New York Tax Deductions

Income tax deductions are expenses that can be deducted from your gross pre-tax income. Using deductions is an excellent way to reduce your New York income tax and maximize your refund, so be sure to research deductions that you mey be able to claim on your Federal and New York tax returns. For details on specific deductions available in New York, see the list of New York income tax deductions.

Getting Your New York Tax Refund

If your state tax witholdings are greater then the amount of income tax you owe the state of New York, you will receive an income tax refund check from the government to make up the difference.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. E-filing your return and filing early can help ensure your refund check gets sent as quickly as possible.

Once you’ve filed your tax return, all you have to do is wait for your refund to arrive. If you want to check the status of your New York tax refund, you can visit the New York Income Tax Refund page.

Use Approved Commercial Software

Use an approved software provider to prepare and e-file your federal and state return together. The software you choose may include a free option please read the eligibility requirements before you get started.

See E-file-approved commercial software for a list of software providers you can use.

Note: Some software is available in Spanish. Look for Disponible en español after the product name.

Also Check: Change Llc Name Ny

Use Glacier Tax Prep To File Your Federal Tax Return

GTP will help you easily fulfill your tax obligations by asking you a series of questions and filling in all necessary forms for you. It will also inform you of any tax benefits that may apply to you.

1. Get access to GTP by logging in with your NYU net ID and password. GTP is available free of charge to NYU students and scholars.

You will need to create a user ID and a password with your NYU email address by first logging in with your NYU Net ID and password. Once you log into GTP follow the instructions in each step. If your NYU Net ID is not active, first visit . If you are having difficulty accessing GTP, visit our Tax FAQ for instructions.

If you were employed at NYU or received an NYU scholarship or fellowship you may have already logged into Glacier. GTP would populate the information from Glacier to expedite the process. Log in using the user ID and password you created when you first started an account on Glacier. If you have forgotten your user ID or password click on Forgot ID to reset your user ID or password.

2. Print the forms GTP generates. Review, sign and mail them no later than April 15 to the address given by GTP. We suggest mailing using Certified Mail. Please note, you cannot electronically file your tax forms if you are considered a non-resident for US tax purposes.

Do I Have To Pay New York State Income Tax

Generally, you have to file a New York state tax return if:

-

Youre a New York resident and youre required to file a federal tax return or your federal gross income plus New York additions was more than $4,000 .

-

Youre not a New York resident but got income from a source in New York during the tax year.

If youre not a resident of New York but your primary workplace is there, your days telecommuting during the pandemic are still considered days worked in New York unless your employer established an office at your telecommuting location. Generally, you will continue to owe New York State income tax on income earned while telecommuting.

» MORE: Track the status of your state tax refund

RESIDENT STATUS RULES

In general, youre a resident of New York for tax purposes if your permanent home is there , or if you leased or owned a place there and spent 184 days or more in New York state during the tax year.

-

New York considers your permanent home the place you intend to return to after things like vacations, business trips, military assignments or the end of a college semester.

-

There are special rules for people who were in a foreign country for at least 450 of 548 consecutive days.

-

Where you vote, where your drivers license and registration are issued or where your will is are not primary factors in establishing domicile. Its more about where your stuff is and where you spend your time.

PART-YEAR RESIDENT STATUS RULES

NONRESIDENT STATUS RULES

Recommended Reading: Seattle Promise Eligibility

If You Had Us Income During 2020 You May Need To File A State Tax Return

State taxes may have different residency guidelines than US taxes. For a fee, you can use Sprintax to file your state taxes. There are two easy ways to access Sprintax:

You may need to file for every state you lived and/or worked in for 2020. Remember, you cannot electronically file your tax return if you’re using Sprintax and filing as a nonresident for US tax purposes.

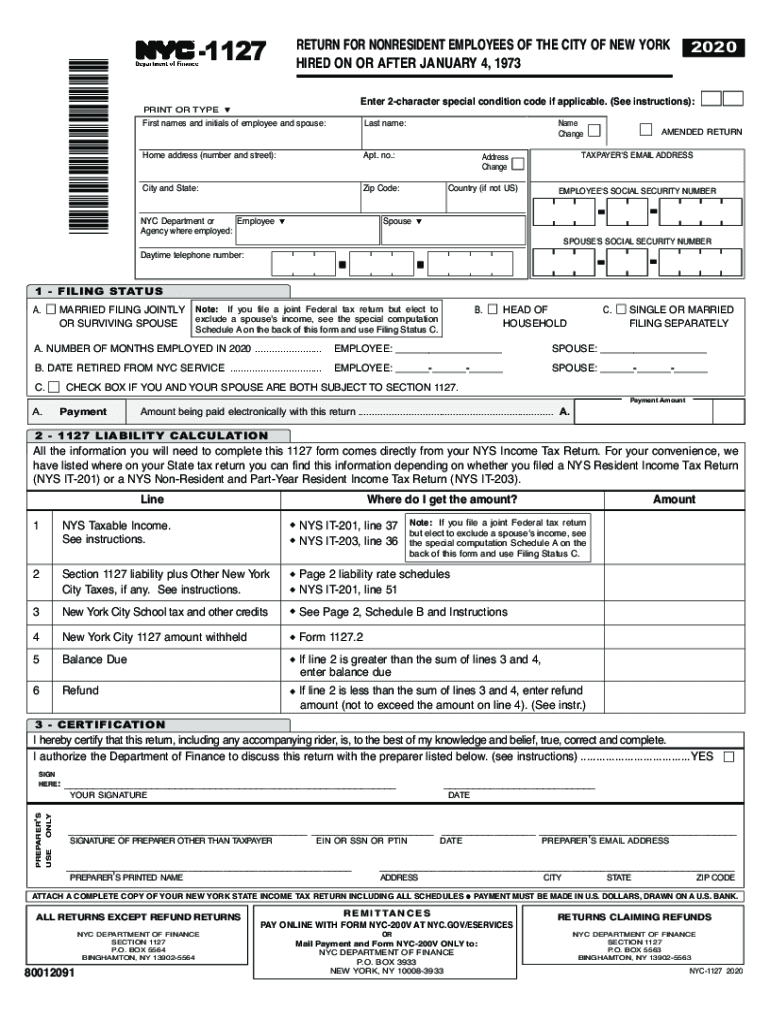

NEW YORK STATE and CITY TAX

You must file a NY Tax Return if:

- You are a NY resident and you filed a US tax form for 2020 or

- You had NY income greater than $4,000 in 2020 or

- You want a refund of NY State or City taxes withheld from your paycheck in excess of what you actually owed.

NEW JERSEY STATE TAX

- International students, professors and scholars are considered non-residents for NJ state tax purposes unless they had a permanent home in NJ.

- Make sure to confirm your own tax residency to determine your tax filing status NJ state.

- Use the appropriate NJ tax form:

- Either NJ resident tax form NJ-1040

- or NJ nonresident tax form NJ-1040NR.

File Your Taxes With Nyc Free Tax Prep

The deadline to sign up for Advance Child Tax Credit payment was November 15, 2021.

You can still file your 2020 tax return for free with NYC Free Tax Prep if you meet income requirements. Review checklist of documents you need to file your taxes. NYC Free Tax Prep providers can help you claim important tax credits including the Child Tax Credit. Note: If you owe the government money, be aware that late filing and/or late payment penalties may apply.

Please also monitor this webpage as we plan for the 2022 tax season.

Don’t Miss: New York Times Poem Submission

All Turbotax Products Include

- 100% accuracy guaranteed

Our calculations are 100% accurate so your taxes will be done right, guaranteed, or we’ll pay you any IRS penalties.

- Maximum refund guaranteed

We search over 350 deductions & credits to find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed.

- Get the green light to file

CompleteCheck will run a comprehensive review of your return before you file so nothing gets missed.

Common Rejection Reasons For A Ny Offer In Compromise

Here are some common reasons for rejections.

- The taxpayer is not insolvent or discharged in bankruptcy.

- Your application doesnt prove that paying in full would cause undue economic hardship.

- The state thinks it could collect more by taking legal action against you.

- The application includes false or misleading information.

- There is evidence that you transferred assets after learning about the tax liability.

- You didnt make a good faith effort to pay the taxes owed.

- The taxes owed is related to a crime for which the taxpayer pled or was found guilty.

- The offer undermines voluntary tax compliance.

- Accepting the offer is not in the best interests of the state of New York.

As with IRS application process, the New York State Offer in Compromise process is not easy. We highly recommended that you work with a tax firm or a licensed tax professional. Start your search below by selecting New York Department of Taxation and any other tax agencies you are having an issue with.

Disclaimer: This article is not legal or tax advice. This article should not be used as a substitute for the advice of a competent attorney or tax professional admitted or authorized to practice in your jurisdiction.

You May Like: Defamation Of Character Ny

Pay Nothing Out Of Pocket Use Your Federal Refund To Pay For Turbotax Learn More

TurboTax CD/download also available

- Earned Income Tax Credit

- Child tax credits

- Student Loan Interest deduction

What Credentials Will New York Give Me

New York will provide you with one IFTA license and a set of decals. A photocopy of the original license must be maintained in the cab of each one of your qualified motor vehicles. The original license should be kept at your business address in a safe place. Your New York IFTA license is valid for the calendar year January 1 through December 31.

Don’t Miss: How To Pay A Traffic Ticket In Ny

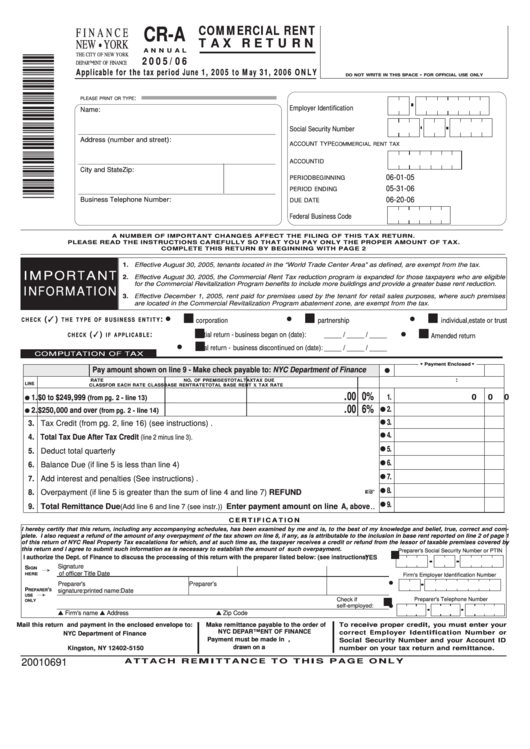

S To Manually Filing A Sales Tax Return In New York

File A Tax Extension In New York

New Yorkers needing an extension for state tax returns can file an extension online via tax.ny.gov or by mail.

To apply for an extension, New York residents must submit Form IT-370, while partnerships and fiduciaries must file form IT-370PF.

Individuals can request an extension to file using this link or by typing ‘Personal Income Tax Extension’ into the search bar at tax.ny.gov.

Forms to extend state tax returns can also be found at most local libraries.

However, the New York Department of Taxation and Finance said filers requesting an extension must make a full payment of the estimated tax balance due when the request is made.Mario Marroquin covers real estate and economic development. Click here to see his latest stories. He can be reached at mmarroquin@gannett.com or @mars3vega

Recommended Reading: Can I Register A Car Online In Ny

Taxable And Exempt Shipping Charges In New York

New York sales tax may apply to charges for shipping, delivery, freight, handling, and postage.

Shipping and handling charges billed by the vendor to the customer are generally taxable in New York if the sale is taxable, whether the charges are combined or separately stated on the invoice. Shipping and handling charges billed by the vendor are generally exempt when the sale is exempt, whether combined or separately stated.

When a vendor charges a single charge for delivery of both taxable and nontaxable property or services, the entire charge is generally subject to tax. However, if taxable and nontaxable charges are separately stated on a bill, and the charge for delivery is separately stated and allocated between taxable and non-taxable sales, the charge to deliver the taxable goods is taxable and the charge to deliver the exempt goods is exempt.

If a customer arranges delivery by a third person and pays that person directly, the third persons delivery charge is not taxable, even if the item delivered is taxable.

There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. Specific questions on shipping in New York and sales tax should be taken directly to a tax professional familiar with New York tax laws.

For additional information, see the New York State Department of Taxation and Finance, Shipping and Delivery Charges.

New York Property Tax

Property taxes are assessed exclusively by counties and cities in New York State, which means that rates vary significantly from one place to the next. Effective rates taxes as a percentage of actual value as opposed to assessed value run from less than 0.7% to about 3.5%.

Surprisingly, the city with the lowest effective property tax rate is New York City, where property taxes paid total an average of just 0.88% of property value. The reason for that relatively low rate is that the taxable value of most residential property in New York City is equal to just 6% of the market value. That is, if your home is worth $500,000, you will only be charged taxes on $30,000 of that amount. Outside of New York City, however, rates are generally between 2% and 3%.

Regardless of city, if you are looking to refinance or purchase a property in New York with a mortgage, check out our guide to mortgages in New York. Weve got details on average mortgage rates and other information about getting a mortgage in the Empire State. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York.

Recommended Reading: Is Niagara Falls In New York Or Canada

Don’t Miss: Apply For Nys Medicaid

Take Advantage Of Free Tax Filing Options Available To Many New Yorkers Nys Tax Department Also Launches Free File Ad Campaign In New York City

For Release: Immediate, Friday, February 09, 2018

For press inquiries only, contact: James Gazzale, 518-457-7377

The New York State Department of Taxation and Finance today reminded taxpayers of the free tax filing options available to many New Yorkers.

Free tax assistance sites are open to help eligible taxpayers e-file their income tax returns and claim valuable credits. Taxpayers with adjusted gross household incomes of $66,000 or less in 2017 may use free, user-friendly software at these sites to electronically prepare and file both their state and federal tax returns. Eligible taxpayers dont need to visit a site, though: they can also access and use the same free software anytime from their computer, smartphone, or tablet at www.tax.ny.gov .

The tax preparation software helps reduce filing errors that can delay return processing and refunds. It also prevents valuable credits from being overlooked.

Tax Department experts will be available at each free tax assistance site to assist low- and middle-income New Yorkers through the filing process at no charge. A schedule of dates, times, and locations is available online at .

Tax Department experts are also able, at certain locations, to assist taxpayers in multiple languages, including Arabic, Bengali, Chinese, Haitian Creole, Italian, Japanese, Korean, Russian, Spanish, and Urdu.

Listen to the radio spots in English and Spanish.

View poster .

Considerations You Need To Understand

Here are some additional points you should understand before submitting an offer.

- Submitting an OIC does not automatically suspend the collection of a warrant.

- Submitting an offer does not change the time you have to respond to an assessment.

- The statutory period for collections is suspended while the offer is pending and for a year afterward.

- You must file all tax returns and pay all tax owed for five years after the offer is accepted.

- If you qualify for any refunds or credits, the state applies those amounts to your taxes owed. That applies to the calendar year that you submit the offer and to any years prior to the offer.

- You may have to provide a collateral agreement to the state. A collateral agreement is where you agree to pay more than the offer if you come into extra money. For example, if your income goes up in the next few years, you agree to pay some of that money to the state.

- If you submit an OIC for trust taxes on behalf of a business, responsible individuals part of the business may still be personally liable. Trust taxes are withholding taxes that were withheld from an employees paycheck but not paid to the state. They also include sales taxes which are held in trust by the business on behalf of the consumer and remitted to the state.

- If the tax bill is more than $100,000, a New York Supreme Court judge needs to approve the OIC.

Read Also: Town Of Warwick New York

Late Sales Tax Filing Penalties And Interest

Filing a New York sales tax return late may result in a late filing penalty as well as interest on any outstanding tax due. For more information, refer to our section on penalties and interest.

In the event a New York sales tax filing deadline was missed due to circumstances beyond your control , the New York Department of Taxation and Finance may grant you an extension. However, you may be asked to provide evidence supporting your claim.

Hopefully you dont need to worry about this section because youre filing and remitting New York sales tax on time and without incident. However, in the real world, mistakes happen.

If you miss a sales tax filing deadline, follow the saying, better late than never, and file your return as soon as possible. Failure to file returns and remit collected tax on time may result in penalties and interest charges, and the longer you wait to file, the greater the penalty and the greater the interest.