Is A Dba Better Than Changing The Legal Name Of My Business

Both solutions could give you a new name for your business. But in most cases, filing a DBA is a simpler, quicker, and less expensive process than a legal name change. And remember, you can register multiple DBAs. So, if your business operates multiple different other businesses, DBAs might offer you more flexibility.

How Do I File A Dba In Queens Ny

In Queens, New York, DBAs must be registered in the county clerks office. Purchase a DBA legal form from a stationery store or online store that sells legal forms. Examples of retailers that sell legal forms are Staples, Office Max and Blumberglegalforms.com. Fill out the DBA form and have it notarized.

When Should I Register A Dba For My Business

You will need a DBA if your business uses a name that is not identical to the name of the company. For example, if you register an LLC called New York Holdings, LLC and you do business as New York Realty, you will need a DBA because those names are different. Similarly, if you use a shortened version of your business name as your assumed name , you will need to register a DBA.

You May Like: Where To Get The New York Times

What Are The Advantages Of Having A Dba

A DBA can accomplish several things for a business owner.

If a business wishes to rebrand itself without forming a new corporation or limited liability company, they can simply register a DBA instead, Babbitt said. If the business receives bad publicity, they may register a DBA to mislead the public into thinking the business is different.

There are also some less obvious reasons to register more than one DBA. For example, theres a scene in Parks and Recreation where Tom and Ben are looking for a tent for an event. The deal falls through with one tent company, so they call another one, only to find that its owned by the same person. In fact, that same person owns all the tent rental companies in a certain mile radius. Babbitt says that this actually happens.

Some businesses will create multiple DBAs to create the illusion of competition, he said. For instance, four taxis could all have separate DBAs even though they are all owned by the same person.

A DBA also comes in handy for entrepreneurs who want to make a distinction among their numerous businesses.

Finally, if you are a sole proprietor, it gives you the chance to build a brand under a name of your choosing instead of using your personal name. This helps you and gets your brand out there in a way that is beneficial to your business.

Michael Keller and Jennifer Post contributed to the reporting and writing in this article. Some source interviews were conducted for a previous version of this article.

How Much Does It Cost To Start A Dba In New York

There are a few fees to keep in mind if you apply for the Certificate of Assumed Name:

- Filing fee: $25

- Youll pay a second county filing fee of $25, based on the county or counties your business does business or will do business.

- The second county filing fee in Bronx, Kings, New York, Queens, and Richmond counties is $100.

- In the state of New York, theres no county fee for limited liability companies or limited partnerships .

If you want certified copies of your business, youll pay a $10 fee.

You May Like: Nyc Pay Traffic Ticket Online

Recommended Reading: How Do I Get A New York State Fishing License

Is Having A Dba In New Jersey A Must

No. A New Jersey business does not need to have a DBA name. In fact, only domestic sole proprietors and general partnerships and foreign corporations, including limited liability companies, can use a DBA name.

A bona fide entity would not need a DBA name since it can pick any available name it wants whereas, a sole proprietor uses his full name, and a general partnership uses all the partners names in the company name.

Two Ways To Register Your Business

MyCorporation® can help you file all of the necessary documents tofile your DBA in New York.

Our free guide provides you with all of the information you’ll need to fileyour DBA in New York. Bookmark this page as a reference so you can return easily as you complete each step of the process.

Our filing experts can get you up and running quickly and accurately, completing the required filings on your behalf.

+ state fees

Also Check: How To Get Affordable Health Insurance In New York

Perform A Name Search

Youll first need to determine if your desired fictitious name is available. Perform a public inquiry at the states official website. If in the area, you can also visit the New York County courthouse basement at 60 Centre Street in Manhattan.

Out-of-state corporations and LLCs that are planning to register to do business in New York can reserve a fictitious name for up to 60 days by filing an Application for Reservation of Name. The filing fee is $20 and is made payable to the Department of State. If you need more time, you have the option to file a Request for Extension of Reservation of Name form. The extension costs an additional $20 and will let you hold the name for an extra 60 days.

Get A Dba Name For Your New York Business Today

If youre an entrepreneur in New York, you may not wish to use your businesss full legal name for all of your companys activities. If so, a doing business as name could be a helpful branding tool, allowing you to conduct your small business under a different title.

Doing business as names are an excellent alternative to using legal personal names or business names. They afford levels of flexibility for business owners that are not otherwise possible. New York business owners can file for DBA names, or assumed names as they are known in the state, to enhance brand personality or augment business operations in other areas.

Businesses that conduct business under a name that is not their legal name in New York need a Certificate of Assumed Name. This certificate is also called the doing business as certificate. Businesses must file the certificate with the New York State Department of State or local county clerk.

Read on to learn about New York DBA names, including how to choose, register, and maintain one, as well as how we can help make the process easier.

You May Like: How Many Hours To Paris From New York

Submit Business Certificate Or Certificate Of Assumed Name

Finally, youll submit your business certificate or certificate of assumed name. After filing your Certificate of Assumed Name, youll receive an official filing receipt. It will contain:

- Assumed name

- Date of when you filed your Certificate of Assumed Name

- Fees paid

- Name of corporation or other business entity

The receipt will serve as proof of your filing, which is important because the Department of State wont issue duplicates.

Certificate Of Doing Business Under Assumed Name

- – Need 3 copies for filing

- – Need 2 copies for filing

Instructions:

Please note the following:

Requirements & regulations are set forth in New York State General Business Law .

If the name requested is already in use or is misleading to the public the Clerk may refuse to accept it for filing. Proper forms are required and there is a filing fee of $25.00 . We recommend that you take two certified copies. Save yourself the trouble of coming back and take two with you. There is a $5.00 charge for each certified copy.

All signatures must be notarized. The Clerk’s Office has notaries on staff. Make absolutely sure the name used and other information given are exactly what is desired before filing. Once filed, the DBA cannot be changed without filing an Amended Certificate and an additional $25.00 will be required. Once filed the $25.00 is nonrefundable.

If and when the DBA is no longer needed you must file a Discontinuance of Business — no fee is required.

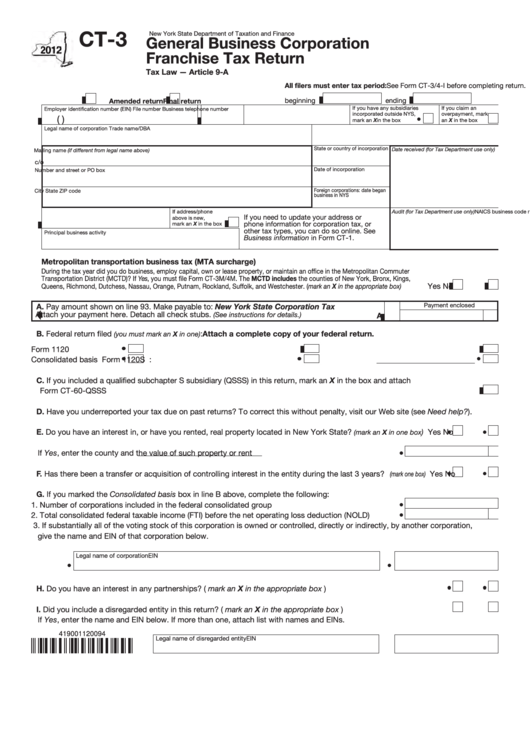

Sales tax information or number, if needed, are obtained at the Department of Taxation & Finance in Utica on the 9th floor of the State Office Building. Obtain State tax information by phone at #1-800-225-5829 or Federal tax information at #1-800-829-1040.

Read Also: Who Reads The New Yorker

How Do I Choose A New York Dba Name

Select a name that reflects what your small business is or its brand personality. Also, look at choosing a DBA name that is easy to spell, memorable, and gives consumers a good sense of your overall branding.

Try to find a name that is unique to your county, if not the entire state of New York. In this way, you will have an advantage, as you will stand out among your competitors. However, its important to note that the state does not require the uniqueness of DBA names.

To ensure that your DBA name is available, you can conduct a name search using the Department of State Division of Corporations, State Records, and UCC Database. It is also a good idea to check for any state or federal trademarks. Trademark law will supersede DBA name law, so it is important that you dont infringe on someone elses trademark. You can conduct a federal search using the United States Patent and Trademark Office database.

Be aware that several legal business designations are not allowed, such as Corporation,Limited, and Limited Liability Company. Entity designators and their abbreviations can be misleading to those you do business with, and the state does not allow these name additions. Further restrictions on name choices are also available to guide your DBA name choice.

Start With A New York Assumed Name Search

New York assumed names must be unique and must also meet New Yorks business name requirements.

First, visit the New York Department of State’s website and search for your new DBA name to make sure it isnt already in use.

Next, review the New York naming requirements. In New York, assumed names should NOT include:

- Words that could confuse your business with a government agency

- Restricted words that may require additional paperwork and a licensed individual, such as a doctor or lawyer, to be part of your business.

Read Also: How To Watch Csi New York

Filing A Business Name

Anyone who conducts a business under a name other than his or her own must file a business name with the County Clerk of the county in which the business is being conducted. To file a business name, you need to complete the necessary documents. These forms can be downloaded or obtained from most commercial / legal stationery stores and attorneys. Some of these forms include:

View a complete list of available forms.

Completed Forms

Once the appropriate forms are completed and notarized, you may bring or mail them with the appropriate fee to: Nassau County Clerk’s Office

Division of Business NamesMineola, NY 11501

Obtain Licenses Permits And Zoning Clearance

It’s important to get any professional and business licenses before beginning activity at your business. New York has a thorough website of every occupation and profession that needs a license by a sole proprietorship. This information can be found on the Online Permit Assistance and Licensing website. You will want to look into what local regulations are required, such as building permits, licenses, and zoning clearances. You can talk to your county and city governments to get more information on this. The Business Express website can be used to find out which permits or licenses are required.

Sole proprietors who have employees need to get an Employer Identification Number. This is a nine-digit number that the IRS gives out to keep track of business.

If you need help with a sole proprietorship DBA NY, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved

You May Like: Where Are You From New York Times

Still Interested In Getting A New York Dba

Getting a DBA isn’t the right move for everyone, so it’s important that you determine if a DBA filing will help you accomplish your business goals. Although partnerships in New York must file for a Business Certificate, other types of businesses may operate without a DBA as long as they use their legal business name only. If filing a DBA is optional for your business, you should consider if it’s worth the time and expenses to get an assumed name.

An attorney in your area could provide advice about getting an assumed name for your business. Reach each out to an attorney and get the answers to your legal questions today.

When you’ve decided to pursue DBA registration, consider using a trusted, simple-to-use online business formation tool that will walk you through the process.

Thank you for subscribing!

Does A Dba Need An Ein

An EIN or Employer Identification Number is a unique nine-digit number that some businesses will register for through the Internal Revenue Department . An EIN is required for partnerships, corporations, multi-member LLCs, or any business that has employees.

Sole proprietorships and single-member LLCs without employees can use the owners social security number to identify the business.

There is no cost to get an EIN when registering directly from the IRS.

Don’t Miss: Jobs Hiring In The Bronx

What Is A New York Dba

For sole proprietorships and general partnerships, a DBA enables you to use a name other than the owners personal name. For limited liability companies and corporations, DBAs allow you to use multiple names to officially refer to your business activities.

There are many different reasons for New York companies to acquire doing business as names.

- For sole proprietorships and partnerships, they can make your company sound more professional than simply using your own name. You can also open a bank account using your DBA, which can not only help you keep your business and personal assets separate, but customers often have a higher comfort level writing out a check to a business name rather than to an individuals personal name.

- For corporations and LLCs, DBAs are frequently used to give the company the option of using different names for separate product lines. Another common usage of a DBA is to distinguish satellite businesses from your main company. Restaurant owners love to do this, as for example it can help a fine-dining establishment open a fast-casual spin-off restaurant without affecting customers perceptions of the original location. Whether you want to create this separation for marketing or accounting purposes , a doing business as name gives companies options that they wouldnt otherwise have.

In short, a DBA in New York allows businesses to communicate their image and express themselves in different ways without having to actually form a new business to do so.

What Are The Disadvantages Of A Dba

A DBA lets you do business under a trade name, so you dont have to use your personal or business legal name on business accounts or official paperwork. The drawback, compared with forming a legal entity, such as an LLC or corporation, is that a DBA doesnt provide legal separation between you and the business.

Recommended Reading: Who Can Prescribe Adderall In New York

Llcs Corporations And Limited Partnerships

Step 1: Conduct an Assumed Name Search

You’ll need to check the records of the New York Department of State for name availability before you file your DBA. It’s important that the name you choose for your business activities is not already in use by another business. Your name also can’t be too similar to a name that’s already on record. Once you’ve made a list of names that you might like to use for your business activities, check for name availability on the Corporation and Business Entity Database. To search the database, simply select the search type and provide the requested information in the designated fields.

Conduct a search on TESS next. The TESS search is meant to show trademarked names. If the name you’d like to use has been trademarked by someone else, you need to choose another name so that you can avoid facing legal action.

There are restrictions regarding the words and phrases that you may use in your trade name. Consider the following restrictions before you submit a trade name to the Department:

- You can’t use words such as “bank,””trust,” or “credit union,” which may signify that you offer financial services

- You can’t use words or phrases such as “Treasury” or “State Department,” because these words or phrases might confuse the public

- You can’t use certain words, like “doctor” or “lawyer”

Step 2: Filing Your Certificate of Assumed Name Form

Step 3: Manage Your DBA

Filing And Registration Of Dba In New York State

A business owner filing a DBA must submit the current name of the business looking for the DBA. The name can be obtained on the filing receipt given by the New York Department of State the day the business entity was formed. The owner can also look for the Business/Corporation Entity Index.

Next, the business owner must fill out the desired Assumed Name together with the main business location, which might be an address that is situated out of the state. However, a post office box is not allowed. They will also need to fill out the county in which the business with the Assumed Name intends to operate and the specific address.

The final step is the signing of the Certificate of Assumed Name on behalf of the business by a manager of a limited company, corporate officer or a general partner of a limited company. The business owner is also required to fill out their own name and mailing address in order to get the receipt as evidence of filing. Note that having an Assumed Name registered by filing a DBA does not in any way change the taxation model applied to your entity.

Also Check: Is There No Fault Divorce In New York