Questions You Must Ask To Find The Best Renters Insurance In Nyc

It only takes one sink to overflow into your neighbor’s apartment to set you back $2,500 to $10,000 or more.

New Yorkers are facing unprecedented economic difficulties as a result of the coronavirus and may be forced to cut expenses. Renters insurance, however, should not be one of them.

Thats because when it comes to renters insurance, the biggest mistake you can make is not having any. Even if you think your possessions aren’t worth very much, it only takes one sink to overflow into your neighbor’s apartment to set you back many thousands of dollars. The average claim size for a sink, tub or toilet overflow is between $2,500 to $10,000.

The type of coverage is also important. As president of New York City apartment insurance broker Gotham Brokerage for more than 40 years, Ive personally helped thousands of renters find the best policy for their situation and budget. I’m very familiar with the questions renters ask before they buy insurance. Im also familiar with the questions they should be asking but often dont.

Heres what you need to know besides how much it costs:

What Are The New York Renters Insurance Discounts

Most carriers provide various discounts for renters insurance as well just like for auto insurance. Here are some most common discounts.

| Discount | Description |

|---|---|

| Multi-Policy | If you purchase both renters and auto insurance from the same company, you may qualify a discount for the auto insurance. |

| Secure Home | If you have extinguishers, burglar alarms devices or you are in a gated community, you may qualify for the secured home discount. This averages about 5% from quite a few carriers. |

| Claim-free | Just like auto insurance is lower for accident-free drivers, renters insurance is also cheaper for claim free tenants. If you have never reported any claims before, you will qualify for the claim-free discounts from quite a few carriers. |

| Age | Usually, for renters insurance, older people pay less than younger people for a similar property. So, if youre a college student and trying to find a renters policy for your apartment near school, you probably will pay more. |

| Good Credit | A customer with a credit score higher than 700 can often get a better rate than those who dont. |

| Pay-in-full | If the carrier supports both monthly and yearly payment, usually paying-in-full will give you a discount. In other words, if you choose to pay monthly, you should pay attention to the extra fee charged by your carrier. |

| Paperless | A few carriers even provide paperless discounts. But more and more new insurance carriers do not offer it probably because the overall cost has already been saved. |

Reasons You May Need A Guarantor For Leasing An Apartment

Its clear that New York City apartments are not easy to get into, especially if youre looking for an affordable apartment before you actually have the income you expect to have.

Qualifying for an apartment in New York is notoriously difficult and some cases more difficult than qualifying for a mortgage.

You may need a guarantor if any of the following are true.

Read Also: New York State Medicaid

Learn Renters Insurance 101 With These Faqs

Mar 2, 2020 Get all your frequently asked questions about renters insurance answered. value coverage for your personal property, or you can You can typically expect to pay between $100 and $250 per year on It is important to determine how much it would cost to replace each item as brand new.

by ET SCHNEIDERMAN · Cited by 3 The rights of residential tenants in New York State are protected by a variety of federal $2,500 or more and the apartments occupants have a total annual income in excess of Rent stabilized tenants have a right to a one or two year renewal lease, when rent is paid in cash, a money order, and a cashiers check or in.

Renters insurance protects you and your possessions when you rent a place to live. and are not influenced by payment we receive from our advertising partners. It: State Farm wins as the best company for renters insurance overall because year.2 Prices may increase based on how much liability or personal property

The average price of car insurance for a 20-year-old is $232/month or Use The Zebra to help save money on auto insurance. drivers pay $893 more every year compared to other young adult drivers in their 20s. State Farm, $1,236, $206 over the course of three years can be as much as your total premium in a year.

Choose how you spend your money today, not a year from now. A collection of Rhino renters.

Types Of Alarm Systems Installed In Your Home

Your renters insurance company will consider several different aspects of your rented home, like its age and construction. It will also consider how your home can alert you to danger having a burglar alarm and a fire alarm installed can reduce the chance that your items are damaged in the first place, and in turn, the risk to your insurance company. Often, insurers will give discounts for renters with these types of alarms.

Don’t Miss: Proof Of Registration Ny

How Do You File A Claim For Medical Liability

Under your renters insurance policy you should have coverage for personal liability and medical liability. Both may come into play in the same scenario.

For example, someone who was injured in your house or apartment decides to sue you.

The personal liability would cover the lawsuit and the medical liability would cover the injured person’s medical bills.

You do not file a claim for medical liability. The claimant here is the injured person who has incurred medical expenses.

The injured party should be given your insurance policy number and instructions on how to file a claim.

You should document the incident in detail, and gather as many witnesses as possible.

Important Considerations When Using A Guarantor Service

Although finding a third-party professional guarantor sounds like a dream come true, especially if your income is a little low or your credit is not high enough, don’t get carried away with excitement.

As when finding any guarantor, you still need to be responsible. That means conscientiously making your rent payments on time.

A professional guarantor service is no time or excuse to skip one month of rent “just because”!

You will still be on the hook for the rent, even if the insurance will cover your rent.

The guarantor service only ensures that your credit will not take a hit and/or that you will not be evicted or your lease terminated.

Because each vendor has different requirements, it’s important to do your own research of each company.

For example, the Guarantors performs a soft pull on your credit, but it’s not clear if Leapeasy or Insurent does as well.

If that’s the case, you’ll need to weigh how pulling your credit multiple times during the apartment-hunting process will affect your credit.

Learn about any potential hidden costs that can be incurred, and carefully review their refund policies.

Read Also: New York Life Insurance Cancellation

Why Is My Renters Insurance So High

Location can be a big factor when determining insurance premiums. If your area is vulnerable to severe weather or natural disasters, you may be paying more for your policy each month. Replacement cost will pay to replace your possessions, regardless of depreciation, if theyre damaged by a covered peril such as fire.

Should I Purchase Renters Insurance

While not required otherwise, anyone renting any type of residence long-termbe it an apartment or single-family homeshould strongly consider purchasing a renters insurance policy. For most tenants, renters insurance is an invaluable tool to protect against potentially devastating financial consequences.

Recommended Reading: Tolls Between Nyc And Dc

What Do All These Insurance Terms Mean

We hate jargon as much as you do, which is why weve broken down the most common terms youll want to understand when comparing, purchasing, and using renters insurance.

DeductibleThe initial amount you are responsible for before coverage kicks in. In most cases, this amount is simply deducted from your payout after a claim. For example, if your deductible is $500 and you have a $2,000 claim, you will receive $1,500.

PremiumThe total amount that you pay for an insurance policy.

Actual cash valueThe current market value of lost or damaged property at the time of loss. This usually factors in depreciation .

Replacement cost

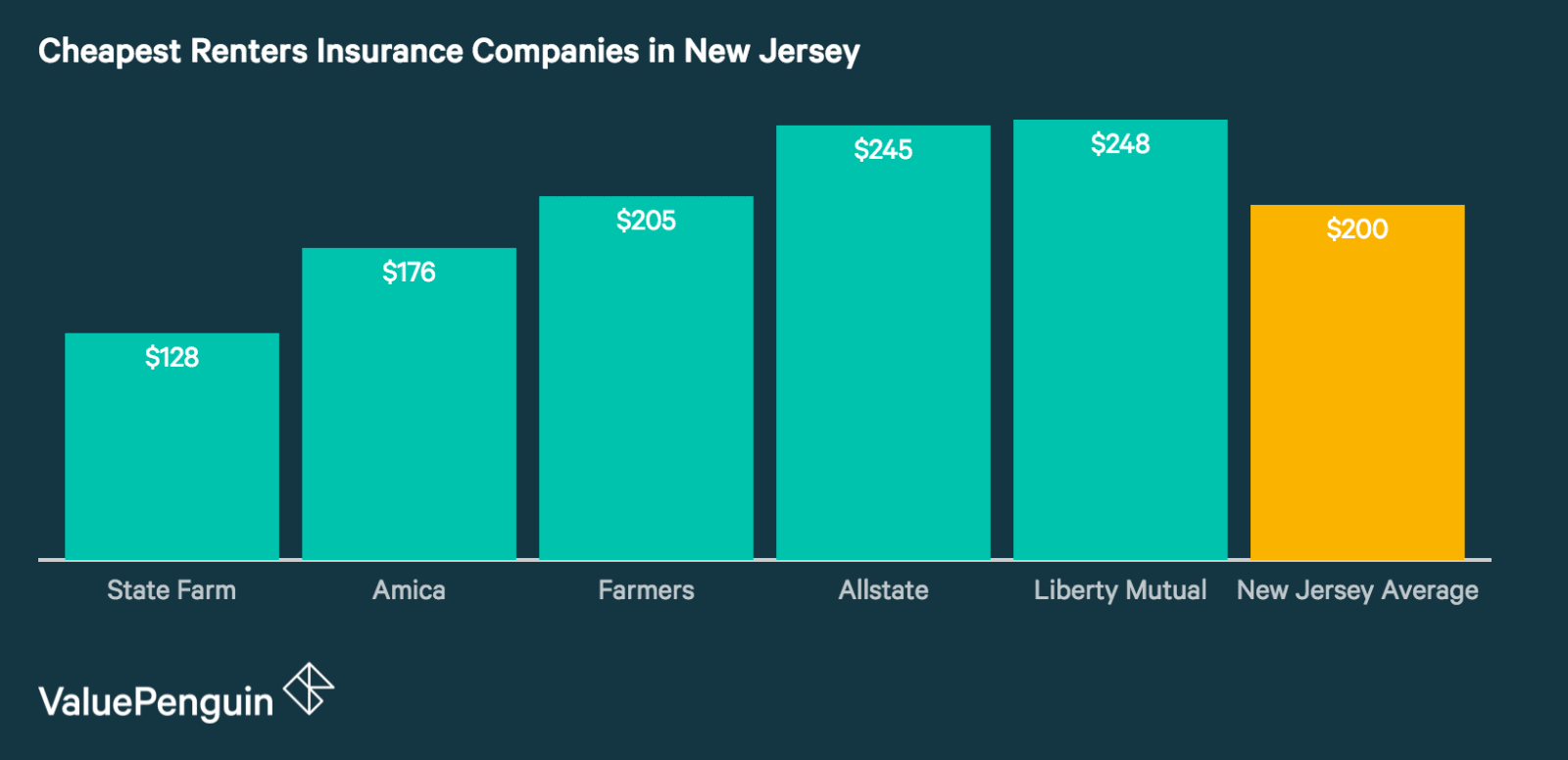

How Much Is Renters Insurance In New York

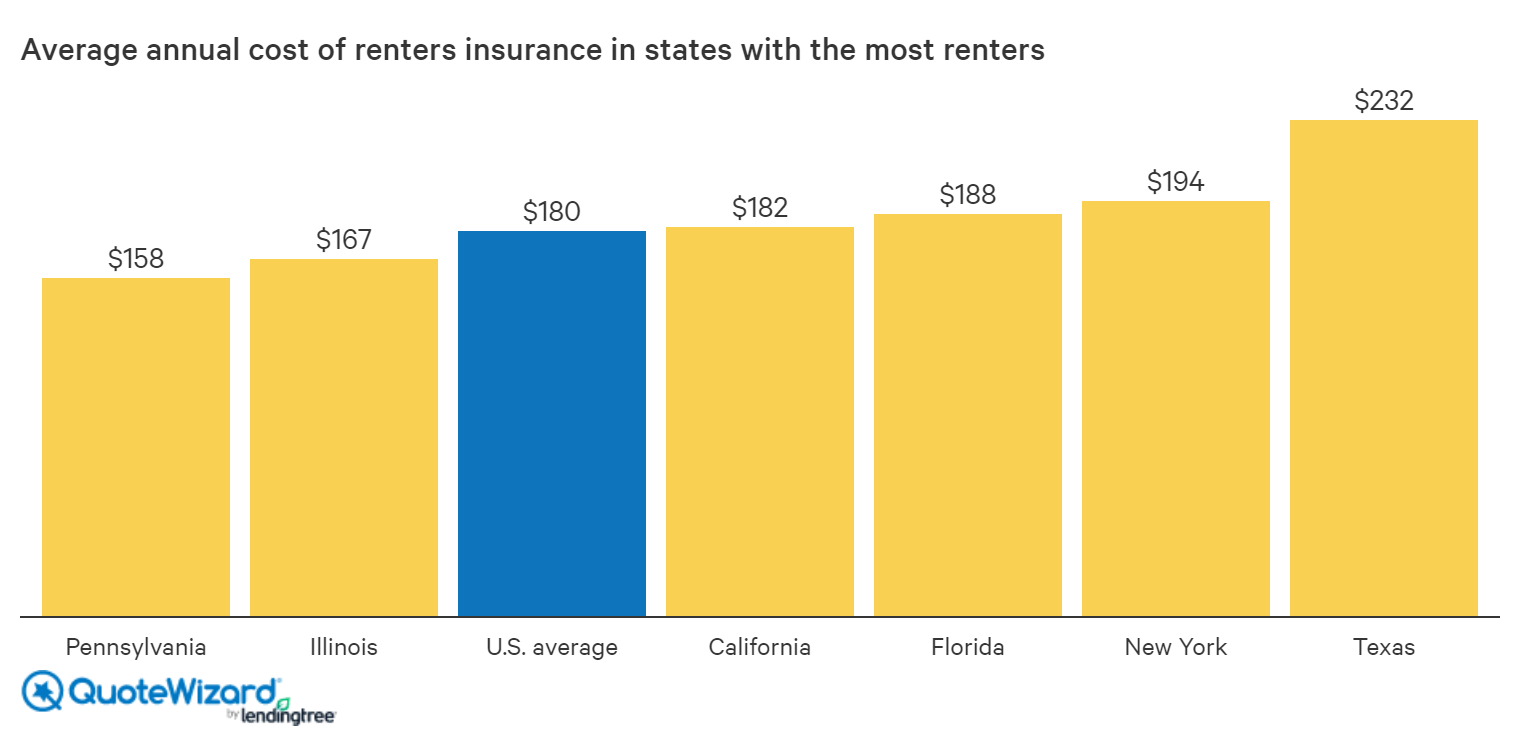

The average cost of renters insurance in New York is $142 a year, or about $12 a month. Thats less expensive than the national average of $168 a year.

Renters in New York City pay a bit more than the national average at $174 a year.

Below are average renters insurance rates for the 25 largest cities in New York state.

|

City |

|---|

» MORE:The best cheap renters insurance

Don’t Miss: How Much Are The Tolls From Virginia To New York

What Happens To Your Renters Insurance When You Move

If you were already planning on switching insurance companies or moving into a purchased home instead, you should notify your current insurance provider that you will be moving and discontinuing your coverage.

Otherwise, expect to continue making payments for an apartment you no longer live in.

If you want to keep your insurance carrier, you just need to contact your company to change the information and you may update your coverage at this time.

Depending on the update, you can expect changes in your premium.

Document The Damage Or Incident

Whether there’s damage due to an accident, natural occurrence, or a break-in, you should carefully document the particulars before you clean everything up.

You can write a description along with taking photos. Photographic or video evidence is especially helpful.

Think of the way police detectives and forensic teams behave at crime scenes.

While you won’t be dusting for fingerprints, you do want to take the same level of care in recording the state you found your possessions in.

Get your landlord involved if it includes damage or break-in to the apartment in any way. It also makes your landlord privy to the incident.

Most importantly, if it involves a crime, you should most definitely file a police report, which will corroborate your claim.

Make sure you also review your policy to make sure you’re covered for this incident.

Also Check: How To Register A Car In New York

Who Is The Guarantors It Right For

This might be the company for you if prize transparency above all.

As one of the most upfront about their requirements and fees, the Guarantors are a great pick for people who dont want surprises when it comes to their paperwork.

They also are known for being avid educators about everything involving NYCs rent reform.

Do You Need An Inspection For Renters Insurance

No. Getting renters insurance is really simple.

You can get a quote online in most cases from either directly from an insurance company or a comparison site.

However, if you file a claim for damage, you might find yourself being visited by a claims adjustor who will inspect the damage, depending on the type of claim.

This is unlike homeowners insurance, where the insurance company may send someone to confirm or inspect the premises to make sure they are accurately insuring and quoting.

You May Like: Delete Nyt Account

Increase Your Home’s Security

Lowering your rental insurance can be as simple as getting a home security system or alarm installed in your apartment if no other security measures have been put in place in your rental building such as security cameras or a doorman.

Be sure to speak to your landlord about the possibility first.

New York City requires all apartments and houses to be outfitted with smoke detectors, so this is an automatic plus.

However, you can do one better by keeping a fire extinguisher in your unit.

Doesnt The Owner Insure The Building

Of course the owner insures the building. That covers his liability and damages that cant be attributed to a tenants negligence. Ultimately, if you cause a fire, chances are that the landlords insurance will pay out and then come after you for the money it paid. The problem is that you dont have that money. Renters insurance liability coverage takes care of that and even helps to defend you against the lawsuit that youre likely to face.

Read Also: New York Times Paywall Smasher For Google Chrome

Who Needs Renters Insurance

The short answer is renters, and not just clumsy renters or those living in areas with lots of storms or tornadoes.

All people who rent their living spaces, whether it’s a house or an apartment, should get renters insurance. Insurance is for all those unexpected situations in your life.

Insuring your possessions can give you the peace of mind you need to move forward with every step in your life, because as they say, “life happens”.

How Much Will I Need To Pay For A Guarantor

How much a person will pay varies based on which company you choose, your citizenship, as well as the proof you have of your financial status.

A renter can expect to pay anywhere from 60 to 95 percent of what they expect to pay for rent.

Remember, that if you default on your rent payments, while your landlord will be covered by the third-party guarantor, you are still on the hook for the rent payments.

The rent payments should be made to the insurance company.

Also Check: What Time Is Shabbos In New York

What’s Renters Insurance Vs Condo Insurance

Renters insurance and condo insurance are actually quite similar, with condo insurance being a bit more extensive than renters.

Condo or co-op insurance is actually a form of homeowners insurance.

Regular homeowners insurance covers the entire structure of your home, however, condo/co-op insurance only covers what’s within the unit owner’s home.

A condo owner or a co-op shareholder do not need to purchase insurance for the common areas of the building or property since the condo association or co-op are required to hold insurance for these areas.

As a matter of fact, a part of your HOA fees are going towards this.

In that sense, condo insurance is very similar to renters insurance.

The main exception is that condo insurance, as a form of homeowners insurance, will cover damage to the actual physical unit, whereas renters does not.

Liberty Mutual: Best For Low

Liberty Mutual stands out as a company because of its sheer affordability. Their national average on premiums is noticeably lower than most other major big-name companies.

However, just because you’re saving on your premiums it doesn’t mean that you’re compromising on your coverage albeit their standard coverage is a no-frills policy.

Liberty Mutual does over add-ons so you can expand coverage to meet your needs.

| Pros | |

|---|---|

| Mixed reviews on customer service | |

| Many discount opportunities | Not great for those with a lot of valuable possessions |

| Offered nationwide | Not a lot of policy customization opportunities |

| Claims can be filed by phone, online, or mobile app |

Don’t Miss: New York Toll Calculator

How Much Total Money Is Paid For Renters Insurance In New York State Every Year And Risk Reduction

how much total money is paid for renters insurance in new york state every year? is a tool to reduce your risks. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. And if the accident / insurance event occurs, the insurance company will bear all or all of the costs in full or in part. And these costs can be from $ 100 to several tens or even hundreds of thousands of dollars, depending on the subject of insurance. So, choose a reliable company!

So Is Renters Insurance Worth It

Renters insurance and home insurance, for that matter, are worth it. It’s there to cover all the unexpected.

Renters have a lot less to worry about than the average homeowner.

They don’t have to worry about the cost of damage from water leaks, short circuits, fires, weather or natural-disaster related damage to the place their living in.

However, they still have to worry about the things the own–and not just the expensive they have for fun but some times essential work-related items.

Say if you’re a freelance photographer or you work from home if your neighbor’s apartment floods and you have a bad leak in your apartment which damages your cameras or desktop, where will you get the money to replace those items?

Your landlord and your neighbor are not legally required to give you any compensation.

These kinds of incidents happen to renters every day and if this happened to you, you’d say renters insurance is definitely worth it.

Also Check: Can You Register A Car Without A License In Ny

Average Cost Of Renters Insurance

May 3, 2021 Our study found that the average cost of renters insurance is $15 a The cost of renters insurance differs considerably by state, but its an affordable investment overall. Mississippians paid the most, at $252 a year, or $73 more than the New York has the highest percentage of renter-occupied housing

Feb 5, 2021 The average renter can expect to pay about $179 per year in total for coverage. bring into your new rented home or apartment, and your own personal liability what your landlords insurance is for it will protect you and your property. Heres what the average renter paid for coverage in each state in

Understanding New York City Renters Insurance Quotes

Renters insurance provides renters with four types of coverage, including:

-

Property coverage: Reimburses your for property that is destroyed, damaged, or stolen.

-

Liability coverage: Covers legal costs if a guest is injured in your home and sues you.

-

Medical payments to others: Covers the medical expenses if a guest is injured in your home.

-

Loss of use: Pays temporary living expenses if you canât live in your apartment due to damage or repairs.

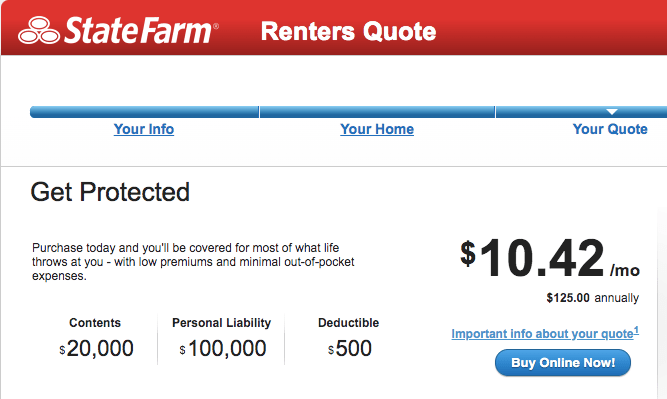

Each of these types of coverage comes with its own coverage levels. Loss of use and medical payments to others are usually set by the insurance company, but property coverage and liability coverage are variable and can be chosen and adjusted by you. The more coverage you have, the more expensive your plan will be.

Also Check: Tolls From Virginia To New York