Polls Close At 10 Pm Eastern In Five States

Nevada is the last big swing state of the day, and virtually everything is up for grabs: The races for Senate, three House seats, governor and secretary of state. There is also an unexpectedly competitive Senate race in Utah between Senator Mike Lee, a Republican, and Evan McMullin, an independent. Maggie AstorNov. 8, 2022

Florida Governor

What To Do If You Dont Receive A Form W

You will not receive Form W-2G if your gambling winnings did not meet the automatic withholding threshold. Still, the IRS considers all gambling winnings taxable income. That raises the question: How do you calculate wins and losses from the previous year without a W-2G?

The answer: By keeping accurate records of your wagering activity, which the IRS mandates for all bettors. Thus, players should retain and keep handy all relevant betting records and receipts from New York sportbook apps.

One advantage to gambling online is your operator can provide an electronic record of all your wagers made during the previous year, making it easy to track profits and losses.

Overview Of New York Taxes

New York state has a progressive income tax system with rates ranging from 4% to 10.9% depending on taxpayers income level and filing status. Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. New York Citys income tax system is also progressive and rates range from 3.078% to 3.876%.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

You May Like: Is Community College Free In New York

Services Subject To Tax In New York City

New York City collects sales tax on certain services that the state doesnt tax. Examples include beautician services, barbering, tanning and massage services. The city also charges sales tax at health and fitness clubs, gymnasiums, saunas and similar facilities. If youre trying to improve your credit, keep in mind that New York City charges sales tax on most credit reporting services.

Nassau County New York Sales Tax Rate

Nassau County Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Nassau County?

The minimum combined 2022 sales tax rate for Nassau County, New York is . This is the total of state and county sales tax rates. The New York state sales tax rate is currently %. The Nassau County sales tax rate is %.

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in New York, visit our state-by-state guide.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

NOTE: The outbreak of COVID-19 may have impacted sales tax filing due dates in Nassau County. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Also Check: What To See In New York In 3 Days

Publication 873 Sales Tax Collection Charts For Qualified Motor Fuel Or Diesel Motor Fuel Sold At Retail

Publication 873 provides charts that show the amount of the local sales tax in the pump price of a gallon of automotive fuel. The charts in this publication apply only to jurisdictions that continue to impose sales tax on automotive fuels using a percentage sales tax rate. The charts in this publication are for use in verifying the sales tax due, not to establish pump prices.

Note: A Tax Bulletin is an informational document designed to provide general guidance in simplified language on a topic of interest to taxpayers. It is accurate as of the date issued. However, taxpayers should be aware that subsequent changes in the Tax Law or its interpretation may affect the accuracy of a Tax Bulletin. The information provided in this document does not cover every situation and is not intended to replace the law or change its meaning.

Earned Income Tax Credit

You can claim the earned income tax credit in New York if you have a qualifying child and can also claim the federal earned income tax credit. You are not entitled to this credit if you claimed the Noncustodial Parent New York State Earned Income Tax Credit . The credit equals to 30% of your allowable federal earned income tax credit minus your household credit.

Also Check: How To Get A New York State Teaching Certificate

Proof Of Sales Tax Payment Or Sales Tax Exemption Or Purchase Price

When you register a vehicle in New York , you must either

- pay the sales tax

- prove that sales tax was paid

- prove your vehicle registration is exempt from sales tax

You probably also will need to pay county use tax when you register. See estimate registration fees and taxes for information about county use taxes.

You must get a sales tax receipt from the DMV even if the transaction is exempt from sales tax.

Here are specific instructions

The Sales Tax Exemption form provides information and the definitions to defer your sales tax. You must pay the sales tax when you leave the Armed Forces or you return to New York.

New York Gasoline Tax

The Motor Fuel Excise Taxes on gasoline and diesel in New York are 8.05 cents per gallon and 8.00 cents per gallon, respectively. Furthermore, the Petroleum Business Tax is paid by petroleum businesses for certain types of fuel and paid at different points in the distribution chain. As of Jan. 1, 2020, the PBT is 17.4 cents per gallon.

Don’t Miss: How Many Hours To Paris From New York

New York Estate Tax Rate

The estate tax rate for New York is graduated. It starts at 3.06% and goes up to 16%. The taxable estate is the value of the estate above the $6.11 million exemption . Heres how to figure out what youll be paying: First, figure out what your taxable estate is. If your total estate is worth less than $6,415,500 million, the taxable estate is the total amount minus $6.11 million. So if your estate is worth $5.35 million, the taxable amount is $100,000.

Next, find your taxable estate bracket in the chart below. The base taxes amount in the second column is what you owe on money that falls below your tax bracket. Then figure out by how much your estate exceeds the lower limit of your bracket and multiply that number by the marginal rate. Add that number to your base and you should know what you owe.

Heres an example: Lets say your total estate is worth $7 million. That exceeds the cliff, so all of it is taxable. Next, we find where that number falls on the chart. The base tax for the bracket is $522,800. The bottom of the threshold is $6.1 million, so we subtract that from $7 million and get $900,000. That amount multiplied by the marginal rate of 12.8 is $115,200. When we add that number to the base rate, we get a total tax of $638,000 on a $6 million estate.

| NEW YORK ESTATE TAX RATES |

| Taxable Estate* |

Sales Tax Takers And Leavers

If you’re a consumer, you’ll want to consider that all but four states Oregon, New Hampshire, Montana and Delaware rely on sales tax for revenue.

Of these, Alaska also has no income tax, thanks to the severance tax it levies on oil and natural gas production. 37 states, including Alaska and Montana, allow local municipalities to impose a sales tax, which can add up. Lake Providence, Louisiana has the dubious distinction of most expensive sales tax city in the country in 2021, with a combined state and city rate of 11.45%.

Factoring the combination of state and average local sales tax, the top five highest total sales tax states as ranked by the Tax Foundation for 2021 are:

- Tennessee 9.55%

Residents of these states pay the least in sales taxes overall:

- New Hampshire 0%

Also Check: Is New York Aquarium Free

In Michigans National And State

Democratic House candidates outperformed Biden in several Michigan districts, bucking a rightward trend and maintaining seven of their seats. Democrats also won the Governors office, State Senate, and appear poised to take the State Assembly, and voters affirmed abortion rights in the state. Albert SunNov. 9, 2022

U.S. House

Parking Services Sold In New York City

Charges for parking services in New York City are subject to the 4% state tax, the 6% New York City local tax, and the % Metropolitan Commuter Transportation District tax .The borough of Manhattan has an additional 8% parking tax that applies unless the purchaser is a certified exempt resident . Eligibility rules and the application to apply for the exemption from the additional 8% parking tax can be found at www.nyc.gov.See Tax Bulletin Parking Services in New York City for additional information.

Don’t Miss: Valhalla Place Brooklyn Park Mn

New York Income Tax Calculator

taxnew-yorktax

New York Income Taxes. New York States top marginal income tax rate of 8.82% is one of the highest in the country, but very few taxpayers pay that amount. The state applies taxes progressively , with higher earners paying higher rates. For your 2020 taxes , only individuals making more than $1,077,550 pay the top rate, and earners in the next bracket pay nearly 2% less.

New York Estate Tax Exemption

The New York estate tax threshold is $5.92 million in 2021 and $6.11 million in 2022. That number will keep going up annually with inflation

This means that if a persons estate is worth less than $6.11 million and they die in 2022, the estate owes nothing to the state of New York. New York has a cliff that impacts very wealthy estates. If the estate exceeds the $6.11 million exemption by less than 5%, it only pays taxes on the amount that goes over the threshold. If the total value is more than 105% of exemptable amount, taxes are paid on the entire estate.

Heres an example of how that works: 105% of $6.11 million is $6,415,500 million. If your estate is worth between $6.11 million and $6,415,500 million, you only pay tax on the amount that exceeds $6.11 million. So if your estate is worth $6.26 million, your taxable estate is only $150,000. If your estate surpasses $6,415,500 million, all of your estate is taxable. If your total estate is $6.5 million, for example, you will pay estate taxes on all of that.

Read Also: How To File For Divorce In New York State

What Is The Tax Rate On Alcohol

However, post-GST, they are taxed at 18%. Hence, even with no major changes in the VAT rates charged on beer or liquor, the cost of beer and liquor had increased due to the increase in input taxes.

Is alcohol taxable in NYS?

New York State imposes an excise tax on the sale or use of: beer, cider, liquor, and.

Does alcohol include tax?

We pay liquor suppliers for their products after the product is sold to liquor licensees. We also collect the provincial liquor markup as well as any federal liquor taxes and levies.

Nyc School Tax Credit

The NYC School tax credit is available to NYC residents who have a total household income below $250,000. Individual taxpayers who cannot be claimed by another are eligible for a $63 credit. Those filing jointly would receive a $125 credit. To claim this credit, you also cannot be claimed as a dependant on another filers tax return.

Recommended Reading: How Do I Renew My Passport In New York

New York State Is Set To Raise Taxes On Those Earning Over $1 Million

The deal, a sign of Gov. Andrew Cuomos weakened influence, would mean wealthy New York City residents would pay the highest combined local tax rate in the nation.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

By Luis Ferré-Sadurní and Jesse McKinley

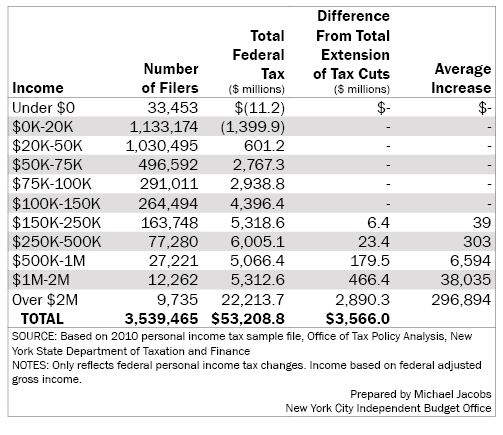

Gov. Andrew M. Cuomo and New York State legislative leaders were nearing a budget agreement on Monday that would make New York Citys millionaires pay the highest personal income taxes in the nation, a stark result of the pandemics economic fallout.

For years, Mr. Cuomo resisted such a move, arguing that raising taxes, especially on the wealthy, would drive business out of state. But the coronavirus-related revenue shortfalls combined with the growing strength of the Legislatures progressive wing and the governors waning influence created sudden momentum.

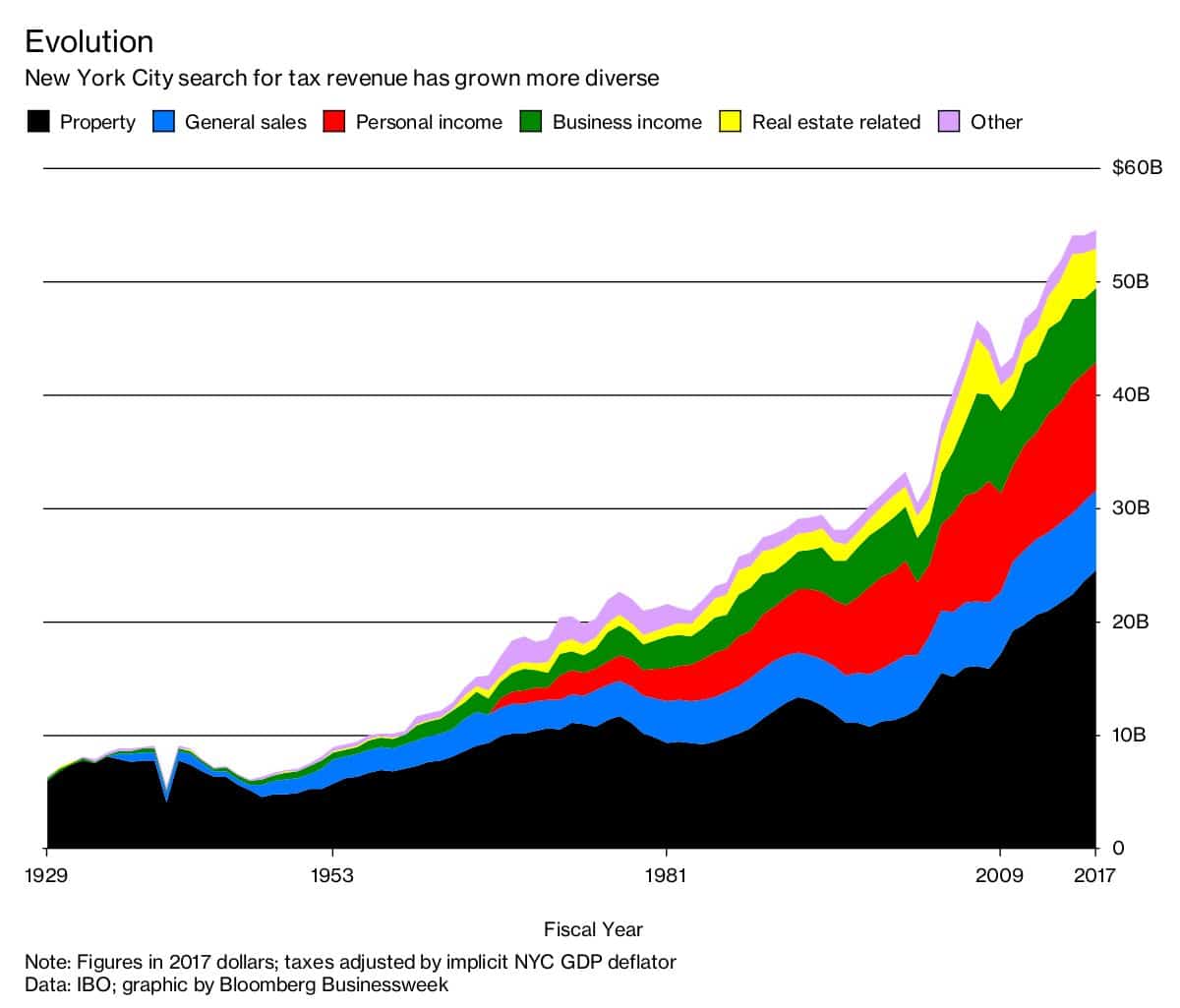

If enacted, the deal would raise income and corporate taxes to generate an extra $4.3 billion a year and would potentially legalize mobile sports betting to raise an additional $500 million in new tax revenue.

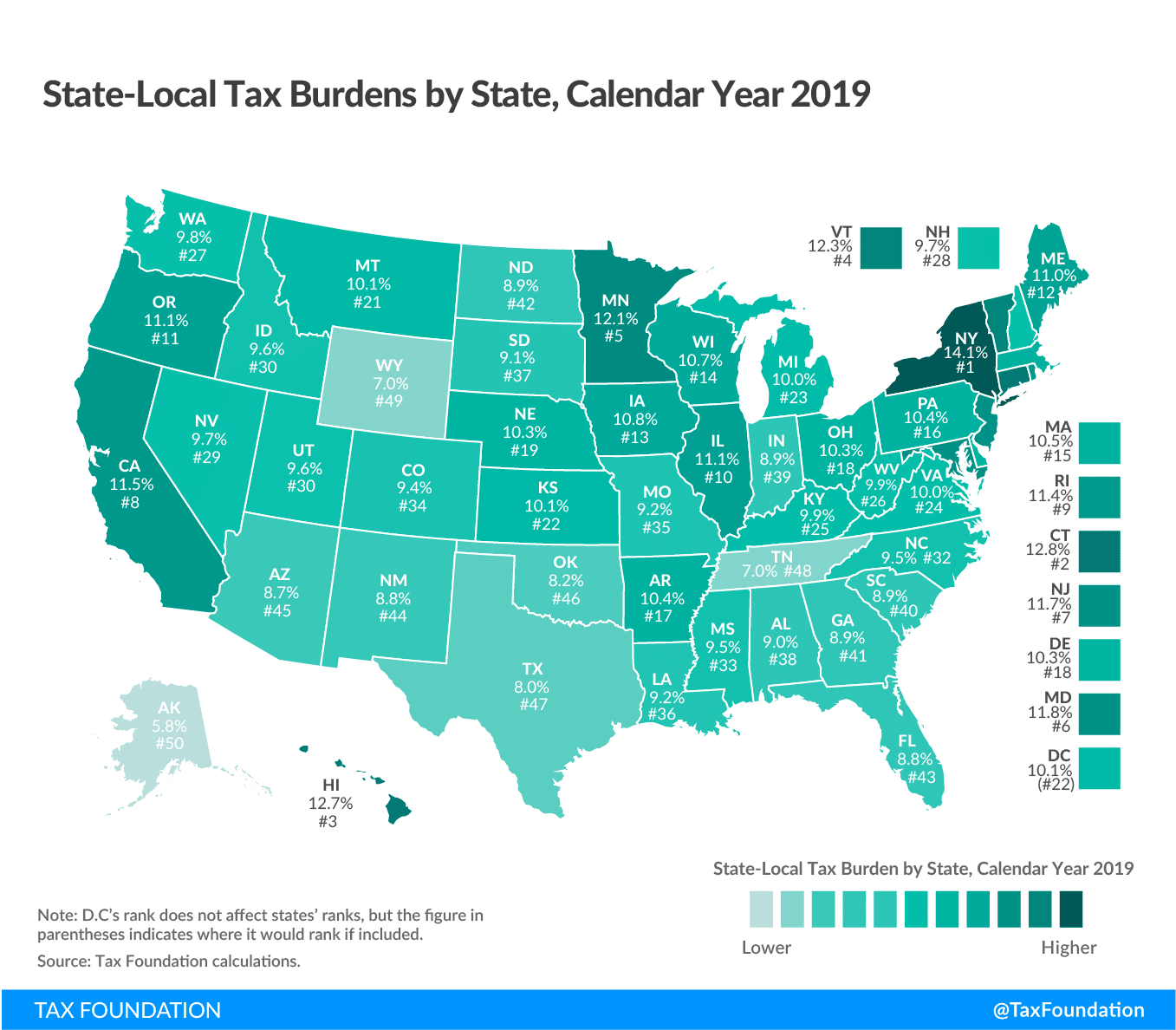

Under the proposed new tax rate, the citys top earners could pay between 13.5 percent to 14.8 percent in state and city taxes, when combined with New York Citys top income tax rate of 3.88 percent more than the top marginal income tax rate of 13.3 percent in California, currently the highest in the nation.

How To Calculate New York Sales Tax On A Car

You can calculate the state sales tax on a vehicle purchase by first taking the vehicles purchase price and then deducting any trade-ins, rebates, and incentives. This will be a portion of your out-the-door costs. From there, you can multiply this cost by 4.5%.

As an example:

- Lets say you purchase a new vehicle for $50,000.

- Your trade-in vehicle is worth $7,500 and you get a $2,500 rebate.

- That puts your out-of-pocket cost at $40,000.

- Now multiple $40,000 by 4%.

- This gives you a state sales tax of $1,600.

Also Check: How To Get Sex In New York City

Claiming Tax Exemptions If You Lived In The House At Least 2 Years Of The Last 5 Years Prior To Sale

If the property being sold is the primary residence and the taxpayer lived in the house for 2 out of the 5 years preceding the sale, the taxpayer can avail of a federal tax exemption of $250,000 from capital gains if single and $500,000 for married couples filing jointly. In the Hamptons house case above, if you are a married couple living in the property as your main home, the capital gain will be $800,000 instead of $1,300,000 because of the $500,000 tax exemption on married couples filing jointly on income arising from property lived in as their main home.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: Can You Conceal Carry In New York

Do I Have To Pay New York State Income Tax

Generally, you have to file a New York state tax return if:

-

Youre a New York resident and youre required to file a federal tax return or your federal gross income plus New York additions was more than $4,000 .

-

Youre not a New York resident but got income from a source in New York during the tax year.

If youre not a resident of New York but your primary workplace is there, your days telecommuting during the pandemic are still considered days worked in New York unless your employer established an office at your telecommuting location. Generally, you will continue to owe New York State income tax on income earned while telecommuting.

» MORE: Track the status of your state tax refund

RESIDENT STATUS RULES

In general, youre a resident of New York for tax purposes if your permanent home is there , or if you leased or owned a place there and spent 184 days or more in New York state during the tax year.

-

New York considers your permanent home the place you intend to return to after things like vacations, business trips, military assignments or the end of a college semester.

-

There are special rules for people who were in a foreign country for at least 450 of 548 consecutive days.

-

Where you vote, where your drivers license and registration are issued or where your will is are not primary factors in establishing domicile. Its more about where your stuff is and where you spend your time.

PART-YEAR RESIDENT STATUS RULES

NONRESIDENT STATUS RULES