New York Income Taxes

New York States top marginal income tax rate of 10.9% is one of the highest in the country, but very few taxpayers pay that amount. The state applies taxes progressively , with higher earners paying higher rates. For your 2020 taxes , only individuals making more than $25,000,000 pay the top rate, and earners in the next bracket pay 0.6% less. Joint filers face the same rates, with brackets approximately double those of single filers. For example, the upper limit of the first bracket goes up from $8,500 to to $17,150 if youre married and filing jointly.

Overview Of New York Taxes

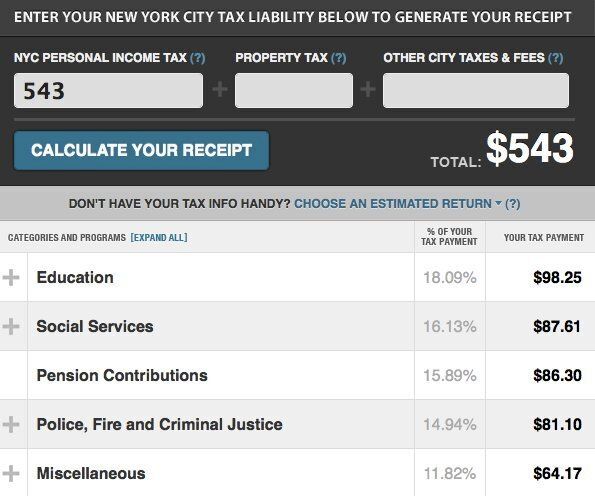

New York state has a progressive income tax system with rates ranging from 4% to 10.9% depending on taxpayers income level and filing status. Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. New York Citys income tax system is also progressive and rates range from 3.078% to 3.876%.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Is There A Tool That I Can Use To Calculate Ny Car Sales Tax

To calculate the sales tax you may pay for a vehicle in New York, you can use the tool provided by the New York State Department of Taxation and Finance website. This tool enables individuals to input their zip code and address to get an estimate of the total state and local taxes they may be subjected to pay for a vehicle. You will then multiply the sales price of your vehicle by the tax rate provided for your address in New York.

You May Like: Best Private Elementary Schools In Brooklyn

How To Calculate New York State Tax In 2023

New York tax is calculated by identyfying your taxable income in New York and then applying this against the personal income tax rates and thresholds identified in the New York state tax tables . Please note that certain states do not collect State Income tax, these include Alaska, Florida, Nevada, South Dakota, Washington and Wyoming.

Taxable Income in New York is calculated by subtracting your tax deductions from your gross income. Incredibly, a lot of people fail to allow for the income tax deductions when completing their annual tax return inNew York, the net effect for those individuals is a higher state income tax bill in New York and a higher Federal tax bill. So why do people choose not to claim income tax deductions in New York? The sad truth is that a lot of people fear making a mistake on their New York tax return and subsequently facing fines and issue with the IRS and or New York State Government tax administration. Clearly, declaiming deductions can really reduce your tax bill in New York but this is a personal choice, itemised deductions for the combined Federal and New York State tax return include Office expenses, Property Maintenance and Repairs, certain trades and jobs are provided special allowances. A full list of tax exemptions and elements which can be claimed as part of an itemised New York state tax return is available on the New York Government website.

How Much Do I Owe In Self Employment Tax To The Government

The New York self-employment tax is calculated in two sections. First, a set amount is established each year against which the 12.4% of Social Security is applied. For 2020, that amount is the first $137,700 of your net earnings. The second amount, the 2.9% Medicare payment, is applied to all your combined net earnings. Variations can occur if you file as a married couples business, or your spouse is your partner or your employee.

Don’t Miss: Is New York Safety Council Legit

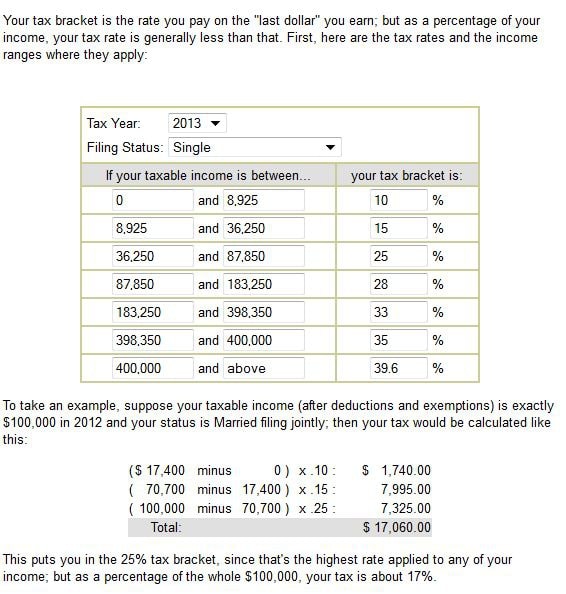

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Taxes can really put a dent in your paycheck. But with a Savings or CD account, you can let your money work for you. Check out these deals below:

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

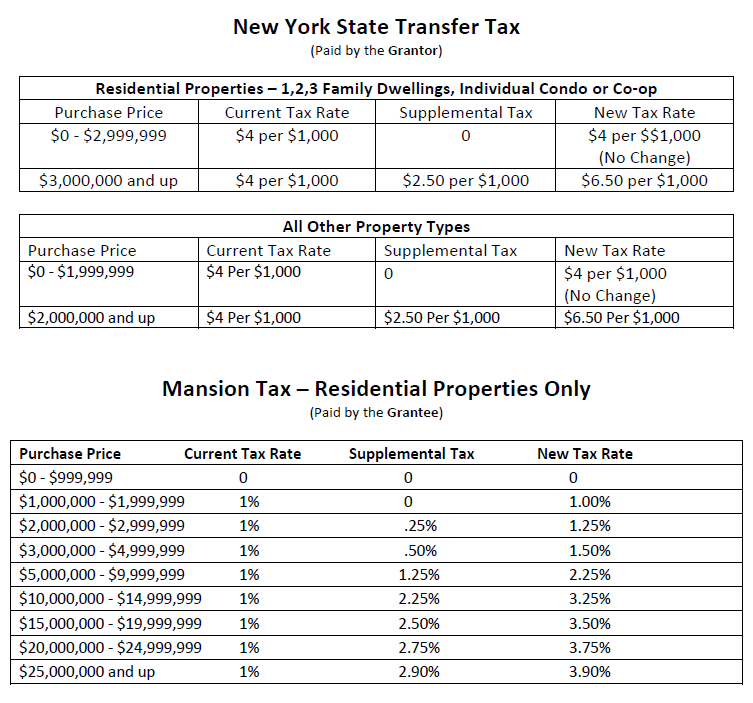

Ny State Transfer Tax

The New York State Transfer Tax is 0.4% for sales below $3 million and 0.65% for sales of $3 million or more. The higher rate of 0.65% kicks-in at a lower threshold of $2 million for commercial transactions and residential properties with 4 or more units. Prior to the New York Tax Law amendments in 2019, the NYS Transfer Tax was previously a fixed 0.4% regardless of the sale price. The New York State Transfer Tax is authorized by New York Consolidated Laws, Tax Law TAX § 1402.

Read Also: How To Get From New York To Chicago

The Nyc Household Credit

You might qualify for the New York City Household Credit if you can’t be claimed as a dependent on another taxpayer’s federal income tax return. This credit is available to resident and part-year residents of New York City.

The amount of the credit is determined by your income and filing status. Credit amounts start at $15 to $30 for single and married filers, and go up with each dependent you have.

New York Property Taxes

Property taxes in the state of New York vary greatly between New York City and the rest of the state. In New York City, property tax rates are actually fairly low. The average effective property tax rate in the Big Apple is just 0.88% more than half the statewide average rate of 1.69%. In fact, many New York counties have rates exceeding 2.50%, which is more than double the national average of 1.07%.

Those low rates don’t necessarily mean that homeowners in the city pay less than those in other parts of the state, however. Due to Manhattan’s sky-high real estate values, the typical homeowner in the city pays $8,980 annually, while the statewide median payment is $5,732.

If youre looking at homes in New York, check out our mortgage guide for information about rates and getting a mortgage in New York.

A financial advisor can help you understand how homeownership fits into your overall financial goals. SmartAssets free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

You May Like: How Expensive Is Rent In New York

What Is Tax Abatement In Nyc

A tax abatement is a tax break on property or business taxes. Owners of co-ops and condos in NYC who meet certain requirements can qualify to have their property taxes reduced. The requirements include using the co-op or condo as a primary residence, not owning more than three residential units in any one development , and not being part of the Urban Development Action Area Program.

New York Property Tax

Property taxes are assessed exclusively by counties and cities in New York State, which means that rates vary significantly from one place to the next. Effective rates – taxes as a percentage of actual value as opposed to assessed value – run from less than 0.7% to about 3.5%.

Surprisingly, the city with the lowest effective property tax rate is New York City, where property taxes paid total an average of just 0.88% of property value. The reason for that relatively low rate is that the taxable value of most residential property in New York City is equal to just 6% of the market value. That is, if your home is worth $500,000, you will only be charged taxes on $30,000 of that amount. Outside of New York City, however, rates are generally between 2% and 3%.

Regardless of city, if you are looking to refinance or purchase a property in New York with a mortgage, check out our guide to mortgages in New York. Weve got details on average mortgage rates and other information about getting a mortgage in the Empire State. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York.

Recommended Reading: Condos For Sale In Brooklyn

New York State Tax Calculator

The New York tax calculator is updated for the 2023/24 tax year. The NY Tax Calculator calculates Federal Taxes , Medicare, Pensions Plans allow for single, joint and head of household filing in NYS.

The New York income tax calculator is designed to provide a salary example with salary deductions made in New York. You can choose an alternate State Tax Calculator below:

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

Read Also: Assisted Living In The Bronx

Write Your Employees Paychecks

Youre good enough, youre smart enough, and gosh darn it, youve figured out all your payroll! Once youve calculated your employees net pay by working out all their deductions and withholdings, youre ready to cut their checks.

In addition to making sure your employees get paid on time, dont forget to set aside the employer taxes your company is responsible for. Those FICA and UI payments can add up if you dont remit them on a regular basis.

Federal tax filings are due quarterly by filing Form 941 and annually by filing Form 940, but for most New York employers, taxes must be paid on an ongoing basis via the EFTPS payment system. Find detailed information from the IRS here.

New York Assessed Values

The property tax system in New York starts with an assessment of your property to determine the market value. That is done by a local official, your city or town assessor. Assessments should happen regularly, but many cities and towns have not made reassessments in many years.

Since many assessments are not current, each tax area is assigned a Residential Assessment Ratio that represents the ratio between assessed values and current market values. So, for example, if the market value of your home is $100,000, and your citys RAR is 54%, your assessed value should be $54,000.

Your RAR doesnt affect the taxes you actually pay, but it is important to know to ensure that your home is not over-assessed. For example, if your home is worth $150,000, your local RAR is 50%, and your assessed value is $125,000, your home is over-assessed. Your assessed value implies a market value of $250,000, much higher than the true market value of $150,000. In that case, you may want to contest your assessment. Otherwise, you will wind up paying more than your fair share of taxes.

Don’t Miss: How Much Is Community College In New York

How To Estimate The Tax

You should use one of the forms below to compute your estimated tax payments. You can pay electronically, check balances, and review payments in your estimated tax account by creating an Online Services account.

If you are married and filing a joint New York State income tax return, both spouses should establish their own estimated tax account. We will credit the balances of both accounts to your joint income tax return.

Minimum Wage In New York

The minimum wage in New York is greater than the federal rate of $7.25 per hour, and it was recently increased in several parts of the state. Except for farm laborers, cab drivers, members of religious organizations, and volunteers at recreational or amusement events lasting up to eight days, all employees are covered.

Employees in most industries in New York State are covered under the state’s general minimum wage schedule. Workers in fast food or hospitality who rely on customer gratuities are not included in the timetable.Let’s look at what firms in the state will have to pay their employees in the future:

|

General Minimum Wage Rate Schedule |

|

|

Location |

|

|

$12.50 |

The minimum wage for fast-food workers has its own schedule for rate hikes. New York City has a rate of $15 as of 2021. In New York City, all fast-food workers must earn at least $15.00 per hour. Minimum wage rates in the rest of the state, excluding New York City, are set to rise annually until they reach $15.00 on July 1, 2021.

New York State payroll rules, as well as wage and hour requirements, will undergo some modifications in 2021.

The minimum pay levels that are now exempt from overtime are increasing, and some firms may no longer be able to use tip credits to offset their minimum wage.

Recommended Reading: How Do You Get A Birth Certificate In New York

How Much Is The Car Sales Tax In New York

When buying a car in New York, you will pay a 4% sales tax rate for your new vehicle, according to Sales Tax States. This statewide tax does not include any county or city sales taxes that may also apply. Sales taxes for a city or county in New York can be as high as 4.75%, meaning you could potentially pay a total of 8.75% sales tax for a vehicle in the state.

The lowest city tax rate in New York is found in Pleasantville, which has a rate of 4%. The highest possible tax rate is found in New York City, which has a tax rate of 8.88%. The average total car sales tax paid in New York state is 7.915%. New York is one of the five states with the highest rate of local vehicle sales taxes.

What Salary Do You Need To Live In Nyc

Recommended Salary in New York City To live comfortably, a resident would need to earn at least $11,211 monthly before taxes. Thats pretty steep. If you chose to live in the more affordable Bronx borough, youd need to earn three times the $1,745 monthly rent rate before taxes, which amounts to $5,235.

You May Like: What Is New York Paid Family Leave

How Are Local Taxes Calculated

There are 3 different methods used to calculate local taxes, it depends on the jurisdiction.

Most of these taxes are paid by the employee, but there are a few which are paid by the employer. This calculation process can be complex, but PaycheckCityâs payroll service can do it for you. Learn about PaycheckCity Payroll.

Do You Believe Your Property Taxes Are Too High

First, you should consider whether your assessment is accurate. To learn how to determine if youre assessed fairly and what to do if you arent, see Contest your assessment.

If your assessment is fair, but you still believe your taxes are too high, you should:

- examine the scope of your taxing jurisdictions’ budgets and expenditures

- address your concerns to the appropriate forum, such as meetings of the school board, city council, town board, or county legislature.

You May Like: Cheap Cars For Sale Bronx Ny

Factors To Consider When Calculating Ny Car Sales Tax

The following are factors to consider when calculating how much sales tax you will pay for a vehicle in New York:

- Manufacturer or dealership cash incentives

- Manufacturer rebates

- Whether the vehicle is sold below fair market value

If you receive incentives or rebates when purchasing your car, the sales tax you will pay will be based on the price of the car after the incentives or rebates are subtracted. Additionally, when buying a car from a private party, you must submit a DTF-802 form with details of the transaction in the event that the car is bought for less than the market value.