What To Do If You Dont Receive Your Minimum Wage

Every employee has the right to be paid for every hour of their work. If an employer pays his employees less than the minimum wage or refuses to pay them at all, they are breaking the wage and hour laws. Employers in the state of New York may also be violating wage and hour laws by not including particular time as work time, such as:

- Time an employee worked off the clock, before clocking in or after clocking out for the day

- Required training programs and classes

- Meals or rest breaks that an employee had to work through

- Certain travel time and

- Waiting time that an employee has spent on the employers premises.

If this happens to you, you have the right to file an unpaid wage complaint against your employer. This way, you will get back whats rightfully yours as well as some additional compensation in the form of liquidated damages, which are typically equal to the amount of unpaid wages. Additionally, you may also be able to collect interest in unpaid wages, lawyer fees, and legal costs.

Employers who willfully and repeatedly violate the minimum wage or overtime laws may become subject to civil money penalty of up to $1000 for every violation. However, such willful violations may result in criminal prosecution, where an employer can be fined up to $10,000, and if they repeat the violation, they may face imprisonment. If an employer makes false statements about supposedly exempt overtime employees, they may be fined up to $16,000 or imprisoned for as many as 16 months.

How Should Small Business Owners Prepare For Minimum Wage And Paid Leave Increases In 2022

Every business is different, so there isnt one right way to prepare. Here are a few options you may want to consider:

- Audit your expenses: Check your cash flow in detail and create a hiring plan that you can afford. In some cases, you may find that hiring temporary workers as needed is less expensive than taking on full-time regular staff. If you are a new business, be sure to register for a free EIN so you can begin hiring and to stay compliant

- Make sure you hire and keep the right employees:Replacing an employee costs a lot. You decrease the total cost associated with recruiting and training when you hire the right people. Look for candidates with good track records, who come recommended, and who fit in with the company culture. Once theyre onboarded, make sure you build a relationship and provide paths for growth it makes it more likely that they will stay in their role.

- Increase prices: This is a great way to increase cash flow. Customers are rarely happy with a price hike, but keep in mind that your competitors will be forced to do the same. Just make sure you keep track of trends, and dont raise prices too high.

- Update tech: Consider automating certain aspects of the work , and learn how to do payroll yourself to reduce production costs. Square Payroll is easy to use and can help you avoid common payroll mistakes.

Employer Launchpad

Job Loss Due To Wage Garnishment

A wage garnishment can happen to just about anyone, so having your wages garnished shouldnât be a reason for your employer to fire or penalize you. Both federal and New York state laws make it illegal for your employer to fire you, withhold a pay raise, or pass you over for a promotion solely because you have an income execution in place. That said, each wage garnishment requires extra accounting and compliance work for your employer. As a result, these state and federal protections donât apply if you have more than one income execution.

Also Check: How To Print New York Times Articles

State Minimum Wage Rate For New York

Observation:

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Units: Dollars per Hour, Not Seasonally Adjusted

Frequency: Annual

For more information, visit

Suggested Citation:

U.S. Department of Labor, State Minimum Wage Rate for New York , retrieved from FRED, Federal Reserve Bank of St. Louis https://fred.stlouisfed.org/series/STTMINWGNY, July 31, 2022.

How Much Money Does A Person Working In New York Make

Average Yearly Salary508,000

A person working in New York typically earns around 114,000 USD per year. Salaries range from 28,800 USD to 508,000 USD .

This is the average yearly salary including housing, transport, and other benefits. Salaries vary drastically between different careers. If you are interested in the salary of a particular job, see below for salaries for specific job titles.

You May Like: How I Met My Wife New Yorker

New York State To Kick Off 2022 With Increases To Minimum Wages And The Overtime Exemption Salary Threshold

4min

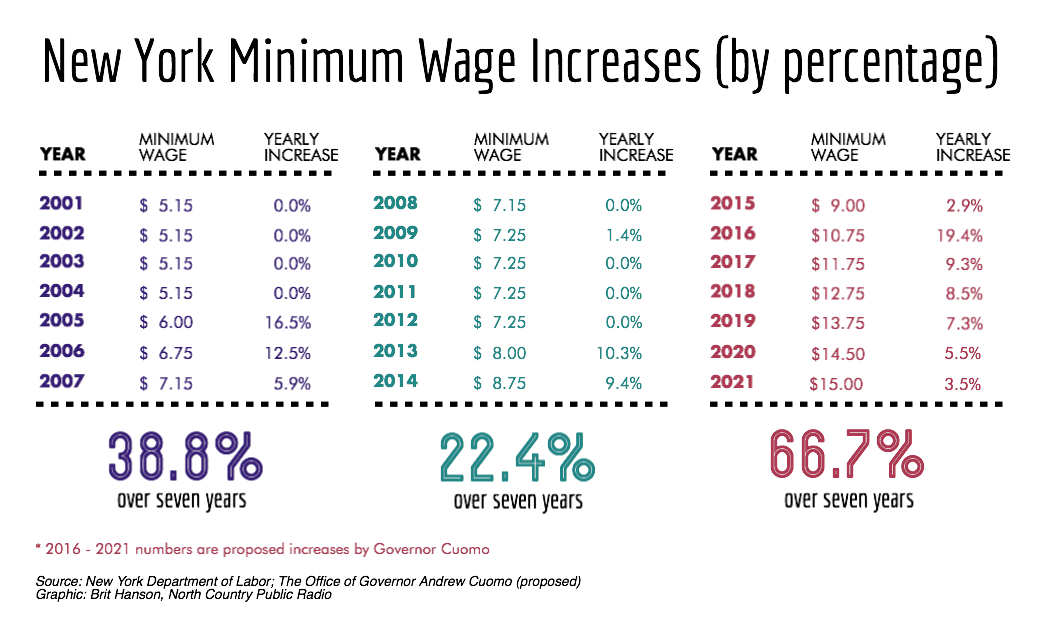

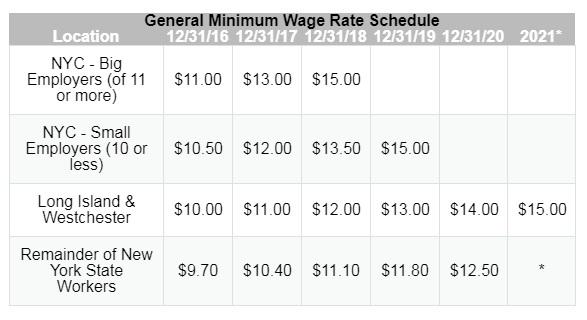

Effective December 31, 2021, employers in certain regions and industries throughout New York State once again saw changes to New York’s wage and hour requirements. Below we summarize the new requirements employers must meet regarding increases in minimum wage rates, tip credits for tipped employees in the hospitality industry, and salary basis thresholds for overtime exemptions.

Standard Minimum Wage Rates

The New York State Minimum Wage Act provides for annual increases in the minimum wage rates throughout the State. These increases occur on December 31 of each year and will continue until a $15.00 per hour rate is reached. This year, employers in Nassau, Suffolk, and Westchester counties joined New York City and large fast-food employers throughout the State with a $15.00 per hour minimum wage ratean increase from the $14.00 per hour rate that went into effect on December 31, 2020. The remainder of employers in New York also saw an increase, although not yet hitting the $15.00 mark, with a move from $12.50 per hour to $13.20 per hour.

Tipped Employees in the Hospitality Industry

Changes to the minimum wage requirements for non-tipped hospitality workers in these regions follow the changes to the standard minimum wage rates detailed above.

Minimum Salary Thresholds for Overtime Exemptions

* * *

Tipped Food Service Worker Minimum Wage

As of December 31, 2016, the minimum wage for tipped for service workers in all of New York is $7.50 per hour. In New York City, the rate will increase on December 31, 2017. A complete table showing tip credits, minimum wage increases, and other minimum wage tables is from the Department of Labor website.

Read Also: Where To Stay In New York City On A Budget

Ny Minimum Wage For Tipped Workers

If you’re a hospitality or restaurant worker who earns customer tips, this is the minimum wage that applies to you.

As of Dec. 31, 2020, the minimum hourly cash wage for tipped workers in New York is:

- $12.50 for service workers $10 for food service workers in New York City

- $11.65 for service workers $9.35 for food service workers in Westchester County and on Long Island

- $10.40 for service workers $8.35 for food service workers in the rest of the state

If tips fall short of a weekly threshold , employers are required to pay their workers the general minimum wage. More information on tip thresholds can be found at the state Department of Labor’s website.

Also of note: As of Dec. 31, 2020, the tipped wage was eliminated for workers at nail salons, car washes, doormen and other industries the state classifies as “miscellaneous.” Those workers now are required to receive the general minimum wage.

Ny Minimum Wage For General Workers

The general minimum wage is the one that applies to workers in most industries. If you do not work in fast food or as a hospitality worker who relies on customer tips, this is the one for you in most cases.

As of Dec. 31, 2020, the general hourly minimum wage in New York is:

- $15 in New York City

- $14 in Westchester County and on Long Island

- $12.50 in the rest of the state

Don’t Miss: What Is The Best Internet Provider In New York

New York Minimum Wage Increasing On Dec 31

NEW YORK – The sixth minimum wage increase for workers outside of New York City enacted under the 2016-2017 New York state budget will take effect on the last day of this year.

The minimum wage for workers in Nassau County, Suffolk County, and Westchester County will rise to $15 per hour on Dec. 31, 2021.

For workers in the rest of the state , the minimum wage will increase to $13.20 per hour. The annual increases for these workers will continue until the rate reaches $15 per hour the percentages will be “based on economic indices, including the Consumer Price Index,” according to the Department of Labor.

“The minimum wage is based on where an employee performs work,” the Department of Labor states. “Workers must be paid the minimum wage rate for their work location regardless of where the main office of their employer is located.”

Get breaking news alerts in the free FOX5NY News app |

The minimum wage for all workers in New York City has been $15 per hour since Dec. 31, 2019.

Minimum wages vary based on industry and region. You can download the Wage Order Summary here for tipped workers in the hospitality industry.

You can review the state’s answers to the Minimum Wage Frequently Asked Questions here.

All Employees This Is The Year Both Large And Small Employers Pay The Same Minimum Wage:

+$1.80 / hour

Because New York City has a higher minimum wage rate than the one set by New York or the Federal government, the higher local minimum wage rate takes precedence and must be paid to all employees covered by the local minimum wage regulation.

Keep in mind that New York and the Federal Fair Labor Standards Act both define various minimum wage exemptions and other labor laws that may apply to employees in New York City. You can find more information about New York’s minimum wage and labor laws on this site.

Recommended Reading: Is Coronavirus In New York City

Living Wage Calculation For New York

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. The assumption is the sole provider is working full-time . The tool provides information for individuals, and households with one or two working adults and zero to three children. In the case of households with two working adults, all values are per working adult, single or in a family unless otherwise noted. The state minimum wage is the same for all individuals, regardless of how many dependents they may have. Data are updated annually, in the first quarter of the new year. State minimum wages are determined based on the posted value of the minimum wage as of January one of the coming year . The poverty rate reflects a person’s gross annual income. We have converted it to an hourly wage for the sake of comparison.

For further detail, please reference thetechnical documentation here.

| 1 ADULT |

|---|

More Than 5 Million Low

Minimum wage workers in New York will see their paychecks go up this year, along with those in 19 other states and two dozen cities and counties. That’s according to a new analysis by the liberal-leaning Economic Policy Institute, which tracks minimum wage changes across the country.

Overall, more than 5 million low-wage workers will see their paychecks go up even as the federal minimum wage remains stagnant for the 12th consecutive year, the EPI said. In New York, approximately 464,000 minimum wage workers will see their paychecks increase. How much depends on where one lives in New York.

According to the New York Department of Labor, minimum wage rates are scheduled to increase each year on Dec. 31 until they reach $15 per hour.

Don’t Miss: Where Is Watkins Glen New York

Garnishment Limits For Private Debts

Private debts include any type of debt that doesnât fall into the public or family debt categories. Credit cards, medical bills, bank loans, and private student loans are examples of private debts.

If your weekly pay is less than the applicable minimum wage multiplied by 30, then your wages canât be garnished for a private debt. For example, if youâre a librarian in Buffalo who makes less than $396 per week , your wages canât be garnished. If your weekly pay is more than this, then the maximum weekly garnishment withholding is whichever of these is less:

-

10% of your gross wages

-

25% of your disposable income

But, under either calculation, the garnishment amount canât be so high that youâre left with less than 30 times the applicable minimum wage.

If more than one creditor tries to garnish your wages at a time, usually only the first creditor will actually receive any withholding. This is because the maximum deduction limits apply no matter how many income executions are issued. Typically, the full amount of allowed withholding will go to the first creditor until that debt is paid.

How Can You Recover Your Minimum Wage

There are several ways in which you can recover your unpaid wages. The best and most efficient method is to file a private lawsuit against your employer. In this case, you should seek an experienced employment lawyer, preferably one who offers a free initial consultation and who works on a contingency fee basis. Your lawyer will help you figure out how your employer has violated minimum wage laws and provide you with options for challenging his unlawful conduct. It is important that you have any valuable documentation such as copies of pay stubs, personal records of hours worked, and anything else that can be useful to your claim. Your lawyer can also try to negotiate a settlement of your unpaid wage claim without having to file a claim with the FLSA or in court.

It is important to know that your employer has no right to fire you or otherwise discriminate against you for filing an unpaid wage claim. If they try to threaten you with termination or any other discrimination, they may face serious monetary penalties or imprisonment. But, it is also important to know that a two-year statute of limitations applies to the recovery of unpaid wages, except in the case of an employers willful violation when a three-year statute of limitations applies. Overall, under the New York Labor Law, a six-year statute of limitations applies to all unpaid wage claims.

Don’t Miss: Is Grand Canyon University Accredited In New York

How Does The Education Level Affect Your Salary

It is well known that higher education equals a bigger salary, but how much more money can a degree add to your income? We compared the salaries of professionals at the same level but with different college degrees levels across many jobs, below are our findings.

varies drasticallydepends hugely

Workers with a certificate or diploma earn on average 17% more than their peers who only reached the high school level.

Employees who earned a Bachelor’s Degree earn 24% more than those who only managed to attain a cerificate or diploma.

Professionals who attained a Master’s Degree are awarded salaries that are 29% more than those with a Bachelor’s Degree.

Finally, PhD holders earn 23% more than Master’s Degree holders on average while doing the same job.

Is a Master’s degree or an MBA worth it? Should you pursue higher education?

A Master’s degree program or any post-graduate program in United States costs anywhere from 39,500 US Dollar to 118,000 US Dollar and lasts approximately two years. That is quite an investment.

You can’t really expect any salary increases during the study period, assuming you already have a job. In most cases, a salary review is conducted once education is completed and the degree has been attained.

Many people pursue higher education as a tactic to switch into a higher paying job. The numbers seem to support this tactic. The average increase in compensation while changing jobs is approximately 10% more than the customary salary increment.

Find Out What’s Happening In Tarrytown

In New York City, employees in companies with 11 or more individuals saw their minimum hourly wage go from $13 to $15 as of Dec. 31, 2018. Employees in companies with 10 or fewer individuals went from $12 to $13.50 as of Dec. 31, 2018, with the wage going up to $15 on Dec. 31, 2019.

Employees in Long Island and Westchester saw their wages go from $11 to $12 as of Dec. 31, 2018, with rates going up $1 each year until it reaches $15.

You May Like: What Shows Are On Broadway In New York City

Maximum New York Garnishment Amounts

New Yorkâs laws limiting how much can be garnished from each paycheck closely mirror the federal wage garnishment laws. These limits are based on your weekly income. Hereâs how to calculate your weekly pay:

-

If youâre paid every two weeks, divide your pay by two.

-

If youâre paid twice per month, such as on the first and fifteenth, divide your pay by 2.17.

-

If youâre paid once per month, divide your pay by 4.33.

In New York, different garnishment limits apply to different types of debts. To calculate the garnishment limits that apply to you, youâll need to know:

-

Your gross income: Your weekly pay before any deductions are taken out.

-

Your disposable income: Your weekly take-home pay after subtracting mandatory deductions, such as taxes and unemployment insurance.

-

The minimum wage that applies to you: The minimum wage in New York differs depending on where you live. If you live in New York City, Long Island, or Westchester, itâs $15. If you live anywhere else, itâs $13.20. There are also different rates for tipped service employees and tipped food service workers.