Have You Established A Nexus In New York

As mentioned previously, a physical nexus occurs when you have an office, property, or employee in the state.

If your operations in New York are remote, then economic nexus will apply. The first type of economic nexus is based on revenue. It is established once you make more than $300 000 in the last 12 months selling to New York-based customers or complete more than 100 transactions in the state.

Other types of nexus are the following: Affiliate. If an affiliate uses your trademark in New York or helps your business develop a market in the state, you must start collecting sales tax for New York.

Click-through. If a New York-based representative facilitates your sales via a link and the resulting sales price reaches $10 000, you are considered to have a nexus with the state.

Trade shows. New York sales tax rate should be charged on the sales that you make during trade shows or exhibitions in the state.

Are all goods and services taxable in New York?

Not all goods and services should include sales tax rates New York in their prices. In New York, non-prepared food items and medical supplies are tax-free. Among other exemptions are fuel and equipment for manufacturing, U.S and N.Y flags, commercial aircraft, and other property. More information about taxable and non-taxable items is published on the New York State Department of Taxation and Finance website.

Services are generally sales tax-exempt, with a handful of exceptions highlighted on the NY tax authoritys website.

Penalties For Failing To Register For Sales Tax

If you are required to register for sales tax purposes but fail to do so and you operate a business without a valid Certificate of Authority, you will be subject to a penalty. The maximum penalty for operating a business without a valid Certificate of Authority is $10,000, imposed at the rate of up to $500 for the first day business is conducted without a valid Certificate of Authority, plus up to $200 per day for each day after. For more information, see Tax Bulletin Sales and Use Tax Penalties .

Offline New York Sales Tax Certificate Of Authority Application Form

While generally slower than applying online, you can apply for a New York Sales Tax Certificate of Authority for your business offline using Form DTF-17, the “Application to Register for a Sales Tax Certificate of Authority”.Form DTF-17 can be downloaded from the Department of Taxation and Finance here .

Also Check: How To Pay A Traffic Ticket Online Ny

New York Sales Tax Guide

Welcome to 1StopVATs New York sales tax guide. After reading this guide, you will be able to determine if you must register for sales tax in New York permit and know how much sales tax in New York your company should charge even if you are a remote seller. In case you dont find answers to your tax-related questions here, consult with the 1StopVAT team by clicking here.

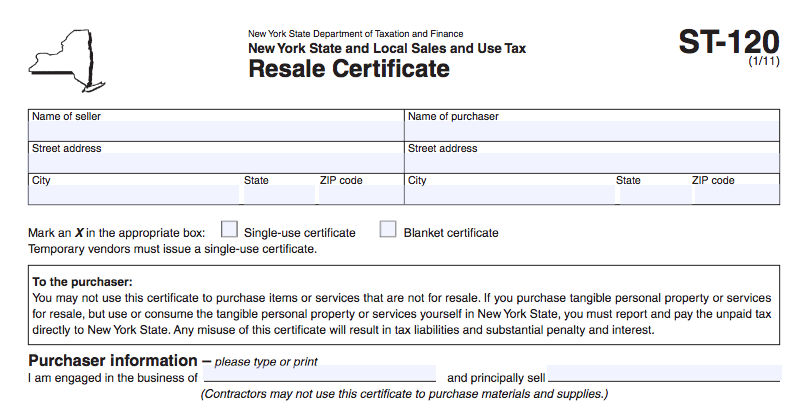

How To Fill Out The New York Resale Certificate Form St

Filling out Form ST-120 is pretty straightforward but is critical for the seller to gather all the information.

If audited, the New York Department of Taxation and Finance requires the seller to have a correctly filled out Form ST-120 Resale Certificate. Without it correctly filled out, the seller could end up owing sales taxes that should have been collected from the buyer in addition to penalties and interest.

You May Like: How Much Does It Cost To Travel To New York

Surrender Your Nys Certificate Of Authority

If your business stops operating, you are required to surrender your Certificate of Authority within 20 days of ending the business and file a final sales tax return.

Failure to properly close your business with NYS will likely result in the business being assessed failure to file penalties as NYS will assume that you are still operating the business.

How Do I Get Tax Exemption For My Non Profit In New York State

Most non profits and religious corporations can apply for an exemption from the New York State Corporation Franchise Tax. You file Form CT-247, which you will find in your online account if you hire Northwest as your NY registered agent. Mail it to NYS Tax Department with copies of your certificate of incorporation, bylaws and IRS letter approving your federal tax exemption. There is no filing fee and processing time is two to three months. Send it to:NYS Tax Department

Recommended Reading: What Airlines Fly To Cabo San Lucas Mexico

Information Needed To Register For A Sales Tax Permit In New York

Before you begin the process of registering with the state, make sure you have access to the following information:

- Federal tax ID, typically called the EIN, issued by the IRS

- Knowledge of your business entity structure

- Business owner information

- Start date with the state of New York

- Your estimated yearly tax liability with New York

Applying for your Certificate of Authority with the State of New York is a two-step process.

Start by following thislink.

You will select New Users, Register Here.

You will then be redirected to a different site in order to create your online profile. Once you have created your profile, you can then go back to .

You will select Get started and follow the prompts to apply for your Certificate of Authority with New York.

What Happens After You Apply for a Sales Tax Permit in New York?

You should receive your Certificate of Authority in the mail within 7-10 business.

You will also receive a PIN number in the mail that will help you access your online account. Once you receive that PIN number letter, please create your account at

Select Login and follow the prompts.

**Please note that New York quarterly filing frequencies are different than most states. The reporting periods covered by quarterly returns are March 1 through May 31, June 1 through August 31, September 1 through November 30, and December 1 through February 28/29.

Are There Annual Filings Required To Keep Your Tax Exemptions In New York State

The New York State Department of Taxation has no annual requirements, but you must report to the department any changes to your organization that affect your tax status. NYCity Department of Finance requires an annual NYC-245 filed by March 15th each year with no filing fee.

Note: Due to the bureaucracy and complicated nature of forming a nonprofit corporation in the state of New York, Northwest does not offer incorporation services for NY nonprofits. We do, however, provide helpful information to help you form a NY nonprofit yourself, and we are happy to provide trustworthy, gimmick-free registered agent service for your non-profit.

Read Also: Nyc Wax Museum Hours

What Are The Requirements For A New York Tax Status Compliance Certificate

In order to be in Good Standing a New York Corporation or LLC must be in compliance with the following:

- The Foreign or Domestic company must be registered as a legal entity with the New York Secretary of State

- The New York company cannot be in default or suspended as defined by the state of New York

- The New York company must have paid all required New York state taxes, penalties and fees

Dont Get Caught Holding The Bag

Sales tax.no one likes collecting it and no one likes paying it. How many times have you heard a business owner say but if you pay me cash How many times has a business owner said my customers wont agree to pay sales tax because the store next door is not charging it?

Weve all heard these arguments and complaints. Unfortunately, sales tax is a duty and responsibility of vendors and customers in New York State . Vendors who are required to collect sales tax are acting as agents of New York State and that responsibility needs to be taken very seriously. The consequences of mistakes or failures to remit the collected sales tax can be dire. Unfortunately, at Katz Chwat, P.C., we are generally only contacted once an audit has begun and a problem has been discovered. The first step to preventing the onerous penalties or balances due for taxes not collected is understanding by whom and in what situations sales tax must be collected. The worst conversation we have to have with a client is at the end of an audit, where, because of a misunderstanding of the sales tax rules they failed to collect sales tax from their customers and the New York Department of Taxation hands them a bill for the sales tax they should have collected. While the client would love to go back to their customers and ask for the tax, that is unfortunately not a realistic solution and instead their profit on the sale has been decreased by more than 8½ %.

Don’t Miss: Register Car In Ny

You Must Be Registered

If you have a business that is required to collect and remit sales tax in New York State, the NY Department of Taxation will require you to have a valid NYS Certificate of Authority .

Before you begin selling tangible items or services that are subject to sales tax in New York State, the State of New York requires that you must be registered with the NYS Tax Department of Taxation and Finance to collect sales tax.

The New York State Department of Taxation and Finance is the governmental agency that governs the collection and remittance of sales tax.

You cannot legally make taxable sales in the State of NY, collect sales tax, or issue exemption certificates until you receive your Certificate of Authority.

You must apply for a NYS Certificate of Authority at least 20 days prior to begin operating your business.

An exemption certificate is a form that a buyer will give to the seller so that there is a record as to why you did not collect the sales tax on a particular transaction.

To request a Certificate of Authority, you can apply online at the NYS Tax Department website.

If accepted, NYS will mail you a Certificate of Authority.

The Certificate of Authority must be displayed at your business.

If you have more than one location, each location requires its own Certificate of Authority.

Registered Sales Tax Vendor Lookup

Savewww7b.tax.ny.gov

Sales Tax Certificate New York

sales tax certificate new york provides a comprehensive and comprehensive pathway forstudents to see progress after the end of each module. With a team of extremelydedicated and quality lecturers, sales tax certificate new york will not only be a place to share knowledgebut also to help students get inspired to explore and discover many creative ideasfrom themselves.Clear and detailed training methods for each lesson will ensure thatstudents can acquire and apply knowledge into practice easily. The teaching tools ofsales tax certificate new york are guaranteed to be the most complete and intuitive.

Recommended Reading: How Many Tolls From Baltimore To New Jersey

New Certificate Of Authority Needed For Transfer Of Ownership And Organizational Changes

A Certificate of Authority cannot be transferred or assigned. If you are buying an existing business, or taking over the ownership of a family business, you must apply for your own Certificate of Authority. You cannot use the Certificate of Authority that we issued to the previous owner.

You must also apply for a new Certificate of Authority if you are changing the organizational structure of your business, such as switching from a sole proprietorship to a corporation. The new business must have its own Certificate of Authority before it begins business.

How Can Businesses Apply For An Nys Certificate Of Authority

When you register for the certificate of authority, you’ll receive a sales tax ID number from the NYS Department of Taxation and Finance. This can be done online through the state’s Business Wizard portal and should be completed 20 or more days before you begin making taxable sales in New York. Complete Form DTF-17, Application to Register for a Sales Tax Certificate of Authority, and the certificate will be mailed to you within five business days.

To complete this form, you’ll need to provide the name and purpose of your business, the reason for your application, your federal employer identification number , and related information. The form also asks for contact information, bank account information, and the date you plan to begin selling in New York. If you don’t already have an EIN, you can apply for one for free from the IRS. You’ll also need to provide the name of your registered agent. A registered agent receives service of process and legal documents on behalf of your business. The filing fee varies depending on the type of company you own and your desired processing time:

- Limited liability company , $275 for a one-week processing time.

- LLC, $475 for processing within one to two business days.

- Corporation, $250 for a one-week processing time.

- Corporation, $450 for processing within one to two business days.

- Non-profit organization, $160 for a one-week processing time.

- Non-profit organization, $360 for processing within one to two business days.

You May Like: Disability Application New York

S For Filling Out Form St

- Step 1 Begin by downloading the New York Resale Certificate Form ST-120 Step 2 Identify the name and business address of the sellerStep 3 Identify the name and business address of the buyerStep 4 If the retailer is expected to be purchasing items frequently from the seller, instead of completing a resale certificate for every invoice, the blanket certificate box can be checked. Otherwise, select single-use certificate. Step 5 Describe the purchasers type of business and the primary products soldStep 6 New York based vendors will enter their Certificate of Authority Number of the vendor in Part 1Step 7 New York based vendors will select whether the purchase being made is: Tangible personal property for resale or certain services A service for resale or Restaurant-type food, heated food, or heated drink for resale

Step 8 Out-of-state purchasers will enter their state of registration and sales tax ID number, in addition to the merchandise being purchased. Step 9 The purchaser will certify the property being purchased is for resale and sign and date the certificate.

The resale certificate is kept on file by the seller and is not filed with the state.

Why Do Businesses Filing For A New York State Certificate Of Authority

The most common occurrences that trigger the need for business registration in New York include the following:

- A new physical location in the state.

- A new employee who lives in the state.

- A new contract or job in the state.

- The requirement of a bank or vendor.

- The requirement of a state licensing authority.

You May Like: How Much Is The Wax Museum In Nyc

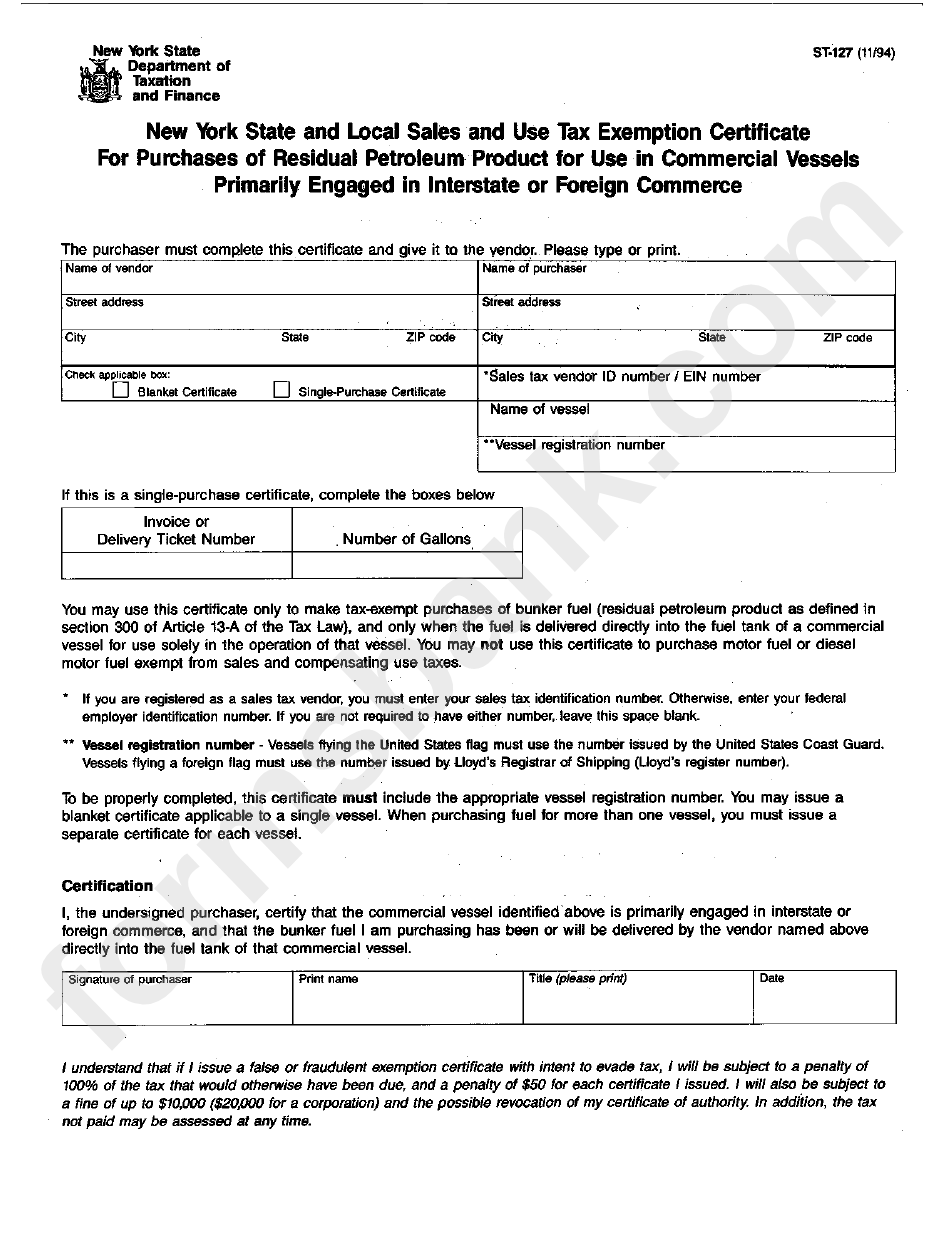

How To Use An Exemption Certificate

As a purchaser, you must use the correct exemption certificate, and complete it properly before giving it to the seller. The exemption certificate must include all the following:

- the date it was prepared

- the purchasers name and address

- the sellers name and address

- the identification number on the purchasers Certificate of Authority

- the purchasers signature, or an authorized representatives signature and

- any other information required by that particular certificate.

You must give the exemption certificate to the seller within 90 days after the date of the purchase. Otherwise, both you and the seller could be held liable for the sales tax.

Sellers have the right to refuse your exemption certificate, even if it is correct and properly completed. A seller that refuses your certificate must charge you sales tax. You may apply for a refund of the sales tax using Form AU-11, Application for Credit or Refund of Sales or Use Tax. For more information, see Tax Bulletins How to Apply for a Refund of Sales and Use Tax and Sales Tax Credits .

For a list of general sales tax exemption certificates, see the chart at the end of this bulletin. Other certificates are listed in Tax Bulletin Quick Reference Guide for Taxable and Exempt Property and Services .

How To Get A Resale Certificate In New York

Home » How to Start a Business in New York » How to get a Resale Certificate in New York

Quick Reference

When a business purchases inventory to resell, they can do so without paying sales tax. In order to do so, the retailer will need to provide a New York Resale Certificate to their vendor.

Learn more about what a resale certificate is, how to get one, and more.

Quick Reference

You May Like: Erase New York

How Do I Get A Nys Sales Tax Exemption Certificate

Businesses can apply for certificates that exempt them from paying sales tax on certain items. These certificates are issued by the New York State Department of Taxation and Finance . Businesses complete the certificate, and provide it to the vendor. The vendor keeps the certificate and makes a sale without tax.

Is A Resale Certificate The Same As A Sales Tax Id

The Sales Tax Certificate of Authority and Resale Certificate are commonly thought of as the same thing, but they are actually two separate documents. The Sales Tax Certificate of Authority allows a business to sell and collect sales tax from taxable products and services in the state, while the Resale Certificate allows the retailer to make tax-exempt purchases for products they intend to resell.

After registering, a Certificate of Authority Number will be provided by the Department of Taxation and Finance. This number will be listed on the Resale Certificate.

Don’t Miss: What Do U Need To Register A Car In Ny

Who May Use Exemption Certificates

You may use an exemption certificate if, as a purchaser:

- you intend to resell the property or service

- you intend to use the property or service for a purpose that is exempt from sales tax or

- you make purchases as an agent or employee of tax-exempt nonprofit organizations or government entities.

In some cases, you must also have a valid Certificate of Authority to use an exemption certificate . Note that many exemption certificates are very specific about what type of purchaser may use the certificate see the certificates instructions for details.

Most sellers must have a valid Certificate of Authority in order to accept an exemption certificate. A properly completed exemption certificate accepted in good faith protects the seller from liability for the sales tax not collected from the purchaser.

Exemption certificates of other states or countries are not valid to claim exemption from New York State and local sales and use tax.