Cheapest Car Insurance Rates By Zip Code In New York City Ny

If you live in a neighborhood that has a higher crime rate, chances are youre paying more for car insurance. ZIP codes are one of the biggest factors used to determine car insurance rates. The more crime and accidents in a given area, the more everyone pays.

Below are the average rates in ZIP codes across New York City.

ZIP code

How Much Is Car Insurance In New York By Age

Age is a factor that can make insurance premiums jump dramatically. For instance, car insurance for teens or inexperienced drivers is often expensive, as insurers view youth and first-time drivers as risky to insure. This is because their lack of driving experience increases the likelihood of accidents.

The most effective way teen drivers can save money on insurance is to be added to their parent’s auto insurance policy. According to MoneyGeek, the average price difference between a 40-year-old and a young drivers full coverage insurance in New York is as much as $5,852 per year.

Its important to note that new drivers in New York regardless of age may face insurance rates comparable to those of teen drivers.

Average Costs of Full Coverage Car Insurance in New York – By Age

Scroll for more

The States That Drink The Most Beer

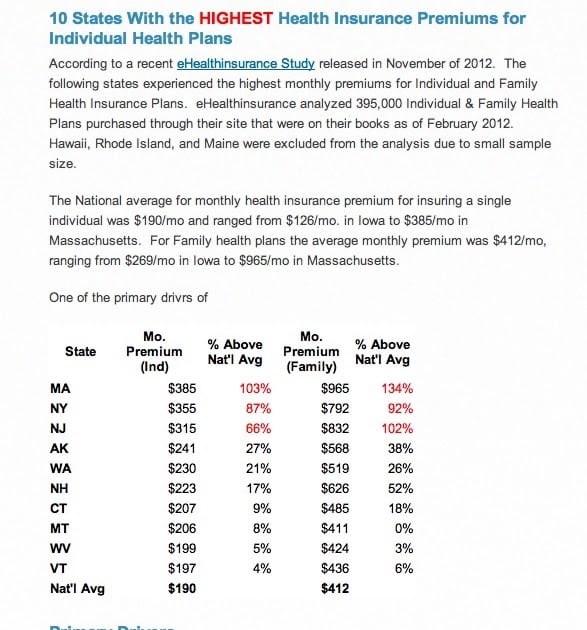

After age 50, premiums rise tremendously. At age 53 the average premium is more than double the base rate, and by 55 the average premium is $446. At age 60, the average premium is $543. If a person is 64 years old, the average health insurance premium is $600 3 full times what it is at 21.

It is also important to note that while this is a general guideline, prices vary dramatically from state to state. Some states, like New York, dont factor age into premiums at all.

Also Check: Why Do Doctors Hate Chiropractors

Recommended Reading: How Can I Watch New York Undercover

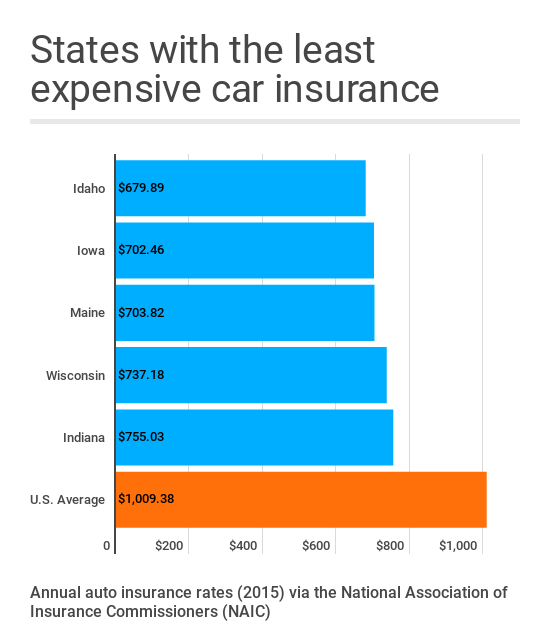

How Much Is Car Insurance In New York

The average car insurance rate in New York is $172 a month, or $2,062 a year for a driver age 30 for full coverage, based on expert analysis by our team. Thats $304 more annually than the national average . For liability limits of 50/100/50, New York drivers will pay $80 monthly . The average car insurance rate for state minimum coverage is $72 a month, or $867 a year.

Is Disability Insurance The Same As Workers Compensation

No. Workers compensation is a program that is mandated by most state governments for large employers. It covers only injuries and sicknesses that happen on the job, or because of the job. Thats an important distinction because most disabling events happen outside of the work environment. Workers compensation usually includes partial wage replacement for the time the employee cannot work, but these benefits vary greatly by state. Its also important to understand that when you accept workers comp, you waive the right to recover damages from your employer through legal means.

Don’t Miss: How Is The Weather In New York

Cheapest Car Insurance For Young Drivers In New York

Enter an age from 18 to 25 to see who has the best rates for young drivers in New York, by company. Youll see in the chart below which car insurance companies have the lowest rates for young drivers buying a full coverage policy. Average car insurance rates by age data shows that drivers typically pay higher rates until age 26, when rates begin to drop as drivers gain more experience on the road. But even young drivers can save money by comparing car insurance rates to see which company has the lowest rates, by qualifying for student discounts and by staying on their parents policy as long as possible.

What Is The Best Car Insurance In New York

NerdWallet named Liberty Mutual one of the best car insurance companies in 2022.3 Thats because we understand that everyone has individual needs when it comes to their New York auto insurance. Some might want the cheapest NY car insurance, while others want more coverage and an auto insurance company they know they can trust. Let us help you customize your New York car insurance, so you only pay for what you need.

Read Also: A Plane Ticket To New York

New York Health Insurance Laws

The Affordable Care Act limits what restrictions and exclusions insurance companies can use to price your policy.

- Pre-existing conditions: Pre-existing conditions cant be considered by insurance companies. People used to pay more for health insurance if they had a pre-existing condition, but the ACA now limits insurance companies from charging higher rates.

- Gender: According to a study by Health Services Research, women historically pay more for health care. The ACA mandates that insurance companies cant charge men and women different prices for the same plan.

- Insurance and medical history: Before the ACA, people with previous medical problems or lapses in insurance coverage would often have to pay more for coverage. Thats no longer the case.

New York has a Family Planning Benefit Program, which requires insurance providers to offer some coverage for the following services for families:

- Pregnancy testing and counseling

Dont Miss: How Much Is Temporary Health Insurance

The Cheapest Health Insurance In Massachusetts By County

Another factor that impacts the cost of health insurance in Massachusetts is the area in which you live. In Massachusetts, similar to other states, insurance providers use rating areas to calculate policy premiums. Rates are computed the same way for counties within each rating area.

Massachusetts has fourteen counties divided into seven rating areas. In Middlesex, its most populous county of the 14 counties in the state, the cheapest Silver plan is Standard Silver: BMC HealthNet Plan Silver A II by BMC HealthNet Plan. It costs $354 per month.

If you want to find the most affordable health insurance plan in Massachusetts for all metal tiers in your county, use the table below.

Cheapest Health Insurance Plans in Massachusetts by County

Sort by county:

Recommended Reading: Starbucks Dental Coverage

Also Check: What Is Abortion Law In New York

Choosing The Right Car Insurance Company In New York City Ny

With so many factors that determine car insurance price, it can be overwhelming to find a company that offers affordable protection and wont let you down when you need it the most.

You want a company with experience and customer service that listens to your needs. When its time to file a claim, you expect your insurance company to make the process as seamless as possible.

At Policygenius, we can help you see quotes from top companies, so you can choose one that meets all your needs.

Compare rates and shop affordable car insurance today

We don’t sell your information to third parties.

Cheapest Full Coverage Car Insurance In New York For 20

Drivers in New York with clean driving records may want to consider the following companies, which had the lowest average rates:

Main Street America: $1,983 per year, or about $165 per month.

Progressive: $2,505 per year, or about $209 per month.

Erie: $2,519 per year, or about $210 per month.

Geico: $3,033 per year, or about $253 per month.

Allstate: $3,955 per year, or about $330 per month.

Read Also: How To Get Discount Broadway Tickets New York

How Much Does Title Insurance Cost In New York City

- On a $1 million property with a mortgage, you can expect to pay .6 percent

- You can save as much as $1,000 to $2,000 by negotiating extra charges

Here’s a tip to spot extra fees: Ask your attorney to send a copy of the title bill before closing day, and compare it to one or two quotes from other title insurance companies.

Cheapest Full Coverage Car Insurance In New York For 50

Drivers in New York with clean driving records may want to get quotes from these insurers, which had the lowest average rates:

Main Street America: $1,026 per year, or about $86 per month.

Progressive: $1,276 per year, or about $106 per month.

Erie: $1,388 per year, or about $116 per month.

Preferred Mutual: $1,448 per year, or about $121 per month.

Geico: $1,796 per year, or about $150 per month.

Don’t Miss: Where To Stay In New York City With Family

Finding The Best Health Insurance Coverage In New York

The best health insurance policy for your family will depend on the availability of plans in your area, as well as your medical and financial situation. When deciding on the right type of plan, you should determine affordability by reviewing the premiums and deductibles for each metal tier. Generally, if you have an emergency savings account and dont expect to have significant health or medical expenses, then a lower metal tier plan with more affordable premiums would make more financial sense.

Gold and Platinum plans: Best if you expect high medical costs

Gold and Platinum plans are the highest tier health insurance policies available in New York. These plans often have the most expensive monthly premiums but come with lower deductibles and out-of-pocket maximums.

For example, if you frequently use expensive prescription drugs, an upper-tier health plan could be the right choice.

Silver plans: Best for people with low income or average medical costs

Silver plans are middle-ground policies that fall between Gold and Bronze plans with regard to premiums and out-of-pocket expenses. We would recommend a Silver plan in most situations â but if you are very healthy, Bronze may be best in terms of cost-effectiveness.

On the other hand, if you expect a lot of medical expenses, then a Gold plan may better fit your needs.

Bronze and Catastrophic plans: Best for young, healthy individuals

Getting Low Cost Auto Insurance In Ny Based On Driver Profile

The severity and frequency of claims in your neighborhood, your driving record, the type of car you drive and other variables are used by insurance companies to figure out the cost of your policy. Thats why the price for the same coverage can vary significantly among insurance companies and why you should compare rates. This holds true whether you have had recent accidents or moving violations or not and whether you have good or bad credit. Below well educate you more on the many different types of car insurance are required to drive in New York. Additionally, well explain minimum New York car insurance requirements, how to buy the best coverage for your needs and how NY insurance laws work.

Read Also: Why Is Turo Not In New York

The Best Car Insurance Companies In New York

New York City drivers seeking to purchase car insurance coverage that incorporates a low cost and quality service can use MoneyGeeks ranking of the best companies in the city to find an ideal provider.

MoneyGeeks scoring system considered J.D. Powers affordability, user satisfaction and financial stability ratings, among other factors, while ranking insurers in New York City out of 100. Based on these scores, the best insurance providers in New York for most drivers are:

- Travelers: MoneyGeek score of 90 out of 100

- State Farm: MoneyGeek score of 88 out of 100

USAA received the highest score in New York City by MoneyGeek’s rating system. It is only available to military members, veterans and their families, and is the best insurer they could choose in New York.

Cheapest Auto Insurance In New York For 30

Drivers with poor credit in New York should consider the following companies with the lowest average rates for full coverage:

Geico: $2,217 per year, or about $185 per month.

Utica National: $2,427 per year, or about $202 per month.

Erie: $3,063 per year, or about $255 per month.

Chubb: $3,091 per year, or about $258 per month.

Encompass: $3,358 per year, or about $280 per month.

Don’t Miss: How Much Do Condos Cost In New York

Other Costs To Consider When Shipping A Dog

What other costs should you consider outside of the actual quote the pet relocation company gives you? There are some you cant get around, like fees for paperwork, a veterinarian exam and a round of vaccinations.

Youll need to purchase a travel crate if youre having your dog transported to or from New York with an Air Nanny. Airlines have stringent requirements for these travel carriers if there are any inadequacies with the carrier, they wont let your dog fly.

If youre using ground transportation, you may not need to buy a crate. While discussing details with the driver before booking, inquire whether they provide one. Those who do provide crates may charge more but the increased travel expenses may not amount to more than the carriers cost.

What Are The Typical Closing Costs For Seller In New York

1. Attorneys Fee

The state of New York mandates the presence of an attorney at closing. Sellers usually hire real estate attorneys to review the sales contract, especially when no real estate brokers are involved or there are any legal issues with the property.

In most cases, the seller and buyer hire different attorneys to represent their best interests. However, if you and the buyer decide to hire the same attorney, the attorney fee will be split.

Typically, the average attorney fee for house closing in New York is $200-$300 per hour.

2. Credits Towards Closing Costs

You can offer to help buyers with closing costs to make the property more attractive, especially if you live in an area where market competition is low. These costs are called closing credits or seller concessions and are paid at closing.

You can also negotiate concessions with homebuyers if a requirement for repairs arises after the inspection. This may help you save some money on the costs of repair.

3.Documentary Stamp

The documentary stamps refer to the excise tax levied on the documentation that transfers the property from you to the buyer. It is like paying tax on a property deed or some other official documentation.

4. Escrow Fee

You should budget between $200 to $500 or more for escrow fee, depending upon the circumstances of their sale.

5. Home Inspection Fee

New York seller disclosure requires sellers to declare any known issues and defects with the property. Some of these are:

6. Home Warranty Fee

Recommended Reading: Fairfield Inn & Suites New York Manhattan

How To Get Cheap New York Auto Insurance

While the providers on our list for the cheapest car insurance in New York are reputable, its still smart to reach out for auto insurance quotes from multiple providers. Comparing car insurance rates allows you to see which companies offer the best coverage and prices for you.

Compare Auto Insurance Policies

What Are Closing Costs In New York

Key Takeaways

CALCULATE YOUR CLOSING COSTS »

Recommended Reading: What Shows Are Playing In New York

Who Pays Closing Costs In New York

Both, the buyer and seller, pay the closing costs. The estimated seller closing costs for New York could reach up to 8% to 10% of the final sale price of the home. This includes the commission of the listing and buyers agent.

As a seller, you can negotiate some closing costs with the homebuyer. However, you must pay closing costs like taxes charged by your state or local jurisdiction. They are non-negotiable.

Most of the closing costs for seller in New York will be deducted from the proceeds you get from the property. As such, you need enough equity to cover some of the expenses.

Most real estate agents know who typically pays what for the closing costs in your local area. So, its important to seek professional advice. Hiring an experienced real estate agent can help reduce your closing costs.

How Do Pip And Other Car Insurance Coverages Work In Nyc

PIP, or personal injury protection, provides no-fault coverage for car accident injuries. However, if you cause an accident in New York, you can be held financially responsible for property damage and certain medical costs not covered by PIP.

State laws require New York City motorists to carry car insurance with the following coverages and limits:

- PIP: $50,000 per person

- Bodily injury liability: at least 25,000 per person/$50,000 per accident

- Property damage liability: at least $10,000 per accident

- Uninsured Motorist: at least $25,000 per person/$50,000 per accident

If you and/or your passengers are injured in a car accident, PIP covers your initial medical bills, regardless of fault. PIP also covers a portion of lost earnings and provides other benefits, up to $50,000 per person.

Its important to know that New Yorks no-fault laws only apply to injuries. Heres a look at the costs you may have to pay if you cause an accident or are in an accident caused by an uninsured motorist.

| Cost |

|---|

|

Uninsured motorist: Costs above $50,000 |

If your share of costs from an accident is greater than your policys limits, you may have to tap into your savings or other assets to cover the difference. This is the main reason to consider coverages and limits that exceed the states minimum requirements.

Don’t Miss: Forces Of Nature Brooklyn Ny

If You Frequently Travel

If you travel a lot and need coverage during this time, you may want to purchase an additional add-on in the health exchange, such as a preferred provider organization . PPOs give you access to out-of-network coverage and allow you to see specialists without a referral. These plans do often come with a high premium and vary per state.