What If You Cant Pay Closing Costs

If you get to the end of your deal and cannot afford the closing costs, you have options. There are HUD programs for both down payment and closing cost assistance in New York City. For example, the HomeFirst Down Payment Assistance Program offers up to $100,000 for closing costs or down payments for first-time homebuyers. Prospective homebuyers need to meet certain requirements including an 80% Area Median Income . Find out more about different loan types for homebuyers.

Additionally, private banks also offer assistance, such as Bank of Americas Americas Home Grant, Chases Homebuyer Grant, and Citibanks Closing Cost Assistance programs.

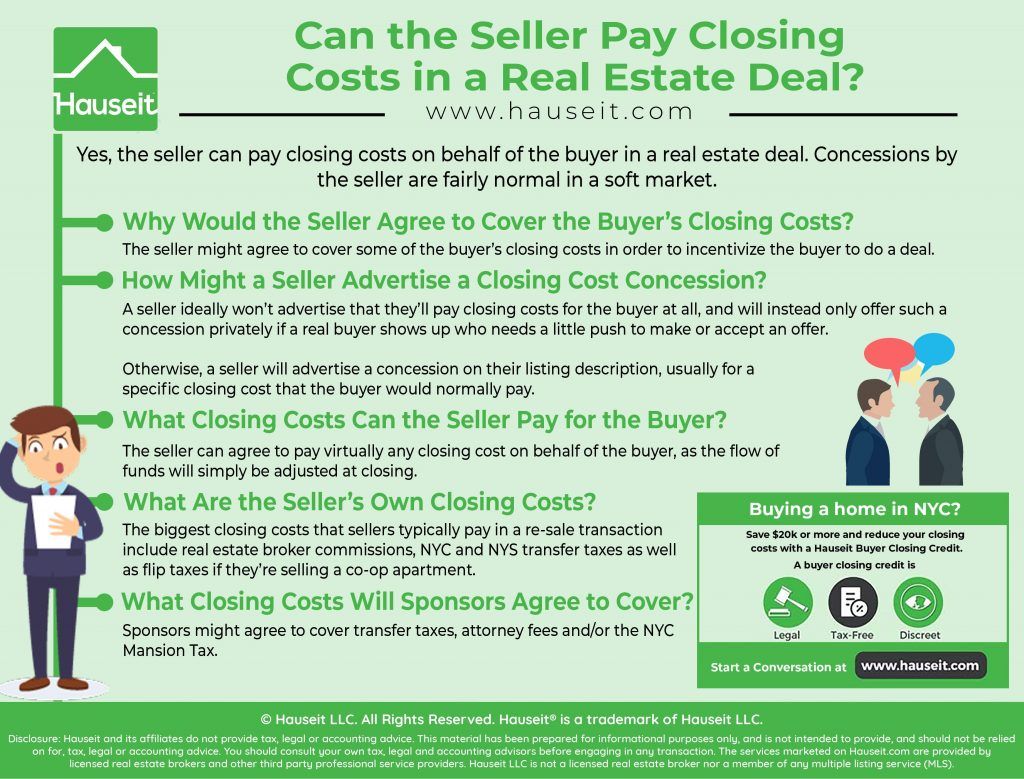

A bank will rarely allow you to include closing costs directly in your mortgage, Niyazov says. However, sometimes the seller will concede to allow the buyer to finance their closing costs. Its called a sellers concession.

For example, imagine a buyer and seller negotiating a deal at $500K, and the buyer has a 5% down payment. However, they dont have much money for closing costs. If the property appraises higher than $500K, the seller can agree to amend the purchase price but only take $500K.

So theyre getting 95% financing, Niyazov says. Now theyre going to get 95% financing of the $515K. So theyre going to get more money from the bank.

Queens Homes Under $650K on StreetEasyArticle continues below

State And Local Government Charges

State and local government charges have to be paid as closing costs as well. These usually include transfer taxes charges by the city, county and state, recordation fee and prepaid property taxes. Taking the closing costs in Westchester example again, buyers need to go through all the formalities required by the government in NY and determine the taxes and costs associated with it.

How To Calculate Closing Costs

Since closing costs are a large part of purchasing a home in NYC, you may be wondering how to budget for closing costs. The best way to prepare for closing costs would be to put aside extra money. Generally, it is recommended to set aside around 2-4% of the sales price of the condo, townhouse, or co-op that you purchased.

However, if the property you purchased or are planning to purchase is one million dollars or more, you should save even more, at around 3-4% of the purchase price. Since condos usually have more closing costs associated with them compared to co-ops, it is also recommended to save around 3-4%.

Additionally, if the condo you purchased is brand new, you may want to increase the savings to 5% of what you paid for it. This is because brand new apartments tend to have higher closing costs associated with them.

Now that youve prepared yourself for closing costs when purchasing a home in NYC, you can better budget your money when it comes time to choosing your perfect home.

Localize is a great resource for your apartment search. Not only will our insights help you avoid unwanted surprises after moving in, but we can help you find homes that perfectly fit your purchasing budget. Happy apartment hunting!

You May Like: How Much Are Tolls From Va To Ny

What Is Closing Exactly

Closing is a term that describes the last step in purchasing a home think of it as closing the deal. Its the point in the buying process when a property has sold and ownership is transferring from the seller to the buyer. On the day that a property closes, both the seller and buyer sign paperwork that finalizes the transaction, and the buyer typically gets keys to the new home. Aside from signing documents for the mortgage lender, title company and other entities, paying certain fees is also part of the closing process. These are the closing costs. Once these funds are distributed and paperwork is finalized, the buyer can take ownership of the home.

Learn More To Save More

Also Check: Ny Car Registration

How To Save On Closing Costs In New York When Buying A Home

When youâre looking to save on the costs of closing in a New York home purchase, you can negotiate with sellers to bring the price down. There are even closing assistance programs available through the VA and FHA.

If you live in New York City, check out their HomeFirst program that allows prospective home buyers to get a certificate to get a loan of up to $40,000 to help with down payments or closing. After you take their course and if you meet the qualifications,youâll have six months to find a home with certification that youâre an eligible buyer.

If you choose to work with a Clever, you could qualify for Clever Cash Back. With an experienced local agent from Clever, you get help during the whole buying process to ensure that youâre able to minimize closing costs overall. Theyâll even work to find additional savings for you throughout the process.

Negotiate For The Buyer To Pay

If you’re selling in the middle of a hot seller’s market with low housing inventory, you may be able to ask the buyer to cover some of your closing costs.

Competition among buyers is fierce in these market conditions, so they’re typically more willing to make concessions so you’ll accept their offer on your New York home.

Also Check: Submit Poems To The New Yorker

Buyers Estimated Closing Costs In Buffalo Ny

Here is a general idea of typical Closing costs in Buffalo NY and Erie County, NY:

- Mortgage Fees includes document preparation fee relative to the mortgage

- Lender Fees and Charges:

- 1st mortgage payment

- NYS Mansion Tax

- Property Tax Escrow paid to the lender at closing for pre-paid real estate taxes, flood or hazard insurance premiums for 2-3 months.

- Private Mortgage Insurance or Mortgage Insurance Premiums for all FHA loans.

- Fire / Hazard Insurance

- Flood certification Fee paid to the lender to search the flood maps for your property

- Title Insurance to protect the buyer and lender from any future, unexpected claims on the property

- Attorney Fees: $600-$1,000

- Title Search Fee to review the title for liens, problems, etc.

- County Clerk Recording Fee $45 $100

Nyc Buyer Closing Costs And Calculator

Buyers can expect to pay the following fees when purchasing a property in New York City.

Buyers Attorneys Fees: Your attorneys fees will be approximately $1,500- $3,500. Your attorney will review the purchase contract, work with your title company, and coordinate the closing with the sellers attorney. Additionally, if you are buying a co-op or a condo, then part of your attorneys role includes assessing the financial condition of the co-op or condo building. If both the contract and the finances of the building are deemed adequate, then you can make your good-faith deposit and sign the contract.

Title Insurance: Title insurance ensures your ownership rights to the property. When you buy title insurance for your property, a title company searches these records to determine and remedy any ownership issues that they discover. You will only pay for this policy once however, your coverage will last for the duration of your ownership of the property.

Property inspection fees: This fee goes towards verifying the condition of a property or checking for repairs that may be necessary before your mortgage lender will agree to fund your property.

Mortgage Bank Fees: If you need a mortgage, you will have to pay various bank fees associated with obtaining the mortgage. These fees can include but are not limited to the appraisal fee, credit check fees, and the banks attorneys fees. The amount is based upon the purchase price of the property.

Recommended Reading: New York Times Magazine Poetry

Closing Costs In Westchester Ny

Finalizing a home purchase and taking up a mortgage loan comes along with a certain amount of closing costs. These costs or fees are associated with the settlement of the deal and include a number of small charges that have to be paid by the home buyer. Only in rare scenarios will the seller of the house also be required to pay these costs along with the buyer.

Closing costs are those which cover various elements that accompany the purchase and vary with each real estate transaction. In simple terms, a home buyer will be looking at paying a down payment, a principle amount with interest for the mortgage and closing costs which are paid to the lender or any third parties involved. These costs also include costs paid to the state or the local government. For example, closing costs in Westchester, NY may include city, county and state fees charged by the government.

When a home buyer applies for a home loan, the lender which may be the bank or any other third party is required to provide an estimated amount of the closing costs by law. The term used for this estimate is called a good faith estimate which gives the home buyer an idea about what he or she is going to be paying when accepting the loan and the offer. The list of individual costs that are accumulated as closing costs is also provided to the buyer. These costs are generally paid with the mortgage price by the home buyer.

Closing costs can be divided in three main categories which are briefed below:

J Total Closing Costs

D + I = J. This is the total of all your closing costs. It represents the sum of all your loan costs and all your non-loan costs. This is roughly the amount you should budget for, since it represents the lenders estimate of what you will owe at closing time.

Weve gone through some of the most common fees that make up your total closing costs. You can generally expect the total to be between 1 and 5% of the price you are paying to buy your home. Payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. Alternatively, you can pay your closing costs in cash, similar to your down payment.

Don’t Miss: Airlines Flying To Cabo San Lucas

Real Estate Agent Commission

The average real estate agent commission in New York is 6%, just slightly more than the national average of 5.8%. Although the fee is generally split evenly between the buyers and the sellers agents, its the seller who usually pays for it. That means that for the sale of a $385,000 home in New York, the average commission cost would amount to $23,100, to be split between buyers and sellers agents.

Since there is no commission rate set by the State of New York, a seller can negotiate the fee with the agent. To find commission information specific to your area, enter your city into HomeLights commission calculator.

What Selling Points To Emphasize

Remember, how your home looks inside and outside can be what makes or breaks a sale. Even if a house has a lot to offer buyers in its size, location and amenities, if it looks dirty or cluttered, people are going to consider other options.

Comparing your property to others on the market can help you see whats attractive to buyers and what typical selling price is for homes like yours which can provide you with a starting point for estimating your closing costs. To begin looking at homes throughout New York, browse through Michèles current listings to see how your home compares.

Don’t Miss: Renting A Yacht In Nyc

Local Real Estate Transfer Tax

In addition to state transfer taxes, some areas impose additional taxes. For example, since 2019, conveyances in New York City have been subject to an additional tax of $1.25 for each $500 or fraction thereof when the entire conveyance of residential property is worth $3 million or more.

As Hilbert says, New York City is a completely different animal. Residential properties that sell for less than $500,000 receive a 1% tax rate, while homes that sell for more than $500,000 pay a rate of 1.425% to the city. That means, for example, a home at the median residential sales price of $745,000 in New York City would be taxed $10,616.25.

Closing Costs In Ontario When Selling A Property

Closing costs when selling a house in Ontario are mostly limited to three items

1.Realtor commission,

2.Real Estate Lawyers Fees,

3. Mortgage payout charges.

The highest cost for the sale of a property is the realtors commission. One must keep in mind that 3% is usually charged if your realtor brings a client if another realtor is involved for the purchaser, the commission may go up to 5% of the property value.

The Lawyer is Fees and disbursements are not as high as realtors commission but do add up to the total amount.

At Shaikh Law, a Real Estate Lawyer would charge his fees plus disbursements in a total of $810+ Tax, including one payout of your mortgage.

If your mortgage is not ready for renewal, you may end up paying for breaking the term of the mortgage. Depending on the Financial institutions and terms of your mortgage, you may end up paying a minimum of 3 months of interest or a maximum of a few thousand.

It would be best if you reach out to your financial institution to inquire what charges would apply if you were to break your mortgage prior to completion of the term of your mortgage.

Real Estate Agents Commission 3% + Tax

Real Estate Lawyers Fees inclusive of Disbursements $810 + Tax

Mortgage Prepayment Charges 3 months interest

Closing Cost for Refinance

Also Check: How To Pay Ticket Online Ny

How Can You Reduce Closing Costs In New York

When you sell your home, the goal is to get as much of a return on investment as possible. Closing costs do eat into your profit and can leave you feeling as if you didnt receive the full value of your home in the sale.

Some types of closing costs such as the transfer taxes arent negotiable. New York charges a percentage of the homes sale price and the only way to pay a lower transfer tax is to reduce the sale price of your home, but doing so would mean you pocket less from the sale.

The closing cost with the most room for negotiation is the brokers commission. While asking an agent to accept a fee of five percent instead of six percent might not seem like it will save you a considerable amount of money, on a sale worth $1 million, it translates to $10,000.

Another option for lowering closing costs is to have the buyer take responsibility for all or some of the brokers commission. Depending on how competitive the market is and how desirable your property is, a buyer might be more than willing to pay part of it, especially if it means getting the home of their dreams.

While it can help your bottom line to find ways to work with your buyer or broker to reduce specific closing costs, one area where you dont want to skimp is your real estate attorney.

Satisfaction Of Mortgage Fee

Satisfaction of mortgage is a document that your lender prepares to verify and confirm that the full payment of your mortgage. When selling your home, you need the satisfaction of mortgage for the title to clear.

The satisfaction of mortgage fee is paid to the government so that it can prepare and record the appropriate materials and so the document can become part of the public record.

In Westchester County, the general fee for mortgage satisfaction is $50.50. The county clerks office charges an additional $5 for each document page beyond the first one. Along with paying the county clerk, a seller might also need to pay the title company a fee to remove any liens from the property.

In addition to any fees involved, satisfying the mortgage means paying the lender any principal and accrued interest remaining on the home loan. If you are selling your property for $2 million, for example, but still owe $1 million including interest on your mortgage, youll need to direct $1 million of the proceeds from the sale to your lender.

You May Like: What Plays Are In New York

Real Estate Closing Costs In New York What Are They

Let us first examine the sellers side of the transactions. Among other things the seller generally pays for realtors commission and transfer taxes. Realtors generally charge anywhere between four to six percent of the purchase price. While a seller might be tempted to go with a lower end of the spectrum realtor, remember you get what you pay for. This past summer I assisted a client in selling her Bedford-Stuyvesant multifamily brownstone. The seller had hired one of the best realtors in the area. The brownstone sold for way above asking price and over $500,000 more than a similar brownstone which sold several months earlier on the same block. While the seller might have paid one or two percent more to the realtor, the price increase alone was well worth it.

The other major fee that is incurred by a seller during a real estate transaction is New York City and New York State transfer taxes. New York City transfer taxes depend on the type of property you are selling but generally for residential properties are 1% if the sale price of the property is $500,000 or less and 1.425% if the sale price is $500,000 or more. New York State charges the seller $4 for every $1,000 of the sale price. Additionally, a seller might incur a Capital Gain tax at the conclusion of the tax year but that discussion is better left to a C.P.A.