What Types Of Plans Does The Ny State Of Health Offer

The exchange offers insurance plans at four different levels that at least meet the minimum requirements for insurance plans sold under the Affordable Care Act. Those tiered insurance plans are broken down into Metals bronze, silver, gold, and platinum level insurance plans. The plans are further broken into Healthy NY, HCTC Healthy NY, or Non-Group/Individual HMO/PSO.

How To Apply If In Ny City:

If you are in New York City, you can easily obtain applications from Human Resources Administration. You can also request information and applications on phone by calling at 718 557 1399.

NOTE: If you need any further assistance, you can call helpline at 693-6765.

Other requirements for applying

In order to apply for Medicaid, you will need to provide

- Proof of age

- Proof of citizenship

- If someone above 65 years of age, disabled or blind lives with you, you will need to provide proof of your income and resources

- Proof of your residence

- If you have any other insurance, you’ll be required to provide its proof and information about it

Medicaid Benefits

Medicaid provides a comprehensive coverage for various health services including

- Inpatient and outpatient services

- Home health care through approved agencies

- Access to smoking cessation agents

- Lab facilities and access to tests

- Eye, dental and mental health services

- Prescription drugs, medical supplies, and necessary medical equipment

- Transportation services

You Might Qualify For A Tax Credit

Depending on your income level, you might qualify for a tax credit when purchasing health insurance at the NY State of Health exchange. Those with annual incomes between 133 and 400 percent of the Federal Poverty Line will have their premium contributions capped at a maximum of 9.5 percent of their income when purchasing a Silver level plan.

For example, if your 2021 income is:

- Up to 133 percent of the FPL = your maximum premium contribution will be 2.07 % of your annual income

- 133-150 percent of the FPL = your maximum premium contribution will be 3.10 4.14 % of your annual income

- 150-200 percent of the FPL = your maximum premium contribution will be 4.14 6.52 % of your annual income

- 200-250 percent of the FPL = your maximum premium contribution will be 6.52 8.33 % of your annual income

- 250-300 percent of the FPL = your maximum premium contribution will be 8.33 9.83 % of your annual income

- 300-400 percent of the FPL = your maximum premium contribution will be 9.83 % of your annual income

Individuals in the 133 to 400 percent of the FPL range are also eligible for a premium tax credit. The premium tax credit is determined by subtracting the difference between the individuals maximum premium contribution and the unsubsidized cost of the second-lowest Silver level plan offered in an individuals geographic area. That amount is their premium tax credit.

Lets take a look at an example:

Also Check: Wax Museum Hours Nyc

What You Need To Know

Important Update: As of September 5, 2021, several federal unemployment benefit programs, including PUA, PEUC, EB, and FPUC, have expired, per federal law. For more information, visit dol.ny.gov/fedexp.

- To collect regular unemployment insurance benefits, you must be ready, willing, and able to work.

- Anyone calling from DOL will verify their identity by providing: the date you filed your application and the type of claim.

- You will receive all benefits you are entitled to, including any backdated payments you are due.

-

If you are eligible, your first payment will generally be made in two to three weeks from the time your claim is completed and processed. In some cases, we must get additional information before payment can be made and your first payment may take longer. We use this time to review and process your application for benefits. You will not receive benefits during this period. This is why you may see your claim status as pending.

- New Yorkers who are receiving Unemployment Insurance benefits are eligible for up to 26 weeks of benefits.

Next Section

Continue

How Much Do I Need To Pay If I Dont Want Health Insurance

Under the Affordable Care Act, everyone is mandated to have health insurance coverage.

Since 2019, the ACAs federal individual mandate penalty has been $0 and that will continue to be the case in 2021. People who are uninsured will not face a penalty unless theyre in a state that has its own mandate and penalty for non-compliance. However, in 2014 the fee for not having coverage was $95 for an individual or 1 percent of income, whichever was higher. In 2015 that penalty went up to $325 or 2 percent of income. Then, in 2016 the penalty increased to $695 or 2.5 percent of income. From 2017 to 2018, the increase in penalty was tied to an annual cost of living adjustment and based on inflation.

Read Also: Flights From Nyc To Cabo

Health Insurance Rate Changes In New York

Health insurance rates are determined by each insurer and are submitted for approval to the New York state exchange. For 2022, the largest cost increase occurred in Platinum plans, which rose in price by nearly 3%. That’s $29 per month more than the previous year.

| Metal tier |

|---|

Monthly premiums are for a 40-year-old adult.

Insurance Plans Sold Through The Ny State Of Health Insurance Marketplace Need To Cover Certain Essential Benefits

Any NY health insurance plan sold through the NY State of Health will need to include coverage for medical services in the following 10 categories under the Affordable Care Act legislation:

- Ambulatory patient services, such as doctors visits and outpatient services

- Emergency services

- Preventive and wellness services and chronic disease management

- Pediatric services, including oral and vision care

States will also play a role in determining which minimum essential benefits will be covered under the Affordable Care Act.

Recommended Reading: New York Speeding Ticket Pay Online

The Following Programs Were Available Prior To 2014 But Are Now Discontinued Because They Are Folded Into Magi Medicaid:

-

Prenatal Care Assistance Program was Medicaid for pregnant women and children under age 19, with higher income limits for pregnant woman and infants under one year than for children ages 1-18 .

-

Medicaid for adults between ages 21-65 who are not disabled and without children under 21 in the household. It was sometimes known as “S/CC” category for Singles and Childless Couples. This category had lower income limits than DAB/ADC-related, but had no asset limits. It did not allow “spend down” of excess income. This category has now been subsumed under the new MAGI adult group whose limit is now raised to 138% FPL.

-

Family Health Plus – this was an expansion of Medicaid to families with income up to 150% FPL and for childless adults up to 100% FPL. This has now been folded into the new MAGI adult group whose limit is 138% FPL. For applicants between 138%-150% FPL, they will be eligible for a new program where Medicaid will subsidize their purchase of Qualified Health Plans on the Exchange.

Caution: What Is Counted As Income May Not Be What You Think

For the NON-MAGI Disabled/Aged 65+/Blind, income will still be determined by the same rules as before, explained in this outline and these charts on income disregards. However, for the MAGI population – which is virtually everyone under age 65 who is not on Medicare – their income will now be determined under new rules, based on federal income tax concepts – called “Modifed Adjusted Gross Income” . There are good changes and bad changes.

GOOD: Veteran’s benefits, Workers compensation, and gifts from family or others no longer count as income.

BAD: There is no more “spousal” or parental refusal for this population and some other rules. For all of the rules see:

Also Check: Submit Poems To The New Yorker

The Marketplace In Your State

No matter what state you live in, you can enroll in affordable, quality health coverage.

Kentucky: For 2022 coverage, use Kynect to enroll

Starting October 1, 2021, Kentucky residents will no longer enroll in coverage through HealthCare.gov. Instead, theyll use Kynect.ky.gov. Enroll for 2022 as soon as November 1, 2021.

Continue using HealthCare.gov for 2021 coverage information.

Maine: For 2022 coverage, use CoverME to enroll

Starting October 1, 2021, Maine residents will no longer enroll in coverage through HealthCare.gov. Instead, theyll use CoverMe.gov. Enroll for 2022 as soon as November 1, 2021.

Continue using HealthCare.gov for 2021 coverage information.

New Mexico: For 2022 coverage, use beWellnm to enroll

Starting October 1, 2021, New Mexico residents will no longer enroll in coverage through HealthCare.gov. Instead, theyll use beWellnm.com. Enroll for 2022 as soon as November 1, 2021.

Continue using HealthCare.gov for 2021 coverage information.

Community Healthadvocates Can Help

www.communityhealthadvocates.org |

Helpline: 614-5400

Community Health Advocates is New Yorks statewide consumer assistance program. CHA provides information on, advice, and help solving health care and health insurance problems for consumers and small businesses.

CHA is in your neighborhood. CHA utilizes a toll-free hotline to provide help throughout the state.

CHA speaks your language. CHA provides services in 9 languages and has translation services for any who need it.

All CHA services are free. CHA provides quality services at no cost no matter what type of insurance you have, even if you dont have insurance. CHA can give you information and help you with things like finding a health plan, troubleshooting insurance problems, managing medical bills, or filing appeals.

Read Also: Can You Register A Car Online In Ny

Most Popular New York Benefits

New York Child Health Plus Healthcare

New York State offers Child Health Plus as a health insurance plan for kids. Depending on your family’s income, your child may be eligible to join either Child Health Plus A or Child Health Plus B. Both Child Heath Plus…

Head Start is a Federal program that promotes the school readiness of children from birth to age five from low-income families by enhancing their cognitive, social, and emotional development. Head Start programs provide a learning environment that su…

The Low-Income Home Energy Assistance Program is a federally funded energy assistance program. New York’s grant is allocated among the Office of Temporary and Disability Assistance for a heating benefit program, the state Division of …

Medicaid is a program for New Yorkers who can’t afford to pay for medical care. Medicaid pays for a number of services, but some may not be covered for you because of your age, financial circumstances, family situation, transfer of resource requireme…

The School Breakfast Program provides funding that makes it possible for schools to offer a nutritious breakfast to students each day. Similarly, the goal of the National School Lunch Program is to protect the health and well-being of the nati…

How Does This Affect My Healthy Ny Plan

On January 1st, 2014, Healthy NY ceased to provide care for individuals and solos, but rather only pursing small businesses. Its benefits will match the benefits of a Gold plan which could bring up the price.

Those individuals who were enrolled in a Healthy NY plan on March 23, 2010, when the Affordable Care Act was signed into law are eligible for grandfathered status. Individuals and sole proprietors not eligible for grandfathered status will be moved over to the exchange.

At the New York State Health Benefit Exchange, the equivalent health insurance coverage to the Healthy NY plans will be plans sold at the gold level.

Also Check: Wax Museum New York

The History Of Health Insurance In New York State

New York State has one of the countrys most progressive health insurance systems. Since 1990, New York State residents have enjoyed the benefits of community rating and guaranteed issue. These two laws are key components of the Affordable Care Act that went into effect on March 23rd, 2010.

Respectively community rating and guaranteed issue mean insurance companies cannot charge people more based on their background or medical history, and deny health insurance coverage to anyone for any reason.

These two laws have expanded health insurance coverage to many New Yorkers since their introduction more than 20 years ago. However, these two policies have also contributed to higher health insurance costs in the state.

Before the Affordable Care Act being enacted and allowing these two laws to now become a right for Americans, some experts thought health insurance rates nationwide would increase. By some estimates, premiums were said to rise by as much as 30 percent, according to a study released by the Society of Actuaries.

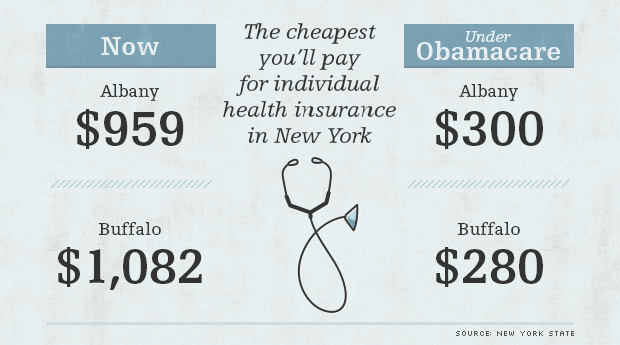

In New York. however, it was thought that health insurance rates could fall by as much as 14 percent when the rest of the Care Act was to take effect, according to the same study.

Again, before the Affordable Care Act, states that already have community rating and/or guaranteed issue laws on the books like Maine, Vermont, Massachusetts, and New Jersey thought theyd also see the same cost declining effect.

Should You Use A Rapid At

The two main types of COVID-19 tests are rapid antigen tests and PCR tests. Antigen tests can be taken at home and return results in about 10 to 15 minutes. PCR tests are more accurate but require lab work and generally don’t provide results for at least 12 hours or even up to 5 days.

Both tests typically use nasal swab samples, though some collect saliva: PCR tests administered by a professional may require a nasopharyngeal sample that involves a much deeper nostril swab. Rapid antigen tests usually require swirling a swab in the nostril less than an inch deep.

PCR tests amplify genetic material from the collected sample up to a billion times to detect even the slightest amount of COVID-19 genes, making them highly accurate. They’re also more expensive, usually costing more than $100 apiece.

Rapid antigen tests simply detect the presence of COVID-19 antigens — the substances that prompt your immune system to create antibodies — and work much like home pregnancy tests. If your sample contains COVID-19 antigens, the thin line of SARS-CoV-2 antibodies on the test strip will change color.

Because rapid tests are simply looking for the existence of antigens, they work best when someone is symptomatic. Rapid antigen tests are less successful with early infections and asymptomatic cases. The risk of a false negative is much higher with a rapid test than a false positive.

You May Like: Wax Museum In Times Square

Life Accident & Health Individual/tba Agent Or Broker

A Life Accident & Health agent or broker is licensed to sell, solicit or negotiate life insurance annuities and/or accident & health insurance

- Life insurance is insurance that provides protection against the death of an individual in the form of a payment to a beneficiary.

- An annuity is an agreement that the insurance company will pay an income benefit, in specified periodic payments for the life of the insured, or for a specified period.

- Accident and health insurance is insurance covering accidental death or personal injury by accident, sickness, ailment or bodily injury.

A life agent or life broker may also be licensed to sell variable life and/or variable annuity products. The Agent or Broker must hold the life line of authority and must be registered with the Financial Industry Regulatory Authority and must furnish the FINRA CRD number.

Making Coverage Expansion Provisions In American Rescue Plan Act Permanent

What is the plan?

This proposal would make permanent the expansion of marketplace subsidies enacted on a limited-time basis by the American Rescue Plan Act . The ARPA made it easier for people to buy insurance plans through state marketplaces, such as the New York State of Health Marketplace, by enhancing premium tax credits for people previously eligible for such subsidies and by expanding subsidy eligibility for those previously above the income cutoff.

Who would be eligible?

Lawfully present New York State residents who are already eligible for PTCs andfor the first timeresidents with incomes above 400% of FPL who buy their own marketplace coverage.

How many people would gain coverage?

In New York State, the number of uninsured residents is estimated to drop by 163,000 people in 2022

How would the plan be financed?

Individuals pay a monthly premium that is dependent on income . Those below 150% of FPL are eligible for a silver plan from the New York State of Health Marketplace with no premium. The premium subsidies are paid for by the federal government.

What would overall costs be?

It is estimated that federal spending would increase by $17.6 billion in 2022 . On average, there would be considerable savings for people who currently buy nongroup insurance : a more than 20% reduction in premium and out-of-pocket costs.

Reference for Cost and Coverage Impact

Don’t Miss: Pay Ny Tickets

What Are My Options

New Yorkers can sign up for affordable, quality health insurance through NY State of Health: The States Official Health Plan Marketplace. Public and private insurance options can be found here. Small businesses can find insurance for employees, too. You can compare plans and choose one that meets your needs. Dont worry, financial help is available.

Navigators are people who can help you enroll in a plan that fits you best. Find someone near you.

Take a look at our fact sheet on finding quality health insurance in NY to learn more.

What Is The Ny Health Care Marketplace

NY State of Health, the Official Health Plan Marketplace, helps individuals to easily shop for insurance, compare plans and enroll in health care coverage. If you live in the State of New York, it is the only resource available where you can receive Federal financial assistance that can help to lower the cost of your health insurance.

Recommended Reading: Nyc Birth Records