority, plus up to $200 per day for each day after. For more information, see Tax Bulletin Sales and Use Tax Penalties .

Sales Tax: A Brief Overview

Sales tax is a tax levied on all sales of physical goods to consumers within most states. Some states also charge sales tax for certain kinds of services.

Not all states charge sales tax: if you live in Delaware, Oregon, New Hampshire, Montana or Alaska, then sales tax either does not apply or applies only in certain circumstances. For sellers in any other state: yes, you do need to worry about sales tax!

You can find your state’s sales tax rate here. It is important that you do this, because taxes vary significantly among the different states. For instance, some have one rate that applies state-wide, while in others, the rate varies between counties and cities.

Determining what state you need to pay tax comes down to where you operate. A base of operations is called a “nexus.” If you are dropshipping from home, you’ll only be responsible for that state’s sale tax because you only have one nexus. If you have a storage warehouse in another state, you have a nexus there, too. If you opt to ship goods via Fulfilled by Amazon, you technically have a nexus in whatever state your goods are warehoused in.

Note: In some states you also need to collect sales tax on shipping and handling.

You can learn more about sales tax here.

Recommended Reading: Registering A Vehicle In New York

A Bit Of Extra Information For You

There are a few other things to consider when looking into the taxes you’ll be responsible for as a seller.

-

Reseller’s Permits and Buying Wholesale

If you are a US citizen purchasing wholesale goods from a supplier within the US, then you will probably need a resale certificate or license from the state in which your business is located.

A resale certificate or license enables you to purchase goods wholesale without paying sales tax. It also allows you to collect sales tax from your customers, the end consumer.

Without a resale certificate, you will have to pay sales tax on the goods you buy wholesale and then also charge sales tax. In this case you can add the sales tax you paid as a deduction on your return, but it is much less complicated to just present your reseller’s license when you buy.

Most wholesalers will ask to see a sales tax ID or reseller’s license before they will sell you the goods. This is because they are legally obliged to check whether you are able to collect sales tax from the end user.

-

Records to Keep

You need to keep your resale certificate on file as part of your business records. You must be able to match your sales records with the certificates for audit purposes.

-

Reporting Sales Tax

How often you need to complete Sales and Use Tax reports will depend on your monthly sales turnover and the state you are working from.

Note: Trading Assistants do not need to collect or remit sales tax.

What Resources Are Available To Me To Help Me Get Set Up As A Business

We encourage you to take advantage of the free resources offered by the City and State to help you set up your business and comply with applicable rules. The Citys Department of Small Business Services offers Solution Centers, where you can visit with a specialist to get advice on starting and operating your business.

You May Like: Submit Poetry To New Yorker

What Licenses Are Needed To Start A Online Retail Business

Expiration Of A New York Resale Certificate

While a resale certificate itself doesn’t expire, a Certificate of Authority is valid for a maximum of three years and is renewable at the the discretion of the Department of Taxation and Finance.”

Determining whether you need to collect sales tax in New York and how to do it properly can be complicated, particularly as a reseller, so you may wish to consult an attorney or online service provider to help you through the process.

About the Author

Michelle Kaminsky, Esq.

Freelance writer and editor Michelle Kaminsky, Esq. has been working with LegalZoom since 2004. She earned a Juris DoctoRead more

Also Check: Csi New York Where To Watch

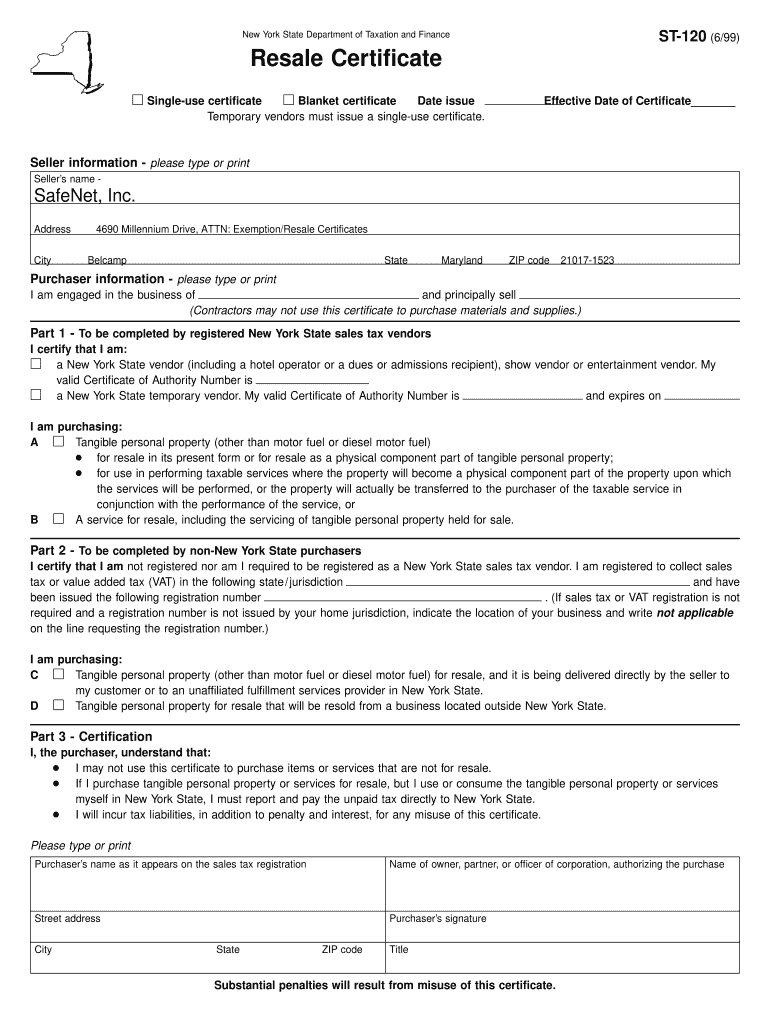

New York Resale Certificate

Once your business is registered with the state and has a Certificate of Authority, you may use a Resale Certificate to purchase items without paying sales tax, as long as you intend to resell them and collect sales tax from buyers.

Within 90 days of purchase, you must provide the seller with a resale tax certificate. You can use a blanket certificate” if you make many purchases from the same seller. New York has several different kinds of exemption certificates, so you must be sure you’re using the correct one for the transaction type. All exemption certificates require specific information, including both the purchaser’s and seller’s names and addresses, date, and purchaser’s signature. Note that New York also accepts electronic sales tax exemption certificates.

There are no fees associated with obtaining a Certificate of Authority or using a resale certificate.

New York takes operating without a Certificate of Authority seriously: violations could result in a penalty of up to $10,000.

Where To Go If You Need Help Registering For A Sales Tax Permit In New York

If you are stuck or have questions, you can either contact the state of New York directly or reach out to us and we can register for a sales tax permit on your behalf.

How to contact the New York State Department of Taxation and Finance if you have questions: You can contact the New York State Department of Taxation and Finance at 485-2889.

How to contact TaxValet if you want someone to handle your permit registration for you: You can learn more about our sales tax permit registration service by .

Read Also: How To Delete A New York Times Account

Do I Need A Resale Certificate In New Jersey

If your business is a retail or wholesale operation that does not want to be responsible for collecting sales tax on resold items and does not want to have any exposure to any future tax liability, then a New Jersey resale certificate will be required. Since sales tax is only supposed to be paid one time on a taxable good or service, then you want to make sure you are compliant at your phase of the products sales life. Even though sales tax is usually paid by the end user, the only way to ensure this is with a New Jersey resale certificate that is properly filled out.

How Does My Business Get A Certificate Of Authority

To get a Certificate of Authority, simply . Weve designed our NY Certificate of Authority service to be simple, convenient, and fast. By using our service, you can avoid confusing NY paperwork and application forms, and you dont have to risk a rejected application due to an error or mistake. Due to our direct electronic state filing methods we can have your sellers permit to you in as little as a few hours.

We process all orders quickly, and we error check and review all permit orders before submitting to New York State to ensure that all permits are issued quickly.

Read Also: New York Toll Costs

Is A Resale Certificate The Same As A Sales Tax Id

The Sales Tax Certificate of Authority and Resale Certificate are commonly thought of as the same thing, but they are actually two separate documents. The Sales Tax Certificate of Authority allows a business to sell and collect sales tax from taxable products and services in the state, while the Resale Certificate allows the retailer to make tax-exempt purchases for products they intend to resell.

After registering, a Certificate of Authority Number will be provided by the Department of Taxation and Finance. This number will be listed on the Resale Certificate.

Types Of Certificates Of Authority

The Tax Department issues two types of Certificate of Authority for sales tax purposes, regular and temporary. The type of Certificate of Authority you need is based on the expected duration of your business activities. The same form and application process are used for both types of certificates however, the temporary certificate will be issued with a beginning and ending date.

Recommended Reading: New Yorker Op-ed Submission

Reseller Permit: Your Questions Answered

How long will it take to have my application processed?

The Department has set a goal to process applications within 10 business days, however it may take up to 60 days to process your application.

Is there any cost or fee to obtain the permit?

Will I get a new reseller permit number each time I renew my permit?

Yes. The last two digits of a permit number represent the year the permit expires, so the number will change.

When selling a business, can the reseller permit be transferred to a new owner? Or does the buyer need to apply for a new reseller permit?

Reseller permits are not transferable. The new owners will need to apply for a reseller permit. They will be responsible for qualifying purchases made with their own permit.

Will business owners need to make copies of their reseller permit and provide one to every place they conduct business?

For all wholesale sales, the seller is required to either keep a copy of your permit or obtain electronic verification from DOR that your permit is valid.

Im a wholesaler. My retail customer provided a copy of their reseller permit with a different trade name listed. How can I verify its registered to that business?

When more than one business is listed under a single UBI number, generally, only one trade name is shown. Use the Business Lookup Tool to verify reseller permits.

If a permit is used without authorization , is there a hold-harmless provision for circumstances beyond the permit holder’s control?

How To Register For A Sales Tax Permit In New York

For more information about collecting and remitting sales tax in New York, check out New York Sales Tax Resources.

1. Who needs a sales tax permit in New York?

Vendors who are making sales in New York subject to sales tax.

According to the state of New York, you are a New York vendor if:

- you maintain a place of business in the state, such as a store, office, or warehouse, and sell taxable, tangible personal property or services to persons within the state or

- you solicit business in New York State through employees, independent contractors, agents, or other representatives, and through these persons, sell taxable, tangible personal property or services in New York State or

- you solicit business through catalogs or other advertising material, and have some additional connection with the state, and through the catalogs you sell taxable, tangible personal property or services or

- you make sales of taxable products to customers within New York State, and regularly deliver the products in your own vehicles.

File for your sales tax permit with the New York State Department of Taxation and Finance.

2. How do you register for a sales tax permit in New York?

Register for a sales tax permit at the New York State License Center.

3. What information do you need to register for a sales tax permit in New York?

General business information such as your name and employer identification number or social security number

4. How much does it cost to apply for a sales tax permit in New York?

Don’t Miss: New York Times Poetry Contest

Requirements For Ny Car Dealerships

After you submit your dealer application packet, a DMV agent will call to schedule a business inspection appointment. At your inspection, an automotive facilities inspector will check for:

- Proof of identification for each person listed on your dealer license application.

- A permanently mounted official dealer sign that must:

- Have white letters on a red background.

- Be at least 3 feet wide and 2 feet tall.

- Read REGISTERED STATE OF NEW YORK MOTOR VEHICLE DEALER in block letters 2 inches high.

- Be visible at all times from the nearest roadway.

Once your dealership passes inspection, the NY DMV will provide you with the necessary registration and licensing certificates. Now get to selling those cars!

Business Licensing And Taxes In New York City

Join a local Host Club: Want to connect with Hosts in your area to get tips and advice? Its easyjoin your communitys official Host Group on !

These information pages can help you get started in learning about some of the laws and registration requirements that may apply to your Experiences on Airbnb. These pages include summaries of some of the rules that may apply to different sorts of activities, and contain links to government resources that you may find helpful.

Please understand that these information pages are not comprehensive, and are not legal advice. If you are unsure about how local laws or this information may apply to you or your Experience, we encourage you to check with official sources or seek legal advice. Note that different cities have different license requirements and rules. The discussion below applies if you are operating within the city limits of New York City. If your business includes or extends to other cities, you should determine whether other licenses are required.

Please note that we dont update this information in real time, so you should confirm that the laws or procedures have not changed recently.*

Recommended Reading: Re Registering A Car In Ny