A Pllc Is Different From A Professional Corporation

A PLLC is not the same thing as a professional corporation . A PLLC is a newer type of business entity than a PC. Here are some of the key differences:

- a PLLC, like other LLCs, is comprised of members, but a PC, like other corporations, is comprised of shareholders

- following from the previous point, PLLC ownership consists of so-called membership interests in the business, but PC ownership is based on shares of stock and

- a PLLC, like other LLCs, is a so-called pass-through tax entity, meaning that in most states only the individual members have income tax obligations, while a PC, like other corporations, usually has its own income tax obligations.

The tax differences between PLLCs and PCs can become complicated. New York, unlike most other states, directly taxes LLCs through an annual filing fee. Moreover, a PC can elect a special tax status that effectively makes it a pass-through tax entity like a PLLC. And, meanwhile, PCs that don’t elect special status may be subject to double taxationin other words, both the PC itself and its shareholders may have to pay taxes on business income.

New York allows professionals to form both PLLCs and PCs, and both PLLCs and PCs provide liability protection for, respectively, their members or shareholders. Because the protection is essentially the same for both PLLCs and PCs, but PLLCs are simpler to create and operate, many professionals prefer the PLLC structure.

New York Business Permits & Licenses

Does a New York LLC need business licenses and permits?

To operate your LLC in New York you must comply with federal, state, and local government regulations. For example, restaurants likely need health permits, building permits, signage permits, etc.

The details of business licenses and permits vary from state to state. Make sure you read carefully. Dont be surprised if there are short classes required as well.

Fees for New York business licenses and permits will vary depending on what sort of license you are seeking to obtain.

Always obtain the necessary New York business licenses and permits for your LLC here are some helpful links:

- Federal: Use the U.S. Small Business Administration guide to federal business licenses and permits.

- State: Apply for licenses, permits and register with The State of New Yorks License Center.

- Local: Chamber of Commerce and local business licenses and permits.

Choose A Registered Agent Vs Become One

There are many things to consider when selecting a registered agent service for your LLC.

If you choose to serve as your own and primarily do business from your home, your home address becomes tied to the business, which means that:

- Your home address becomes public information

- You may receive more marketing or junk mail from companies who purchase mailing lists from the Secretary of State

- In the event you are served legal papers, your family, friends, and neighbors may witness this, which can be embarrassing

- Anytime you move, you will have to update your address with the Secretary of State

LLCs that have not appointed a registered agent risk losing their status and the added asset protection that comes with owning an LLC. You may also miss tax and compliance deadlines or not know that your business is being sued.

This could result in added fines or legal consequences that negatively impact your business.

You May Like: How Much To Register A Car In Nys

Set Up An Accounting System

Setting up an accounting system for your business is one of the most important things you can do for your company to ensure long-term success.

There is just one problem youre not a numbers person.

Just thinking about financial statements, debits and credits, and accounting software makes your head hurt.

Staying on top of finances not only keeps the business on top of tax obligations, but financial statements can be used to track and monitor trends in the business and maximize profits.

Fortunately, understanding the numbers doesnt mean getting a finance degree. Tracking a businesss financials can be done with pen and paper , spreadsheets, accounting software, or hiring a bookkeeper.

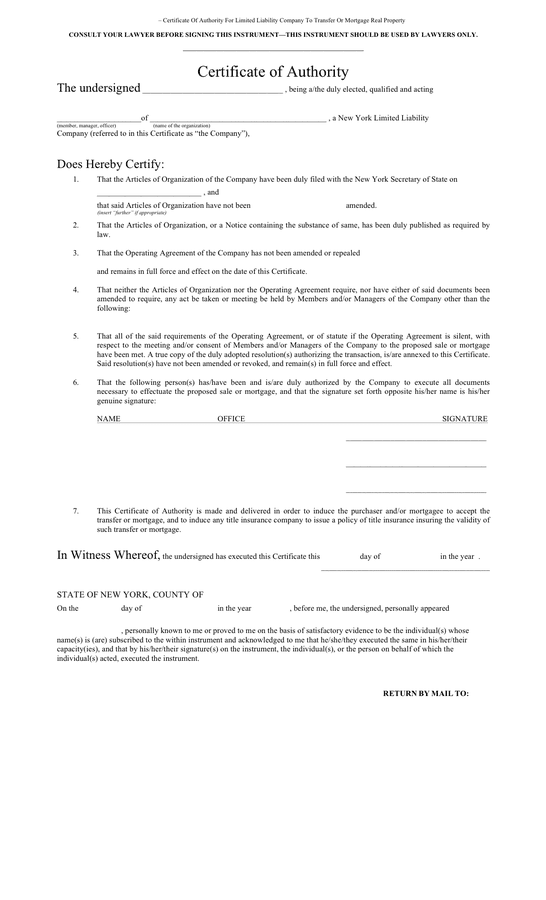

Regular Certificate Of Authority

You must apply for a regular Certificate of Authority if you will be making taxable sales from your home, a shop, a store, a cart, a stand, or any other facility from which you regularly conduct your business. It does not matter whether you own or rent the facility.

If you make sales at a show or entertainment event, such as a craft show, antique show, flea market, or sporting event, you must apply for a regular Certificate of Authority, even if your sales are only on an isolated or occasional basis. The department no longer issues the Certificate of Authority for Show and Entertainment Vendors that was previously issued for these vendors. See TSB-M-08S, Changes Regarding the Issuance of Certificates of Authority to Show and Entertainment Vendors.

Also Check: New York Times Paywall Smasher Browser Extension

Step : Create A New York Llc Operating Agreement

All New York LLCs are required to have an operating agreement. This may be a verbal or written agreement.

What is an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC.

Why are operating agreements important? A comprehensive operating agreement ensures that all business owners are on the same page and reduces the risk of future conflict.

For more information on operating agreements, read our New York LLC operating agreement guide.

Recommended: Download a template or create a Free Operating Agreement using our tool.

FAQ: Creating a New York LLC Operating Agreement

Do I need to file my operating agreement with the State of New York?

No. The operating agreement is an internal document that you should keep on file for future reference. However, many states like New York do legally require LLCs to have an operating agreement in place.

Publish Notice Of Llc Formation

NY state law requires you to publish a copy of your articles of organization or a notice of your LLC formation in two newspapers for six consecutive weeks within 120 days of your LLC formation.

- You have to publish your notice in newspapers approved by the NY county where your LLC is located. To find out which newspapers are acceptable, contact your county clerk.

- If you choose to publish a notice instead of your articles of organization, be sure the LLC name in the notice matches the Department of States records as set forth in your initial articles of organization.

- To get your notice published, contact the newspapers yourself or hire a third-party service to handle it for you.

- The newspapers will provide you with an affidavit of publicationâtheyll also charge a publication fee. NYC-based business may have to pay several thousand dollars due to steep publishing rates for NYC newspapers. To save money, you might choose a registered agent outside NYC so you can use that address as your LLCs office address. That way you could run your publication notice in a newspaper in that county, which likely has lower publishing rates.

Once youve fulfilled the publication requirement, youll need to submit a Certificate of Publication, along with a $50 filing fee, to the New York Department of State.

Don’t Miss: Register Car Online Ny

Penalties For Failing To Register For Sales Tax

If you are required to register for sales tax purposes but fail to do so and you operate a business without a valid Certificate of Authority, you will be subject to a penalty. The maximum penalty for operating a business without a valid Certificate of Authority is $10,000, imposed at the rate of up to $500 for the first day business is conducted without a valid Certificate of Authority, plus up to $200 per day for each day after. For more information, see Tax Bulletin Sales and Use Tax Penalties .

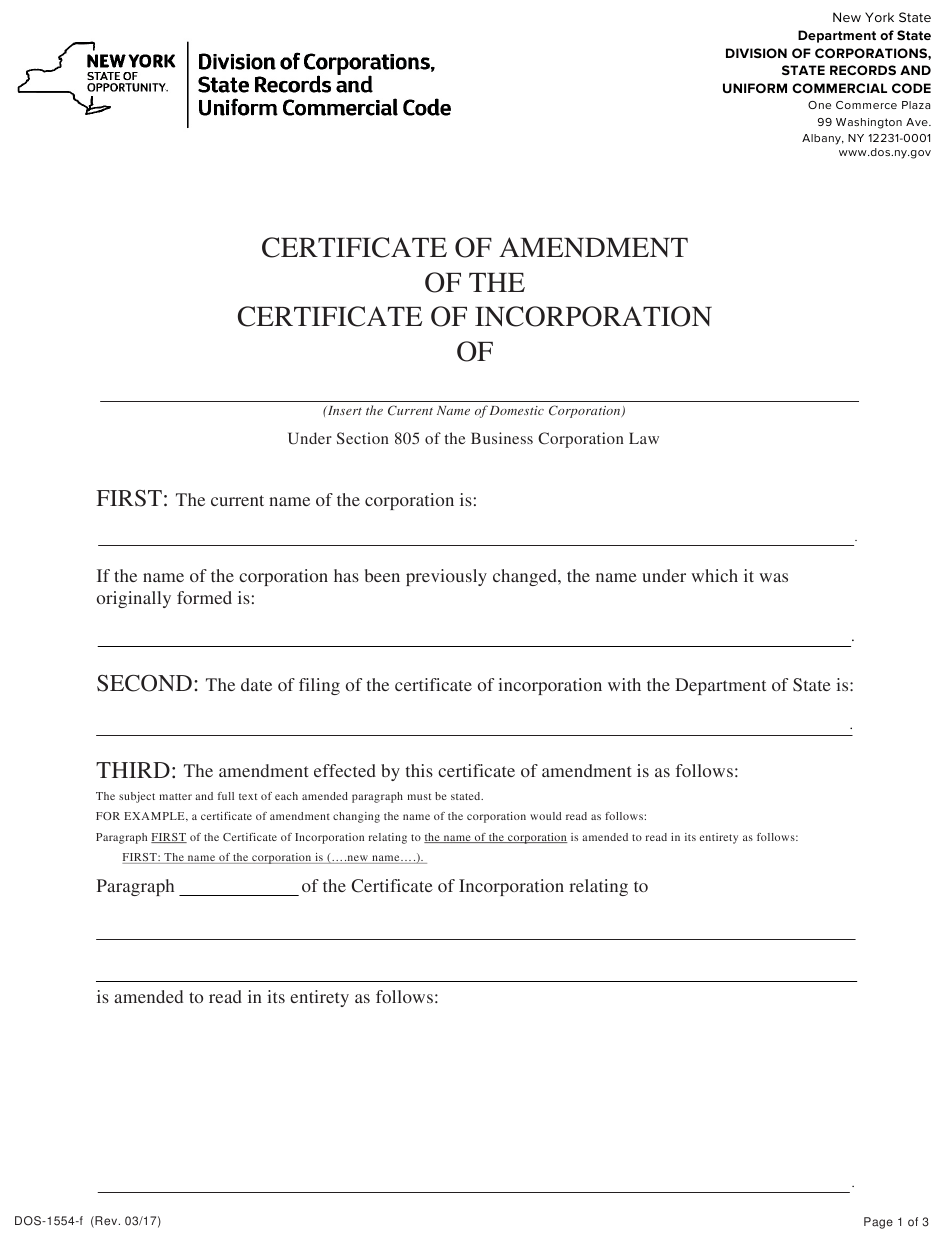

File Articles Of Organization In Ny

You can file online through the Department of States Division of Corporations website. Just type in your LLC name and get started. Some fields on the Articles of Organization are optional and some are required heres a quick rundown for how to fill it out. You can file online, by fax, in person, or by mail. However, the online form offers more options for shaping your LLC and makes it easier to add a registered agent.

This box should be checked if an organizer is completing the Articles of Organization. Anyone can be an organizer you, a fancy attorney, Jenny from the block, or a company like us.

Heres where you fill in your killer business name just make sure it isnt taken first. You can check the New York Department of States business database to make sure its available. Be careful not to use any of New Yorks restricted words . Youll also need to tack on either LLC, L.L.C., or Limited Liability Company to the end. If you have the perfect name but arent ready to pull the trigger on forming an LLC in NY, you can reserve the name for 60 days with the Application for Reservation of a Name .

You can check this box to include the purposes statement. The statement basically affirms that youre going to do business legally and that if you need a license or other permission, youll get it. Its an optional statement. Including it can be useful if youre planning on expanding into other states down the road.

Also Check: How To Submit A Poem To The New Yorker

Step : Create Your New York Llc Operating Agreement

All New York LLCs are required to have an operating agreement. This may be a verbal or written agreement. We would suggest a written agreement.

Explain an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC. this agreement outlines the company structure and the responsibilities there in.

Are operating agreements important? A comprehensive operating agreement ensures that all business owners are on the same page and reduces the risk of future conflict.

For more information on operating agreements, read our New York LLC operating agreement guide.

Filing Your New York LLC Operating Agreement

What are the state requirements?

The State of New York requires every LLC to file an Operating Agreement, regardless of whether the company has one or multiple members. Your Operating Agreement LLC New York will outline the structure and purpose of your company as determined by your LLC members and will bind all the members of your LLC

Create An Operating Agreement For Your New York Llc

Not all states require you to have an operating agreement, but in New York it is part of the LLC formation requirements. This could be either written or verbal.

What is an operating agreement?

This is a legal agreement that outlines the operating procedures and ownership of an LLC. By having an operating agreement, it may prevent conflict in the future, as all the owners of the business know where they stand, as everything is clear and outlined in the document. For example, if your LLC has more than one owner and gets dissolved, the operating agreement will show how all the assets will be distributed.

- .

You can either create your own operating agreement if you feel comfortable doing so, or you can use one of the pre-made operating agreement templates that are available online, which may incur a small fee. Alternatively, if you are using an LLC formation service, depending on the package that you go with, some packages offer an LLC operating agreement, taking the stress off you. If you hire an attorney, they can either write your LLC for you, or look over it once you have completed it to make sure it includes all the necessary information.

Read Also: New York Times Short Story Submission

Register A Foreign Llc In New York

Entrepreneurs often form an LLC in a state other than the state of their residence to have some tax benefits and reduce LLC formation cost. Moreover, some business owners have their LLC franchises in multiple states. In such cases, they register their LLCs or franchises as foreign LLC in all states where they operate their business.

If you have an LLC in any other state and wish to open a franchise in New York or want to form an LLC in New York while you are a non-New York resident, you can form a foreign LLC by and send it to:

Mailing Address

Publish Notices Regarding Your Llc

You have 120 days from the time your articles of organization are effective to publish that your LLC has been established in two newspapers for six consecutive weeks. The articles of organization can be published for this purpose or a notice related to the formation of the LLC. Check with the county clerk in the county where your business is established to determine what two newspapers will be sufficient. Once both newspapers have published, you will need to file a Certificate of Publication with the New York Department of State, Division of Corporations, along with affidavits from both newspapers. This paperwork must be filed with the Division of Corporations. The fee for filing a certificate of publication is $50. If you dont publish and file the Certificate of Publication within 120 days, it could lead to the suspension of the LLCs authority to conduct business.

You May Like: How To Win The Lottery In Ny

Step : Comply With New York Llc Publication Requirements

What is the New York LLC publication requirement? New York requires that within 120 days of formation all LLCs publish a copy of the Articles of Organization or a notice related to the formation of the LLC in two newspapers .

Can I pick any newspapers I want? No. The newspapers must be approved by the local county clerk of the county you designate in your Articles of Organization. After publication, the printer or publisher of each newspaper will provide you with an affidavit of publication.

Where do I file my Certificate of Publication? Submit your Certificate of Publication along with your affidavits of publication to:New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

FILE CERTIFICATE OF PUBLICATION WITH NEW YORK

File a Certificate of Publication with the New York Division of Corporations, State Records and Uniform Commercial Code.

New York City has fees upwards of $1500-$2000 for newspaper publishing. One way to save on fees is to designate a registered agent service thats located outside of the city.

Fee: $50 payable to the Department of State

File An Articles Of Organization

During the formation of an LLC in NY, its crucial to submit your articles of organization linked with the Secretary of its State. A general article should cover up the following:

Also Check: Csi New York Where To Watch

Obtain Your Ein And Register For Taxes

Before you can start conducting business in New York, you need to register with New York’s Tax Department. Its also a good idea to familiarize yourself with your state and local tax requirements, which may differ depending on the type of business youre running. For instance, businesses that sell physical products or perform certain services need to collect a sales tax and obtain a Certificate of Authority, and businesses in New York City are also subject to the citys business income and excise taxes. You can take a look at the states Department of Taxation and Finance website to read up on your tax obligations, but wed recommend talking to a professional who can break it all down for you in simpler English.

At this point, you should also apply for an EIN with the IRS, which youll need in order to file your businesss income tax return or payroll tax return. Youll also need an EIN to open a business bank account, apply for a business credit card, hire employees, and apply for a business loan down the line. The only exception here are sole proprietorships, who can use the owners social security number in lieu of an EIN.

File Articles Of Organization To The New York State

You will then need to file the Articles of Organization Form, also known as the DOS-1336 Form. This important document establishes your LLC as a separate legal entity and includes lots of information about your business.

- .

Filling out the form should be pretty self-explanatory, but you need to make sure you include signatures of all the LLC members, provide the information to show that the LLC name meets all the state requirements, an address in the state which can be reached should a suit be filed against the company, plus all the necessary fees. You will also need to state whether you are planning on starting a member-managed LLC or a manager-managed LLC.

Submitting the form costs a fee of $200 which can be paid in cash, check, money order or card. You can choose to either fill it out online which is available from the Department of State, or if you prefer, you can download, print it out, and then fill it out by hand. If you are filling it out by hand, be sure to use a black pen and clean white paper, so that it can be filed correctly.

Read Also: Dc To New York Tolls

Choose A Unique Business Name And Complete A New York Business Search

You’ll need a distinctive and original name for your New York LLC thats not being used by any other business in the state. Our Business Name Generator can help you brainstorm names if you’re having trouble coming up with a good one. First, read up on the state’s naming rules in the New York Business Names section of this guide.Once you’ve chosen a name, make sure it’s available in the state by using our free tool to do a New York entity search. You can also perform a search on the NYS Department of State website.