How Do I Apply

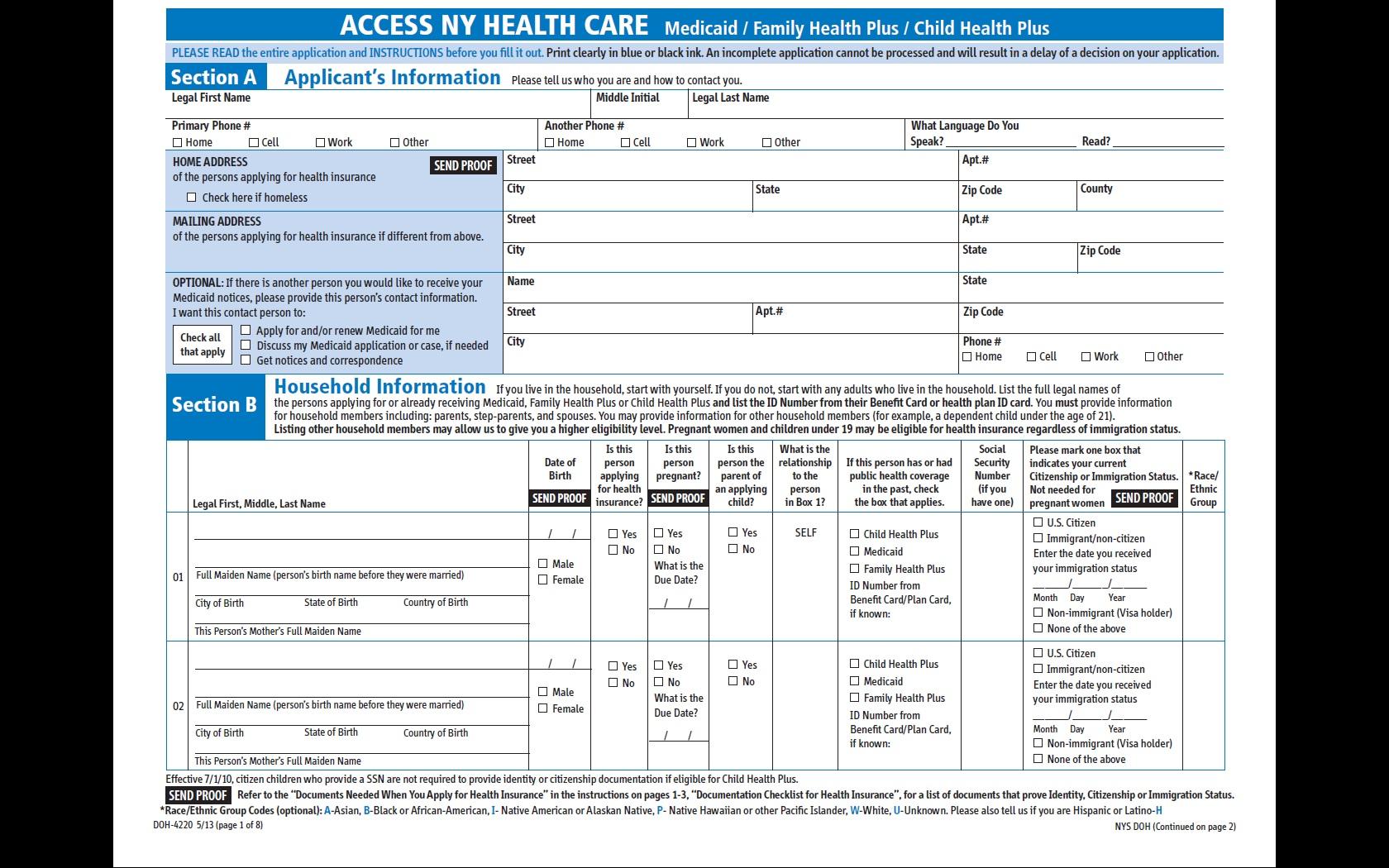

If you apply at one of our Department of Community and Family Services locations, you will need the following documents:

- If you are a U.S. citizen and provide a valid Social Security Number , a match with the Social Security Administration will verify your SSN, date of birth, and U.S. citizenship. If SSA verifies this information, no further proof is needed. The SSA match cannot verify birth information for a naturalized citizen. You will need to submit proof of naturalization or a U.S. passport.

- Proof of citizenship or immigration status.

- Proof of age , like a birth certificate.

- Four weeks of recent paycheck stubs .

- Proof of all your income including sources like Social Security, Veteranâs Benefits , retirement benefits, Unemployment Insurance Benefits , Child Support payments.

- If you are age 65 or older, or certified blind or disabled, and applying for nursing home care waivered services, or other community based long term care services, you need to provide information of all bank accounts, insurance policies and all other resources.

- Proof of where you live, such as a rent receipt, landlord statement, mortgage statement, current utility bill or envelope from mail you received recently.

- Copy of insurance benefit cards .

- Copy of Medicare Benefit Card .

Note: Medicaid coverage is available, regardless of alien status, if you are pregnant or require treatment for an emergency medical condition and you meet all other Medicaid eligibility requirements.

How Did The New York State 2020

The budgetary changes that have been implemented have the potential to severely disrupt the lives of senior citizens and disabled people living in New York State. For those who wish to age in place and remain in their homes and communities while protecting their assets, careful planning will now be required.

In summary, Community Medicaid is an invaluable program for senior citizens and disabled people who require assistance with activities of daily living but who dont require the level of care that a skilled nursing facility provides.

About the author, Carlos Nath:

Carlos Nath is the Senior Trust Advisor with KTS Pooled Trust. As a seasoned professional with over four years of experience in the New York pooled trust space, Carlos has helped thousands to enroll and set up their accounts with KTS. He is proficient in understanding the Medicare process and provides assistance in clarifying what clients may need. Previously, Carlos worked with a Medicaid consulting firm as an advisor who helped clients who were seeking Medicaid assistance.

Will The State Take My Home If I Need Medicaid To Pay For My Care In New York

Sponsored Answer Email

Not if you have done asset preservation planning. The state never takes your home. However, ownership without proper planning may result in a forced sale if Medicaid demands reimbursement after death. Medicaid may also impose a lien during your lifetime if it is paying for nursing home care. Fortunately, these scenarios are avoidable by undertaking asset protection planning with a reputable elder law attorney. Elder law attorneys are best suited to establish viable long-term health care plans and achieve Medicaid eligibility while preserving assets for the benefit of the applicant or his or her heirs.

Unless you have purchased a long-term care policy, the only health care insurance that pays for long-term care is Medicaid. In New York, an applicant for Medicaid cannot own more than approximately $16,000 in assets. While the Medicaid recipient is living in his or her home, it will be exempt. This is known as Community Medicaid, where aides are provided at no cost to the applicant. However, if the home remains in the name of the patient, Medicaid will seek to recover after death. Elder law attorneys can discuss strategies, such as the use of a trust, to avoid such an outcome. New Yorks Community Medicaid eligibility rules are set to change April 1, 2021. The advance notice of these changes is affording clients an opportunity to employ strategies that will no longer be available after April.

Don’t Miss: Nys Car Registration Cost

Trusts Established By The Medicaid Applicant

OBRA 93 changed the rules regarding trust funds, imposing restrictions on Medicaid eligibility. Irrevocable income-only trusts are often used as a tool to protect assets of Medicaid applicants. These trusts typically provide that while income is distributed to the grantor, the trust principal cannot, under any circumstances, be distributed to the grantor. HCFA interpreted OBRA 93 to mean that in such cases the income and not the principal will be deemed available to the applicant. If a trust provides that principal can be paid to the grantor, even if only for a limited purpose, or even at the sole discretion of the trustee, then the entire principal of the trust will be deemed available to the grantor because there is a circumstance under which some principal could be paid, even if it is a remote one. In such a case, Medicaid eligibility will be denied to the grantor for excess resources.

As previously mentioned, if an applicant has transferred assets to or from certain trusts, including asset transfers to an irrevocable income only trust, the look back period will be sixty months, even for transfers prior to February 8, 2006.

Unitedhealthcare Senior Care Options Plan

UnitedHealthcare SCO is a Coordinated Care plan with a Medicare contract and a contract with the Commonwealth of Massachusetts Medicaid program. Enrollment in the plan depends on the plans contract renewal with Medicare. This plan is a voluntary program that is available to anyone 65 and older who qualifies for MassHealth Standard and Original Medicare. If you have MassHealth Standard, but you do not qualify for Original Medicare, you may still be eligible to enroll in our MassHealth Senior Care Option plan and receive all of your MassHealth benefits through our SCO program.

You May Like: What Time Is Shabbos In New York

When Is Medicaid Estate Recovery In New York Prohibited

There are instances that Medicaid estate recovery is not allowed, these are:

Do I Have To Reapply For Medicaid Every Year

Yes, you will have to reapply for Medicaid every year. However, unless your financial or life situation has changed, the renewal application process is usually significantly simpler and takes less time than the initial Medicaid application. Because Medicaid is a government funded health insurance program with strict rules regarding who is eligible and who is not, itâs important that all recipients reapply on a yearly basis to alert authorities to changes in their financial situation. Thus, each year, you will have to review whether or not you are eligible and, if you are eligible, youâll have to provide all the necessary documentation to reapply for Medicaid.

Most Medicaid recipients receive a packet in the mail each year with all the information they need to be able to re-enroll in the Medicaid program and obtain a new CBIC card. If you no longer qualify for Medicaid, you will receive a rejection letter in the mail informing you that you are no longer eligible and will not be receiving a new Medicaid card and coverage for the coming year. Always remember to keep your current address updated with the Medicaid office because Medicaid will only send mail to the address on file. Medicaid documents cannot be forwarded to a new address. So, if you move to a new house or apartment, make sure to update your address so that you will receive the documents you need to reapply in the coming year.

Read Also: Wax Museum New York Tickets

Unitedhealthcare Connected Benefit Disclaimer

This is not a complete list. The benefit information is a brief summary, not a complete description of benefits. For more information contact the plan or read the Member Handbook. Limitations, copays and restrictions may apply. For more information, call UnitedHealthcare Connected® Member Services or read the UnitedHealthcare Connected® Member Handbook. Benefits, List of Covered Drugs, pharmacy and provider networks and/or copayments may change from time to time throughout the year and on January 1 of each year.

You can get this document for free in other formats, such as large print, braille, or audio. Call , TTY 711, 8 a.m. – 8 p.m., local time, Monday – Friday . The call is free.

You can call Member Services and ask us to make a note in our system that you would like materials in Spanish, large print, braille, or audio now and in the future.

Language Line is available for all in-network providers.

Puede obtener este documento de forma gratuita en otros formatos, como letra de imprenta grande, braille o audio. Llame al , TTY 711, de 08:00 a. m. a 08:00 p. m., hora local, de lunes a viernes correo de voz disponible las 24 horas del día,/los 7 días de la semana). La llamada es gratuita.

Puede llamar a Servicios para Miembros y pedirnos que registremos en nuestro sistema que le gustaría recibir documentos en español, en letra de imprenta grande, braille o audio, ahora y en el futuro.

Los servicios Language Line están disponibles para todos los proveedores dentro de la red.

Independent Review Panel Or Independent Medical Review

The law authorizes DOH to adopt standards, by emergency regulation, for extra review of individuals whose need for such services exceeds a specified level to be determined by DOH.” DOH’s proposed regulations draw this line at those needing more than 12 hours/day of home care on average. The assessor will review whether the consumer, with the provision of such services is capable of safely remaining in the community in accordance with the standards set forth in Olmstead v. LC by Zimring, 527 US 581 and consider whether an individual is capable of safely remaining in the community. . Again, this is a panel run by New York Medicaid Choice.

See filed March 13, 2021 on the proposed state regulations for more concerns about these assessments. The final regulations effective Nov. 8, 2021 posted here. make no material changes from these proposals.

Read Also: Flights New York To Italy

Access To Home Care Services Will Be Limited And Require More Hoops To Jump Through

Final state regulations were posted on the NYS DOH website on August 31, 2021 published in the NYS Register on Sept. 8, 2021. Direct link to regulation is here. The regulations have an effective date of Nov. 8, 2021, but they will not all be implemented on that date. DOH’s announcement about the regulations said that the “Independent Assessor” procedures will be implemented before the new Minimum ADL restrictions on eligibility for PCS and CDPAP.

to see the earlier version of the regulations when proposed, DOH requests to CMS to approve these changes, along with NYLAG’s comments on these proposals.

|

Eligibility for Personal care and CDPAP services and enrollment in MLTC will now require the need for assistance for THREE Activities of Daily Living or dementia. They must be prescribed by an independent physician under contract with DOH, and approved by an independent assessor under contract with DOH instead of the local district Medicaid agency and MLTC plan. Current recipients will be grandfathered in. |

If You Are A New York Resident Medicaid May Pay For Your Stay In An Assisted Living Facility That Qualifies As An Assisted Living Program

For those who qualify financially, New York’s Medicaid program will pay for long-term care for elderly or disabled folks who require a certain level of medical care and personal care. In this part of the article we’ll discuss Medicaid coverage of assisted living facilities and home health care services.

Read Also: Tolls Between Nyc And Dc

Until When Will Medicaid Estate Recovery In New York Be Deferred

Medicaid estate recovery will be deferred only until:

- The death of the dependent, heir, or survivor or

- The sale, refinance, transfer or change in title of the real property or

- The determination by the Medicaid program that the dependent, heir, or survivor is in breach of the repayment agreement.

So to answer the title question, is Medicaid truly free? the answer is no, not at all. Knowing why and how Medicaid estate recovery can affect your properties and possibly the lives of your survivors could help you mitigate future inconvenience that you may leave behind. Talk to us to see how we can help you.

Have a Question About our Services?

Community Medicaid In New York State

New York finally adopted several regulations that imposed a major change in Medicaid eligibility. These regulations also introduced a look-back period into New Yorks states Medicaid program.

A 30-month look-back provision gives the state the power to review the financial statements of anyone who is applying for home health care, private nurses, and other kinds of assisted living. By looking back at these records during the time period prior to their Medicaid application, the state can limit applicants eligibility.

Learn more about these changes if youre planning to apply for Medicaid. Let our trusted attorney assist you with your Medicaid application.

How to Stay at home and protect your assets and income

In New York, the Community Based Medicaid program will pay for the cost of a home health aide. When applying, the local department of social services considered the applicants income and assets and whether the Medicaid applicant requires the assistance with the activities of daily living. The following is a breakdown of how DSS evaluates each for a New York Community Medicaid application.

Activities of Daily Living

Income

Most of those who can stay at home will have expenses far exceeding the $787 limit. Medicaid understands this and allows for an exception. The often used exception is called a Pooled Income Trust.

Assets

Recommended Reading: New Yorker Poetry Submission

What Is Included In A Persons Estate

Under 18 NYCRR 360-7.11, for purposes of Medicaid estate recovery, a persons estate includes anything that they have legal title or interest in at the time of death. This includes real property , personal property , and other assets that are passed to heirs with or without a will. To the extent of a persons interest immediately prior to death, the estate includes assets conveyed to a survivor, heir or assign through a joint tenancy, tenancy in common, survivorship, life estate, living trust or other arrangements. It also includes jointly owned financial institution accounts, jointly held real property, life estate interests, interests in certain trusts and annuities regardless of whether there is a named beneficiary or right of survivorship.

Medicare: Excellent Insurance But Without Further Help You Could Go Broke

Medicare Parts A & B Traditional Medicare

Medicare is a federal program available to persons who are sixty five years of age and older, and disabled persons of any age who receive Social Security Disability benefits. Basically, it is the health insurance component of Social Security. Medicare Part A covers hospital and limited amounts of skilled nursing and home health care. Medicare Part B is optional and covers part of physicians costs and other medical services and supplies. Medicare is the most cost-effective health insurance a senior citizen can buy! Everyone eligible should have Medicare coverage and take the optional Part B coverage at the earliest time allowable . Medicare, however, is far from perfect it is in fact a safety net with many holes. Medicare has certain deductibles, limited payment periods, and restrictions on the types of services covered. Two of the most severe restrictions are that it only covers nursing home care if it is skilled rather than custodial care, and it covers only 100 days of nursing home care per spell of illness. A spell of illness begins with the first day of inpatient care in a hospital or nursing home and ends when the beneficiary has been hospital and nursing home free for 60 consecutive days. Recipients of Medicare Parts A and B should have a supplemental Medigap policy .

Medicare Part C

Medicare Part D

Also Check: How To Submit To The New York Times

Establishing A Need For Services

Third, although persons over the age of sixty-five are presumptively disabled for the purpose of Medicaid eligibility, the applicants must show that they require assistance with their activities of daily living . Some examples of activities of daily living include dressing, bathing, toileting, ambulating and feeding. Community Medicaid will not provide care services where the only need is supervisory therefore, it is important to establish an assistive need with the tasks listed above. For some clients, this is not a difficult threshold to reach. However, for many of our clients, when we first inquire as to whether the individual in need of care requires assistance with these tasks the answer is no. However, after further discussions it becomes clear that they do in fact require assistance with many of these activities. This discrepancy lies in the fact that in order to establish need, the applicants need only show that they are unable to complete these tasks unassisted. It is not necessary that there be a showing that they are unable to manage any part of the task, only that they need some level of help.