A Bit Of Extra Information For You

There are a few other things to consider when looking into the taxes you’ll be responsible for as a seller.

-

Reseller’s Permits and Buying Wholesale

If you are a US citizen purchasing wholesale goods from a supplier within the US, then you will probably need a resale certificate or license from the state in which your business is located.

A resale certificate or license enables you to purchase goods wholesale without paying sales tax. It also allows you to collect sales tax from your customers, the end consumer.

Without a resale certificate, you will have to pay sales tax on the goods you buy wholesale and then also charge sales tax. In this case you can add the sales tax you paid as a deduction on your return, but it is much less complicated to just present your reseller’s license when you buy.

Most wholesalers will ask to see a sales tax ID or reseller’s license before they will sell you the goods. This is because they are legally obliged to check whether you are able to collect sales tax from the end user.

-

Records to Keep

You need to keep your resale certificate on file as part of your business records. You must be able to match your sales records with the certificates for audit purposes.

-

Reporting Sales Tax

How often you need to complete Sales and Use Tax reports will depend on your monthly sales turnover and the state you are working from.

Note: Trading Assistants do not need to collect or remit sales tax.

A Standard Resale Package Has Two Parts:

1. What is a resale certificate?The first part is the actual resale certificate, which may also be called a closing statement, estoppel, dues statement, paid assessment letter, 3407 or 5407. In Georgia, these statements are known as closing letters. Florida calls them estoppels. In Ontario, they are status certificates. For simplicity, this article will use the term resale certificate, but its important to make sure you know the language used in your area. The associations property management company, realtor and title company will be well-versed in the terminology you need to know.

The resale certificate provides specific information about the home you are buying and its standing in the community association. It includes any past due payments to the association, pending violations, unpaid violations, unpaid special assessments and fees that are due upon closing. It also includes information about the association as a whole: pending litigation, amounts in the reserve fund and planned capital expenditures for the upcoming year. Some states also include the type of voting that the association uses and other state-specific information. In Florida, the amount that is paid for the certificate must be included on it.

How To Apply For A Resellers Permit In 3 Easy Steps

Applying for a Resellers Permit is actually really easy once you have the required information and documents ready, especially with the handy map weve created for you . All you need to do is click on your state and youll be taken to a page where you can apply for a permit online.

However, I know from experience that filling out government forms can be daunting, especially when youre just starting out. So lets go through the process step-by-step.

1. Determine which states you need a Resellers Permit for

The first step is figuring out which states you need a Resellers Permit for. If you are running a business from home and dont have any storage facilities or offices in other states, then you only need a Resellers Permit for your home state. If you have an office in one state and storage facilities in several other states, you will need to apply for a Resellers Permit in each of those states, because you have nexus in those locations. Use our map to get the relevant information for each state.

See more about what nexus means below.

2. Prepare the necessary documents for your application/s

Theres quite a bit of information you need to provide, so its best to get it all ready before you start the process. Youll need to provide personal identification . Youll also need to provide documents about your business, such as your bank account information, names and locations of your suppliers, and your anticipated monthly sales figures.

3. Complete your application

You May Like: New York Toll Costs

Do I Need A License To Sell Online

The short answer to whether a business license is a requirement for online selling: yes. A business license is a requirement for online selling and its a crucial part of establishing your business as legitimate and legal. But getting an online business license is not as simple as just applying for a document.

General Sales Tax Exemption Certificates

Please note that this chart provides a brief description of the various exemption documents. Additional requirements may apply. See the individual forms and instructions for details.

General sales tax exemption certificates

| Exemption certificate | ||

|---|---|---|

| No, but must be an agency, or instrumentality of the United States | Purchase of any taxable tangible personal property or service by a United States governmental entity | Not a Tax Department form. A copy of a contract signed by an authorized United States government official is also sufficient to show exemption. Form ST-119.1 is not valid to show exemption for governmental entities |

Note: A Tax Bulletin is an informational document designed to provide general guidance in simplified language on a topic of interest to taxpayers. It is accurate as of the date issued. However, taxpayers should be aware that subsequent changes in the Tax Law or its interpretation may affect the accuracy of a Tax Bulletin. The information provided in this document does not cover every situation and is not intended to replace the law or change its meaning.

You May Like: What You Need To Register A Car In Ny

How To Get Resale Certificate Ny

To apply for a Certificate of Authority use New York Business Express. Your application will be processed and, if approved, well mail your Certificate of Authority to you. You cannot legally make any taxable sales until you have received your Certificate of Authority.

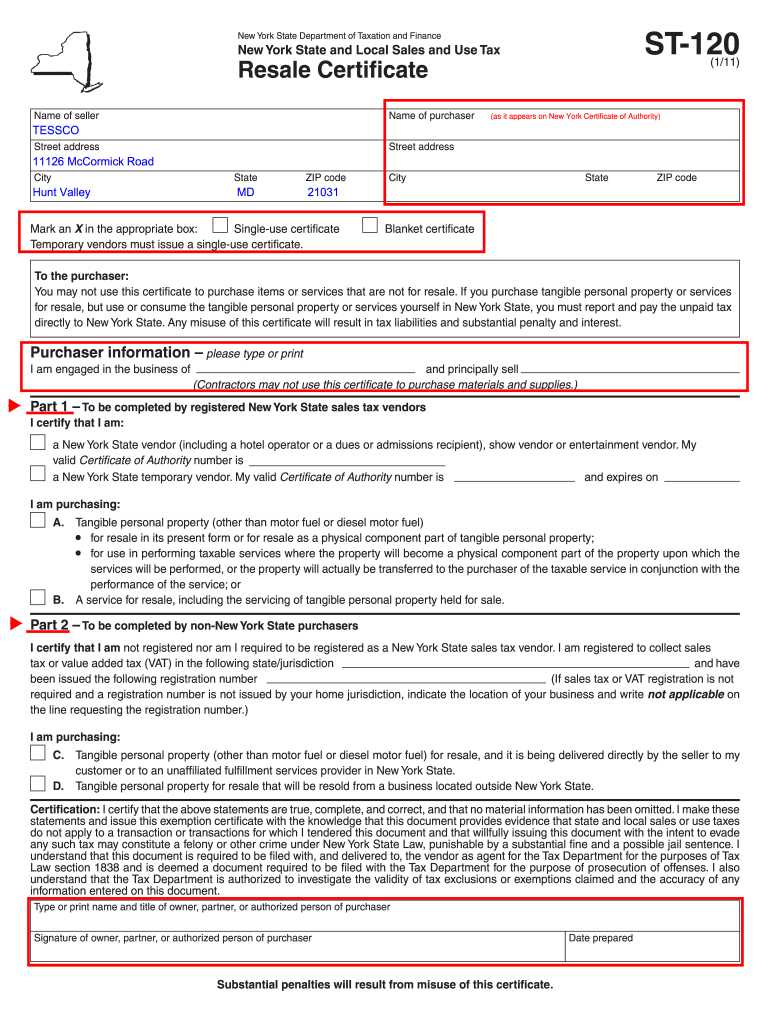

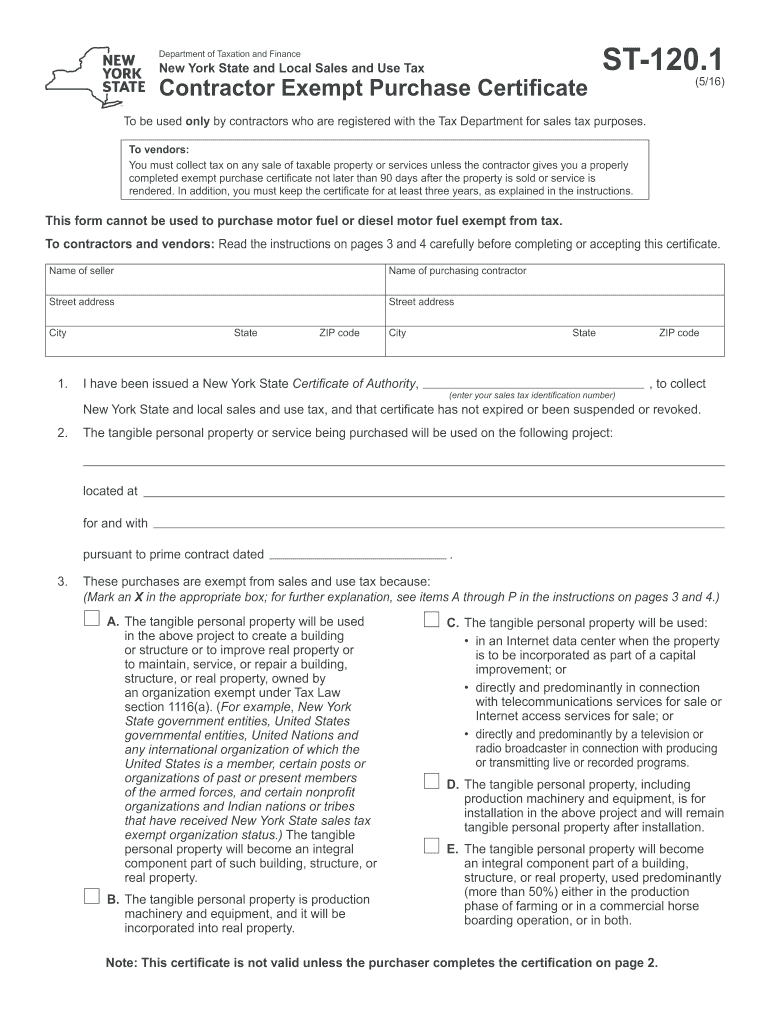

- Steps for filling out Form ST-120 New York Resale Certificate. Step 1 Begin by downloading the New York Resale Certificate Form ST-120. Step 2 Identify the name and business address of the seller. Step 3 Identify the name and business address of the buyer. Step 4 If the retailer is expected

Acceptance Of Uniform Sales Tax Certificates In New York

New York is a member of the Streamlined Sales and Use Tax Agreement, an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states.

Because New York is a member of this agreement, buyers can usethe Multistate Tax Commission Uniform Sales Tax Certificate when making qualifying sales-tax-exempt purchases from vendors in New York.

Simplify New York sales tax compliance! We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process.

Don’t Miss: Proof Of Registration Ny

What Constitutes Taxable Services In New York State

The majority of service businesses are not taxable in New York . The exceptions would be service businesses that manufacture, alter, install or service parts. A good example of this would be a HVAC company that services and sells air conditioning units and their parts.

Additionally, crime prevention and investigative services, nonresidential cleaning services, and pest control services are taxable

Is A Resale Certificate The Same As A Sales Tax Id

The Sales Tax Certificate of Authority and Resale Certificate are commonly thought of as the same thing, but they are actually two separate documents. The Sales Tax Certificate of Authority allows a business to sell and collect sales tax from taxable products and services in the state, while the Resale Certificate allows the retailer to make tax-exempt purchases for products they intend to resell.

After registering, a Certificate of Authority Number will be provided by the Department of Taxation and Finance. This number will be listed on the Resale Certificate.

You May Like: Cheap Ways To New York

Do You Need To Get A Sales Tax Certificate In New York State

You may need a Sales Tax Certificate if any of the following apply your business:

- You have a physical office or place you conduct

- You sell or ship products to a buyer in New York

- You have a distribution location such as a storage area or warehouse space

- You have employees physically present in New York

- You have changed your business structure or moved to a new location

- You have personal short term real property rentals

- Your business leases or rents personal property

- Your business has real rental property

- Your business manufactures products for retail sale

- Your business imports goods from out side of New York for retail sale

- Your business purchases wholesale items for resale in the state of New York

- Your business provides taxable services within the state of New York

Obtaining A Certificate Of Authority

In New York, if you have a connection to the state and sell taxable services or tangible propertyeven from a home-based business or temporarily, such as at craft fairsthe state requires that you register with the state Department of Taxation and Finance using the Business Person and Responsible Contact Questionnaire to obtain a Sales Tax Certificate of Authority before opening up shop.

Tangible property includes most any physical item, such as artwork, flowers, clothing, and motor vehicles. Many services that involve repairing or maintaining tangible personal property and real property, such as car repair, dog grooming, and snow plowing, are also subject to sales tax.

The requirement to register as a vendor in New York also applies if you have some additional connection with the state,” which includes maintaining a place of business, soliciting business in the state through employees or agents, or regularly delivering products to customers in the state using your own vehicle, even if you are an out-of-state vendor. Moreover, if you sell through catalogs but have such a connection with the state, operate a hotel, or receive amusement charges, you must also register your business in New York.

For more information about who must register as a vendor in New York, see the state’s Tax Bulletin .

Don’t Miss: Apply For Disability Nys

New Certificate Of Authority Needed For Transfer Of Ownership And Organizational Changes

A Certificate of Authority cannot be transferred or assigned. If you are buying an existing business, or taking over the ownership of a family business, you must apply for your own Certificate of Authority. You cannot use the Certificate of Authority that we issued to the previous owner.

You must also apply for a new Certificate of Authority if you are changing the organizational structure of your business, such as switching from a sole proprietorship to a corporation. The new business must have its own Certificate of Authority before it begins business.

How To Verify A Resale Certificate In Every State

Alabama . From there, click the Start Over button > Business > Verify an Exemption Certificate.

Arizona Enter the number here. Number should have 8 digits

Arkansas Use either the resellers permit ID number or Streamlined Sales Tax number

California Enter available information for verification.

Colorado Enter the 7, 8, 11 or 12-digit account number to be verified. Do not include an L or M prefix.

Connecticut Enter the business ID and certificate number.

District of Columbia Verify online at My Tax DC.

Florida Enter the required seller information, then enter sales tax certificate numbers for verification.

Georgia Follow the steps listed that lead you to the form. Enter the sales tax certificate number for verification.

Hawaii Enter available information for verification.

Idaho Under Other Services, select Validate Sellers Permit. Enter the permit number for verification.

Illinois Select the ID type, and then enter the ID number. Hit enter to verify.

Indiana Online verification is not available. Purchaser will provide you with form ST-105 for your records.

Iowa Online verification is not available. Since Iowa does not issue certificates, the purchaser will provide you with their 9 digit ID number, which you would use to .

Kansas Enter Kansas Tax Registration Number.

Kentucky Online verification is unavailable. You will be provided with Form 51A105.

Louisiana Enter the sellers account number and business name.

Recommended Reading: New York Times Paywall Smasher Browser Extension

Dont Get Caught Holding The Bag

Sales tax.no one likes collecting it and no one likes paying it. How many times have you heard a business owner say but if you pay me cash How many times has a business owner said my customers wont agree to pay sales tax because the store next door is not charging it?

Weve all heard these arguments and complaints. Unfortunately, sales tax is a duty and responsibility of vendors and customers in New York State . Vendors who are required to collect sales tax are acting as agents of New York State and that responsibility needs to be taken very seriously. The consequences of mistakes or failures to remit the collected sales tax can be dire. Unfortunately, at Katz Chwat, P.C., we are generally only contacted once an audit has begun and a problem has been discovered. The first step to preventing the onerous penalties or balances due for taxes not collected is understanding by whom and in what situations sales tax must be collected. The worst conversation we have to have with a client is at the end of an audit, where, because of a misunderstanding of the sales tax rules they failed to collect sales tax from their customers and the New York Department of Taxation hands them a bill for the sales tax they should have collected. While the client would love to go back to their customers and ask for the tax, that is unfortunately not a realistic solution and instead their profit on the sale has been decreased by more than 8½ %.

When An Exemption Certificate Is Needed

A sales tax exemption certificate is needed in order to make tax-free purchases of items and services that are taxable. This includes most tangible personal property and some services. A purchaser must give the seller the properly completed certificate within 90 days of the time the sale is made, but preferably at the time of the sale.

Example: You purchase cleaning supplies, which are taxable, from a distributor. However, if you intend to resell the cleaning supplies to your customers , you may purchase the supplies without paying sales tax.

Since the sale of cleaning supplies is normally subject to sales tax, the distributor needs some record to show why it didnt collect sales tax from you. Otherwise, the distributor could be held liable for the tax. Therefore, if you give a properly completed exemption certificate to the distributor within 90 days of your purchase, you are certifying that you intend to resell the items you purchased.

If you intend to use the supplies yourself, you cannot use a resale exemption certificate, and the distributor must collect sales tax from you.

Certain sales are always exempt from tax. This means a purchaser does not need an exemption certificate to make purchases of these items or services. For a list of items and services that may be purchased tax-free without an exemption certificate, see Publication 750, A Guide to Sales Tax in New York State.

Read Also: Toll Cost From Va To Ny

How To Get A Us Reseller Permit/resale Certificate

Hey, would you like to pay tax that you don’t actually need to pay?

I’m guessing your answer is a big, fat “Nope.” No one does, which is why if you’re going to get into the retail business, you need a reseller’s permit .

If you’re a US-based seller, you don’t need to pay sales tax out of your own pocket for the products you’re reselling to others. Your customers will pay it when they buy the product. You’ll collect the money and send it to the state on a routine schedule.

A reseller’s license is your flag saying “I sell to others. I can buy wholesale products without paying sales tax because I pass the tax onto my customers.”

How To Use Or Accept A New Mexico Resale Certificate

There are reciprocity laws in place governing the use of resale certificates interchangeably between states. So, if you are located in one state and need to purchase items for resale from another state then you can do so. If you are a supplier and need to accept resale certificates from your buyers, it would behoove you to follow some best practice guidelines. Make sure that the certificate falls within a valid reciprocity agreement. If you are a supplier located in New Mexico and your buyer is located in New Mexico, then there is no problem. If, however your buyer is from a non-reciprocating state outside New Mexico, you would not be able to accept their out of state resale certificate. As previously stated, make sure the resale certificate is filled out properly with all the buyers correct information. The last and ostensibly most important thing is to make sure the resale certificate is valid and not expired. As the burden of proof may fall upon you, thoroughly checking and verifying that you are presented with a legitimate resale certificate is paramount. Almost all states in one form or another have a way for you to check the validity of a resale certificate presented to you.

Read Also: Registering A Car In New York State