How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Can I Be A Resident Of New York State If My Domicile Is Elsewhere

You may be subject to tax as a resident even if your domicile is not New York.

You are a New York State resident if your domicile is New York State OR:

- you maintain a permanent place of abode in New York State for substantially all of the taxable year and

- you spend 184 days or more in New York State during the taxable year. Any part of a day is a day for this purpose, and you do not need to be present at the permanent place of abode for the day to count as a day in New York.

In general, a permanent place of abode is a building or structure where a person can live that you permanently maintain and is suitable for year-round use. It does not matter whether you own it or not.

For more information see:

Do You Need To Pay Taxes In Both Ny And Nj

Technically, you are being double-taxed. The good news is that you will gain a New Jersey credit back for those taxes being paid to New York. However, this is not a dollar-for-dollar exchange, says Mark Feinberg, CPA of Feinberg & Company, which has offices in both Manhattan and Fair Lawn, New Jersey. The state of New Jersey uses a formula to calculate the maximum percentage that can be credited back to you, though it is usually a substantially large portion.

Also, keep in mind that other income interest, dividends, capital gains, etc. is still taxed based on where it is sourced. For example, if you sold an apartment in New York City, you will be subject to New York capital gains rules.

Jersey City Rentals Under $3,000 on StreetEasyArticle continues below

Recommended Reading: The New Yorker Poetry Submissions

Tips For Filing Taxes

- A financial advisor can help you develop a tax strategy to benefit your investing and retirement goals. SmartAssets free tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors, get started now.

- If you dont know whether youre better off with the standard deduction versus itemized, you might want to read up on it and do some math. Educating yourself before the tax return deadline could save you a significant amount of money.

- Figure out whether youll be getting a refund or will owe the government money so you can plan your household budget accordingly. SmartAssets tax return calculator can help you figure this out.

Overview Of New Yorks Nonresident Taxation

The tax computation for New York residents is simple. Residents are taxable on one thing: Everything. Nonresidents, however, can be taxed only on income that is derived from or connected to New York sources. That isnt just because New York likes to treat nonresidents more favorably. Under the U.S. Constitution, a state may not tax a nonresidents income unless it has some connection with the state. So the focus in nonresident allocation cases is usually on one thing whether the taxpayers income was derived from or connected to New York sources. Generally, under Tax Law section 631, the New York-source income of a nonresident individual includes all items of income, gain, loss, and deduction entering into the taxpayers federal adjusted gross income that are attributed to the ownership of any interest in real or tangible property located in New York or a business, trade, profession, or occupation carried on in New York.

Don’t Miss: How To Submit Poetry To New York Times Magazine

Calculating Tax On Capital

This tax is based on your total business capital base, which is the fair market value of all the assets and investments your business owns in New York State.

You calculate your businessâ capital base in Part 4 of Form CT-3. Most of the information you need for this step will come from your businessâ balance sheet. For step by step instructions to completing Part 4 of CT-3, consult Page 16 of the instructions to Form CT-3.

Once you do that, you must multiply your total business capital base by one of the tax rates located on the tax rates schedule on page 9 of the instructions to Form CT-3-I.

- For most businesses, this rate is 0.025%

- For some qualified New York manufacturers and QETCs the rate is 0.019%

Child And Dependent Care Credit

You qualify for the child and dependent care credit if you are eligible for the federal child and dependent care credit, whether you claim it or not on your tax return. The is determined by the number of your qualifying children and the amount of child care expenses paid during the year. The credit is worth up to $2,310 for the tax year 2020. If the credit is more than the amount you owe in taxes, you can receive a tax refund.

Also Check: How To Submit Poetry To New York Times Magazine

If I Live In New York But Work In Another State Am I Taxed Twice

A person who lives in one state but works in another may have tax liability in both states, but typically will receive a tax credit in their state of residence to eliminate double taxation of that income.

If you were a full-year or part-year resident of New York State and you had income sourced to and taxed by another state you may claim a nonrefundable resident credit against your New York State tax. This credit is allowable only for the portion of the tax that applies to income sourced to and taxed by the other taxing authority while you were a New York State resident.

For more information see, IT-112-R-I, Instructions for Form IT-112-R New York State Resident Credit.

Types Of Residency Status In New York

|

If your New York residency type is … |

New York taxes this part of your income |

|---|---|

|

Resident |

» MORE: Track the status of your state tax refund

RESIDENT STATUS RULES

In general, youre a resident of New York for tax purposes if your permanent home is there , or if you leased or owned a place there and spent 184 days or more in New York state during the tax year.

-

New York considers your permanent home the place you intend to return to after things like vacations, business trips, military assignments or the end of a college semester.

-

There are special rules for people who were in a foreign country for at least 450 of 548 consecutive days.

-

Where you vote, where your drivers license and registration are issued or where your will is are not primary factors in establishing domicile. Its more about where your stuff is and where you spend your time.

You file Form IT-201. You may have extra paperwork if you live in New York City or Yonkers, since those cities assess local income tax on top of state tax.

PART-YEAR RESIDENT STATUS RULES

Generally, youre a part-year resident of New York if you were a nonresident for some of the tax year. This is often the case for people who moved to New York from another state.

-

If youre a part-year resident, you pay New York state tax on all income you received during the part of the tax year you were a resident of New York, plus on income from New York sources while you were a nonresident.

NONRESIDENT STATUS RULES

Also Check: How Much Are Tolls From Va To Ny

New York State Property Taxes

The average property tax rate across the state of New York is 1.578 percent, but that can vary widely depending on the locality in question. Anyone in New York County has a rate of 1.925 percent, and some counties in Western New York have effective rates over 3 percent.

See: Heres How Much Americans Pay in Taxes in Every State

Pay From Account With A Bank Or Banking Services Provider

- save your bank account information ,

- receive instant confirmation from the New York State Tax Department, and

- schedule payments in advance. Note: To schedule additional payments, return to your Account Summary homepage and select Make a payment again.

Your bank statement will indicate our receipt of your payment with an NYS Tax Payment line item for the authorized amount.

You May Like: Is A Journeyman Electrician Licensed

What If I Won Cash Or A Prize Gambling In Another State

If youre a New York resident who gambled in another state during the year, the process is largely the same. Just add up the amounts in Box 1 on your W-2G forms and include that in your total on Line 16 of your Form IT-201. If the entity you gambled withheld part of your winnings to pay to that state, you can claim that as a deduction from your NY state taxes.

In that case, you need Form IT-112-R. On Line 15B, fill in the total of amounts withheld from your gambling winnings for another state or states. Attach Form IT-112-R to your IT-201. This should encompass all the reporting scenarios as far as gambling winnings go for New Yorkers.

Its pretty simple if the gambling companies do their part. But what if they dont give you the forms you need?

Nonresidents Do Not Pay Nyc City Taxes

This is routinely misunderstood, so I thought Id take a second at the end of the article to make sure its clear. If you are not a resident of NYC, you do not pay NYC taxes.

This wasnt always the case. It was only in the early 2000s that New York City stopped taxing non-NYC residents for income earned in NYC, hence the reason why its still largely misunderstood .

This means that if you live in New Jersey, Connecticut, Long Island or even Florida, the long arm of NYC wont reach you there .

Further Reading:

- Meredith Bentley, Hucaby v. New York State Demonstrates the Need for Legislative Action

Hat tip to MissBonnieMD who alerted me to this blatant money grab by the state of New York.

Lets talk about it. Would you be interested in working remotely for a company in New York?

Joshua Holt A practicing private equity M& A lawyer and the creator of Biglaw Investor, Josh couldnt find a place where lawyers were talking about money, so he created it himself. He knows that the Bogleheads forum is a great resource for tax questions and is always looking for honest advisors that provide good advice for a fair price.

Don’t Miss: How To Submit Poetry To New York Times Magazine

Other New York City Taxes

New York City charges a sales tax in addition to the state sales tax and the Metropolitan Commuter Transportation District surcharge. But food, prescription drugs, and non-prescription drugs are exempt, as well as inexpensive clothing and footwear.

There’s also a state and local tax on hotel rooms for inexpensive to moderately-priced rooms. This tax rate includes New York City and New York State sales taxes, as well as a hotel occupancy tax. Rooms renting for less expensive prices are subject to the same tax rates, but at lesser nightly dollar amount fees.

Medallion owners or their agents pay a tax for any cab ride that ends in New York City or starts in the city and ends in Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, or Westchester counties. This tax, known as the taxicab ride tax, is generally passed on to consumers. Medallion owners are those who are duly licensed with a medallion by the Taxi Limousine Commission of New York City.

What Can I Deduct From My Taxes Related To Gambling

Both the IRS and New York allow you to deduct your gambling losses for the year. The important thing to remember on both returns, however, is that you can only do so if you itemize your deductions.

If you take the standard deduction, you forfeit this privilege. Whether it makes sense to itemize depends on how many deductions you have and what the standard amount is for your tax bracket.

There are two important things to remember here:

- You cant deduct more than you won, even if you did actually lose more than you won during the course of the year.

- You can only deduct what you actually lost while gambling. The cost of your food, lodging, etc., while gambling is not deductible.

Once youve totaled all your gambling losses for the year, put that total on Line 28 of Schedule A, Form 1040. Attach that schedule to your 1040. As noted, New York is one of a few states that also allows you to deduct your gambling losses. For that, youll need Form IT-196. Put your losses on Line 29 and attach the form to your IT-201.

A common mistake that people make when they deduct their losses is trying to simply subtract their losses from their winnings and then reporting the difference as their winnings for the year. Keep the two amounts separate. Reporting this way can result in underreporting, which can lead to fines and interest.

Additionally, its crucial that if you do deduct your losses, keep detailed records of your gambling for at least five years.

Don’t Miss: How To Win The New York Lottery

Star Check Delivery Schedule

Some homeowners receive a check for the STAR credit, rather than receiving the STAR exemption, which is a reduction on their school tax bill. The department issues STAR credit checks prior to the due date for school taxes. Use the 2021 STAR Check Delivery Schedule lookup for the most recently updated information available for your area.

Nys Telecommuting Tax Penalty

Working remotely for a company in another state? You might have to pay state taxes twice depending on the city.

Did you know that some states have regulations requiring both residents and non-residents to pay state income taxes on all income earned from a company thats located in that state even if the employee lives and works in a different state? Neither did I. Did you know that New York is one of those states along with Delaware, Pennsylvania, Nebraska and New Jersey?

I realize this will only apply to select group of readers, but I think its worth pointing out all the same: If you work remotely for a company based in New York, Delaware, Pennsylvania, Nebraska or New Jersey, even if you physically never step foot in those states, you may be subject to state income tax in those states.

The reason why I think this is such an interesting topic is the general trend to decentralize work. At my firm we have multiple associates that work remotely. One that I work with frequently is based in Florida. Her husband is a cardiologist, so she told the firm she planned on following him to Florida when he found a job there. The firm didnt object and shes been working remotely ever since.

This is every New Yorkers dream. Get established in New York. Make New York money. Move to sunny Florida and successfully fend off New Yorks inevitable challenge to your claimed change of domicile. Pay no state income taxes on your income. Is it too much to ask?

You May Like: Wax Museum In Times Square

Gains Or Losses From Real Property

In the past, the rules in this area were clear. Under current legislation, the phrase real property located in this state as defined in Tax Law section 631 is redefined to include interests in a partnership, limited liability company, S corporation, or closely held C corporation owning real property located in New York State if the value of the real property exceeds 50% of the value of all of the assets in the entity. There is a two-year lookback rule to avoid taxpayersstuffing assets into an existing entity before a sale. For sales of entity interests occurring on an after May 7, 2009, any gain recognized on the sale of an interest in that entity will be allocated among the assets in the entity, and the amount allocated to New York real property will be treated as New York-source income.

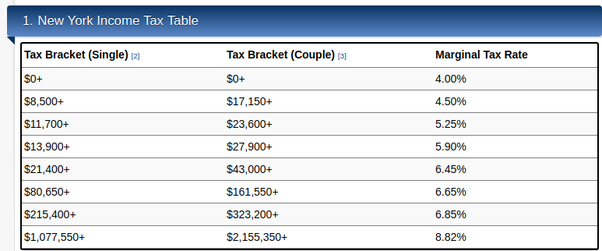

Overview Of New York Taxes

New York state has a progressive income tax system with rates ranging from 4% to 8.82% depending on taxpayers income level and filing status. Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. New York Citys income tax system is also progressive and rates range from 3.078% to 3.876%.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Recommended Reading: Tolls From Baltimore To Nyc