Quarterly Filing Due Dates

Every employer must file reporting forms even if the employer had no payroll in the quarter. Late payment of contributions results in interest assessments and may increase your UI rate in future years.

Note: You may file on the next business day when the due date falls on a Saturday, Sunday or legal holiday.

Next Section

Mandatory Electronic Filing

There are three methods to electronically file your NYS-45 information:

- Web File You can file your quarterly return information and make payments using the Web File application. Learn more about Web File.

- Web Upload The fastest and easiest way to file your quarterly return information and make payments. Learn more about Web Upload.

- FSET-compatible software Some commercially available software allows you to use the FSET program to file your quarterly return information. See which software programs are compatible with FSET.

Next Section

Remuneration includes every form of compensation you pay to covered employees, including:

- Salary

- The value of meals and lodging

- Bonuses

- Other types of non-cash compensation

Employers are required to pay Unemployment Insurance contributions on remuneration paid to each employee in a calendar year up to the UI wage base. On January 1, 2014, several provisions of the recent UI reform legislation will go into effect. These provisions affect the UI wage base. The UI wage base will adjust January 1st of each year as follows:

Also included in the calculation of the UI wage base are wages paid:

New York State Urges Residents To E

BUFFALO, N.Y. New York State residents can receive any potential tax refunds by up to two weeks by e-filing their return and choosing direct deposit.

The state is touting the e-file approach this tax season, saying it’s “safer, faster, and more efficient” than paper returns.

“Combining the power of electronic filing and direct deposit is the most secure and efficient way to submit your tax return and receive any refund due,” New York State Commissioner of Taxation and Finance Michael Schmidt said Wednesday in a statement.

“We strive to issue refunds as quickly as possible, and you can help by filing an accurate return and choosing to have your refund directly deposited into your bank account.”

If you do file by mail, the state encourages residents to make sure the address is correct. Any errors could delay potential refunds.

The state also has made available software on its website where residents can prepare and file their taxes for free. The state says 255,000 New York taxpayers used the software last spring.

Why Would Nys Tax Send A Certified Letter

If you received an IRS certified letter, it usually means one of three things: you are being audited you are going to levied or a federal tax lien is being filed against you. A certified letter from the IRS of NY Tax Department may afford you certain rights under strict timelines.

Also Check: Submit Poetry To New Yorker

Use Of Technology To Track Days

Given the effort and pain associated with keeping records to prove how many days an individual has spent in a given jurisdiction, it may make sense to use technology to automate the process.

Monaeo, for example, has designed software to track the days spent in relevant jurisdictions. Monaeo uses the GPS on a mobile device to do this while protecting the individuals privacy. Monaeo has designed its software to:

- Issue a warning when a user is close to a limitation that may create residency in a specific jurisdiction, such as 183 days in New York

- Automatically generate a third-party record of locations, which may help defend the taxpayer in the event of an audit

How To File Your Taxes

Its important to have your documents in order when preparing to file your taxes in 2022. And IRS.gov has a full list of what you will need prior to filing your return.

Organized tax records can make the process of preparing a complete and accurate tax return easier because you can avoid errors that lead to processing delays with your tax refund.

- Form 1099-INT if you were paid interest

- Other income documents and records of virtual currency transactions

- Form 1095-A, Health Insurance Marketplace Statement, to reconcile advance premium tax credits for Marketplace coverage

- Letter 6419, 2021 Total Advance Child Tax Credit Payments to reconcile your advance Child Tax Credit payments

- Letter 6475, Your 2021 Economic Impact Payment, to determine whether you’re eligible to claim the recovery rebate credit.

Moreover, it’s important to inform the IRS if your address has changed and to notify Social Security Administration of a legal name change.

According to the IRS, most income is taxable and it includes unemployment income, refund interest, and virtual currencies.

Additionally, the IRS has a Free File Program, a free service that allows you to prepare and file your federal income tax online using guided tax preparation.

You May Like: Tolls From Dc To Nyc

How Is Domicile Determined

A domicile audit usually is concerned with change: Did the taxpayer move into or out of New York during the audit period? We are often looking to tie that change to a change in lifestyle or some life-changing event, like a marriage, retirement, new job, and so forth. And despite what many taxpayers and practitioners believe, the inquiry is not really focused on where the taxpayer is registered to vote, maintains a drivers license, or registers his cars. It is a much more subjective inquiry, based on long-standing common-law principles that are often difficult to apply. The general standard from the case law is that the test of intent with respect to a purported new domicile whether the place of habitation is the permanent home of a person, with the range of sentiment, feeling and permanent association with it.

Overall, though, the domicile inquiry has to do with a taxpayers feelings and intentions, which can be difficult to quantify. The nonresident audit guidelines that the Department has put together are of great value in assisting auditors in working through the issues that come up during a residency audit.

If You Had Us Income During 2020 You May Need To File A State Tax Return

State taxes may have different residency guidelines than US taxes. For a fee, you can use Sprintax to file your state taxes. There are two easy ways to access Sprintax:

You may need to file for every state you lived and/or worked in for 2020. Remember, you cannot electronically file your tax return if you’re using Sprintax and filing as a nonresident for US tax purposes.

NEW YORK STATE and CITY TAX

You must file a NY Tax Return if:

- You are a NY resident and you filed a US tax form for 2020 or

- You had NY income greater than $4,000 in 2020 or

- You want a refund of NY State or City taxes withheld from your paycheck in excess of what you actually owed.

NEW JERSEY STATE TAX

- International students, professors and scholars are considered non-residents for NJ state tax purposes unless they had a permanent home in NJ.

- Make sure to confirm your own tax residency to determine your tax filing status NJ state.

- Use the appropriate NJ tax form:

- Either NJ resident tax form NJ-1040

- or NJ nonresident tax form NJ-1040NR.

Recommended Reading: New York Times Travel Submissions

If You Owe Taxes In New York Its Important To Know What Your Filing Options Are As Well As What Types Of Deductions And Credits You Can Claim

Thats especially the case if you live in New York City or Yonkers, where there may be other tax considerations to keep in mind. In this guide, youll learn all that and more, including what happens if you cant pay your bill and how to track a New York state tax refund.

How To File Your New York State Tax

If your income meets certain limitations , you may be able to use IRS Free File to file your federal and New York state income tax returns. If your income exceeds limits, you wont be able to file for free using IRS Free File software. You may still be able to use IRS Free File Fillable Forms. Or, you can use an online tax-preparation service or a professional tax preparer.

offers free federal and single-state tax filing.

If you want to file a paper return, you can fill out the form online and print it out to submit it by mail. If youre expecting to receive a refund, send your paper return to

State Processing Center

If youre including a payment with your return, mail both to

State Processing CenterAlbany, NY 12212-5555

Recommended Reading: How Much In Tolls From Va To Ny

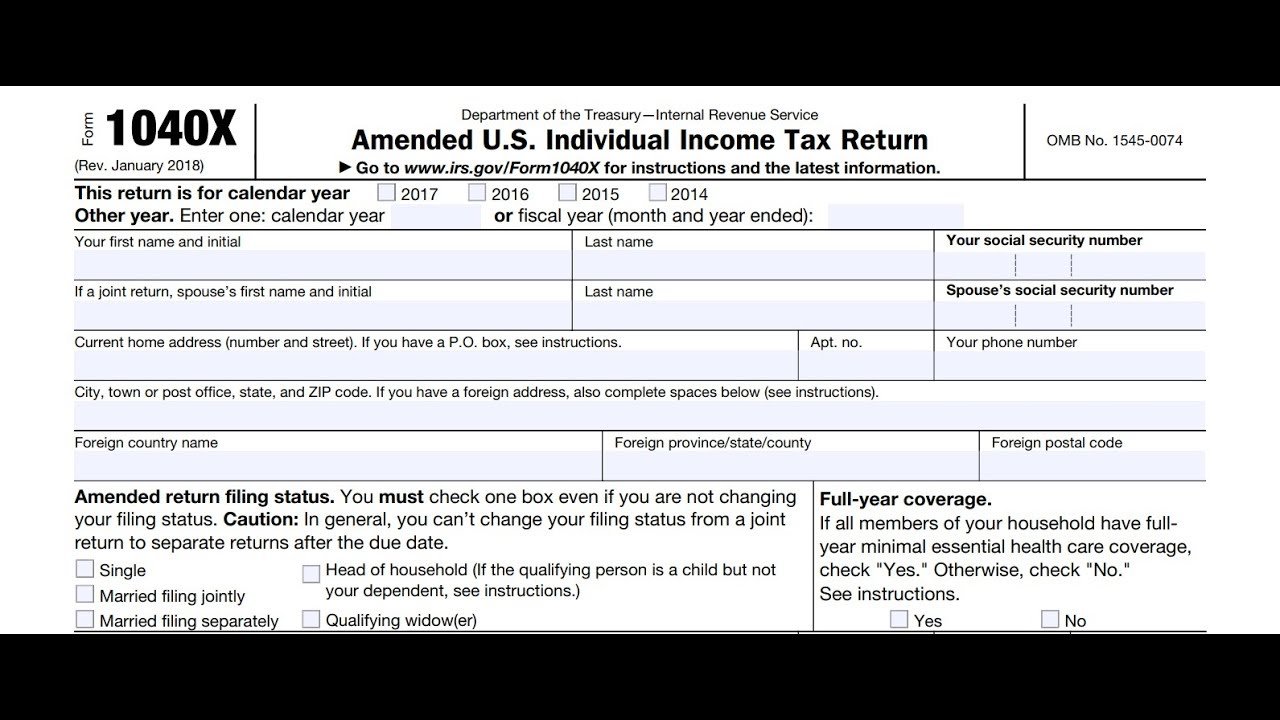

Tax Season 202: What You Need To Know About Filing Your Taxes

U.S. Department of the Treasury Internal Revenue Service 1040 Individual Income Tax forms.

WASHINGTON – Tax season is underway as millions of Americans are getting their documents together to file for their tax refunds. The Internal Revenue Service is encouraging people to file their taxes quickly, preferably through an electronic return.

The agency is understaffed and managing a massive backlog of unprocessed paper tax returns from the previous year.

But before you file your tax return, heres what you need to know.

Residency Status Information For New York Returns

Residents: A resident is an individual who is either domiciled in New York State or whose domicile is not New York State but they maintained a permanent place of abode in New York State for more than 11 months of the year and spent 184 days or more in New York State during the taxable year. There are exceptions to these rules, however. See “Nonresidents” below.

Part-year resident: You are a part-year resident if you meet the definition of resident or nonresident for only part of the year.

Nonresidents: A nonresident was not a resident of New York State for any part of the year. Additionally, an individual domiciled in New York State is not a resident if they meet all three of the conditions in either Group A or Group B as follows:

Group A

- They did not maintain any permanent place of abode in New York State during the taxable year and

- They maintained a permanent place of abode outside New York State during the entire taxable year and

- They spent 30 days or less in New York State during the taxable year.

Group B

New York City and Yonkers Residency – Residency in New York City and Yonkers is determined along the same lines as above. Thus, you can substitute “New York City” or “Yonkers” for “New York State” in the above descriptions.

Don’t Miss: How To Pay Speeding Ticket Online Ny

Taxpayers Have Until April 15 To File

NEW YORK, NY– With the deadline for filing tax returns rapidly approaching, the United States Postal Service reminds last-minute filers to pay special attention to collection box pick-up times and Post Office retail hours. Most Post Offices close at 5 p.m. and many collection box pick-up times are earlier. Post Office, Alternate Access locations that includes Self Service Shipping and Mailing Center having later business hours to send mail, and collection box location, hours, and pick-up time information is available at 1-800-ASK-USPS or online at www.usps.com.

Taxpayers can mail at the retail window services at the James A. Farley Main Post Office, 481 8th Ave in Manhattan until 12 midnight on April 15, Monday. Postal officials will be available in the lobby. Self Service Shipping and Mailing Center kiosks are also available 24/ 7 to ship packages and send mail. SSS& MC kiosks offer special services such as Express Mail, Priority Mail, Certified Mail with return receipt, purchase postage and many other self service transactions. All self service kiosk transactions provide a receipt that shows the date of the transaction. These kiosks help speed up your visit to the post office bypassing waiting in line at the retail window counter.

TIPS FOR MAILING TAX RETURNS:

Please remember that mail must be deposited before the last collection time at the post office collection box on April 15th to receive an April 15th postmark.

# # #

Follow the Postal Service on and at .

How Likely Is It That I Will Be Audited

Very likely. If you are a high-income taxpayer claiming a move into or out of New York, its a near certainty you will be audited. The Tax Department is sophisticated and aggressive. Consider some of the numbers:

- The tax department has ten district offices located across the State .

- There are more than 300auditors who focus on these

- Over the past five years, the Tax Department has conducted over 15,000 of these

- These audits have generated over $1 billion in revenue over this time

In short, there are a billion reasons why the New York Tax Department watches these issues carefully. If you claim a move from New York, expect to get audited.

Also Check: Nyc Public Arrest Records

General Tax Return Information

Due Date – Individual Returns – April 15, or same as IRS

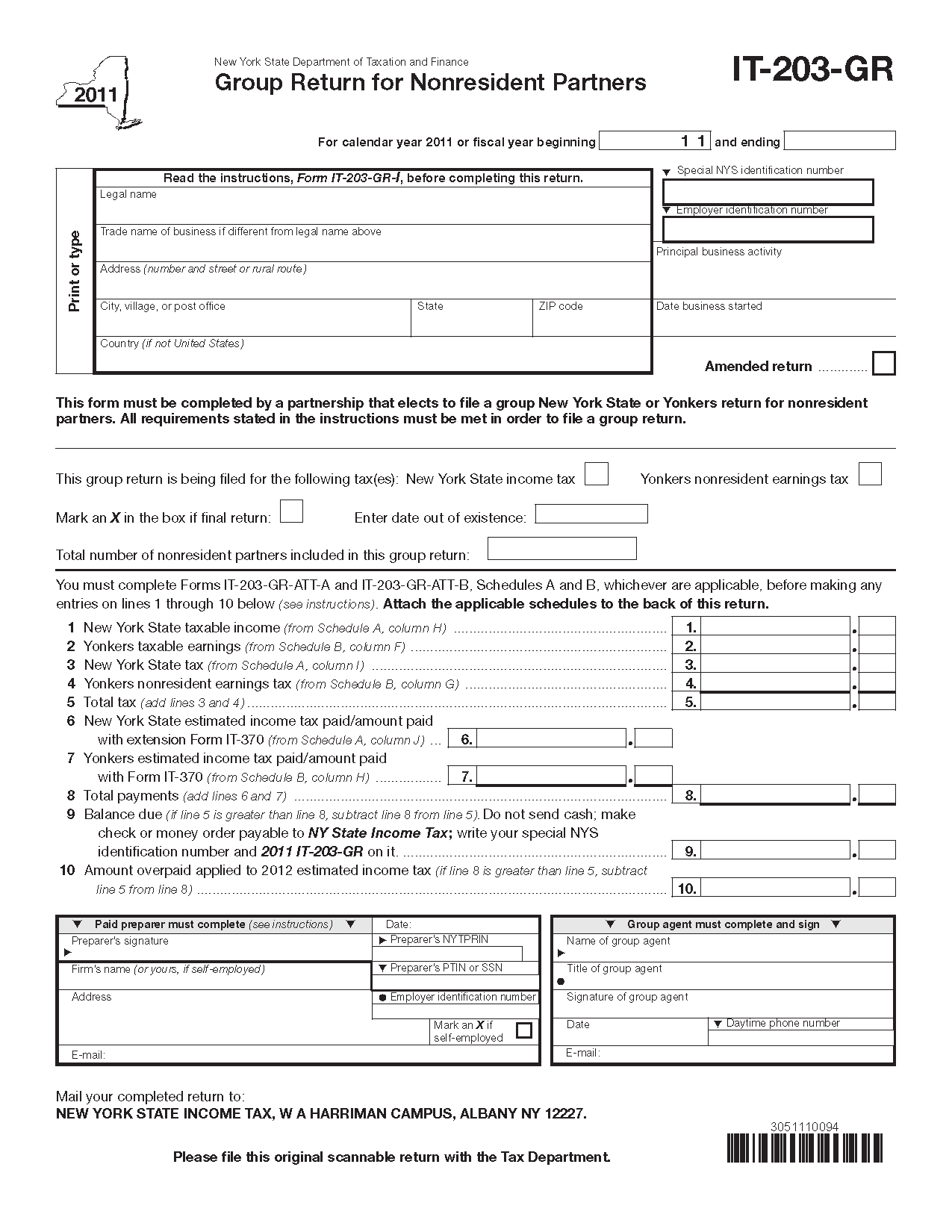

Extensions – The New York Tax Department does not accept federal Form 4868 in place of an NYS extension request using Form IT-370, Application for Automatic Extension of Time to File for Individuals. Form IT-370 must be filed on or before the filing deadline to receive a six month extension of time to file. Taxpayers must, however, make full payment of the properly estimated tax balance due when requesting extension of time to file.

Special filing deadlines:

- Taxpayers outside of the country with a Federal due date of June 15 can file their return or extension by June 15. If filing an extension, the return due date is extended four months to October 15.

- Nonresident aliens with a Federal due date of June 15 can file their return or extension by June 15. If filing an extension, the return due date is extended six months to December 15.

- A taxpayer who is not a nonresident alien and whose spouse dies within 30 days of the April 15 due date is given an additional three months to file their return or extension, and if filing an extension the return due date is October 15.

- A nonresident alien whose spouse dies within 30 days of the June 15 due date is given an additional three months to file their return or extension, and if filing an extension the return due date is December 15.

Are There Any Special Safe Harbors Against The Domicile Test

Yes, there are a couple, mainly to cover people who are still domiciled here but spend very little time in New York or the United States. They are:

- The 30-Day Test. This will apply to taxpayers who do not maintain a permanent place of abode in New York for any part of a tax year, do maintain a permanent place of abode outside of New York for all of the tax year, and spend no more than 30 days in New York during the tax year.

- The 548-Day Test. This will apply to taxpayers who are present in a foreign country on 450 days of any 548-day period are not present in New York for more than 90 days of the same 548-day period and whose presence in New York during any portion of the 548-day period that is less than a full year will be in the same proportion to the total number of days in the short period as 90 is to 548.

Don’t Miss: Wax Museums In Ny

Was Your Refund Less Than You Expected

Owing money to any New York state agency can result in your income tax refund being seized. If youre behind on child support or have unpaid restitution or court fees, your state refund taxes can be used to pay those debts.

Your tax refund may be less than you expected because you made an error on your tax return. The Department of Taxation will notify you of the changes made to your return. Review the information provided to ensure you agree with the changes made.

Do I Send My State And Federal Taxes To The Same Place

Do not mail the federal and state returns together in the same envelope! They do not go to the same place. When you print out your returns there should be instructions that tell you where to mail them. When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2s or any 1099s.

Also Check: How Much Are The Tolls From Virginia To New York

How Will The New York Audit Affect My Home State Tax Return

We may advise you to file a protective refund claim with your home state to keep its statute of limitations open until the New York audit is concluded. Then, some of the additional New York tax paid may be used to claim a credit from your home state for taxes paid to another state. This is not a dollar-for-dollar calculation and will be limited to the amount of tax you actually paid to that state on the New York income as well as that states rules with respect to allocation of income and other items.

New York Income Tax Rates

The state has a progressive tax rate thats based on your income level and where you live. Rates for 2019 ranged from 4% to 8.82%. You can check the most-recent tax rates on the New York State Department of Taxation and Finance website.

Note that if you live in New York City or Yonkers, youre required to include your local income tax from those cities on your state return.

Read Also: Thrush Poetry Submissions